Hello everyone and welcome to another issue of Alpha Made Here. If you’re reading this but haven’t yet signed up, you can join others and get Alpha delivered to your inbox by subscribing here:

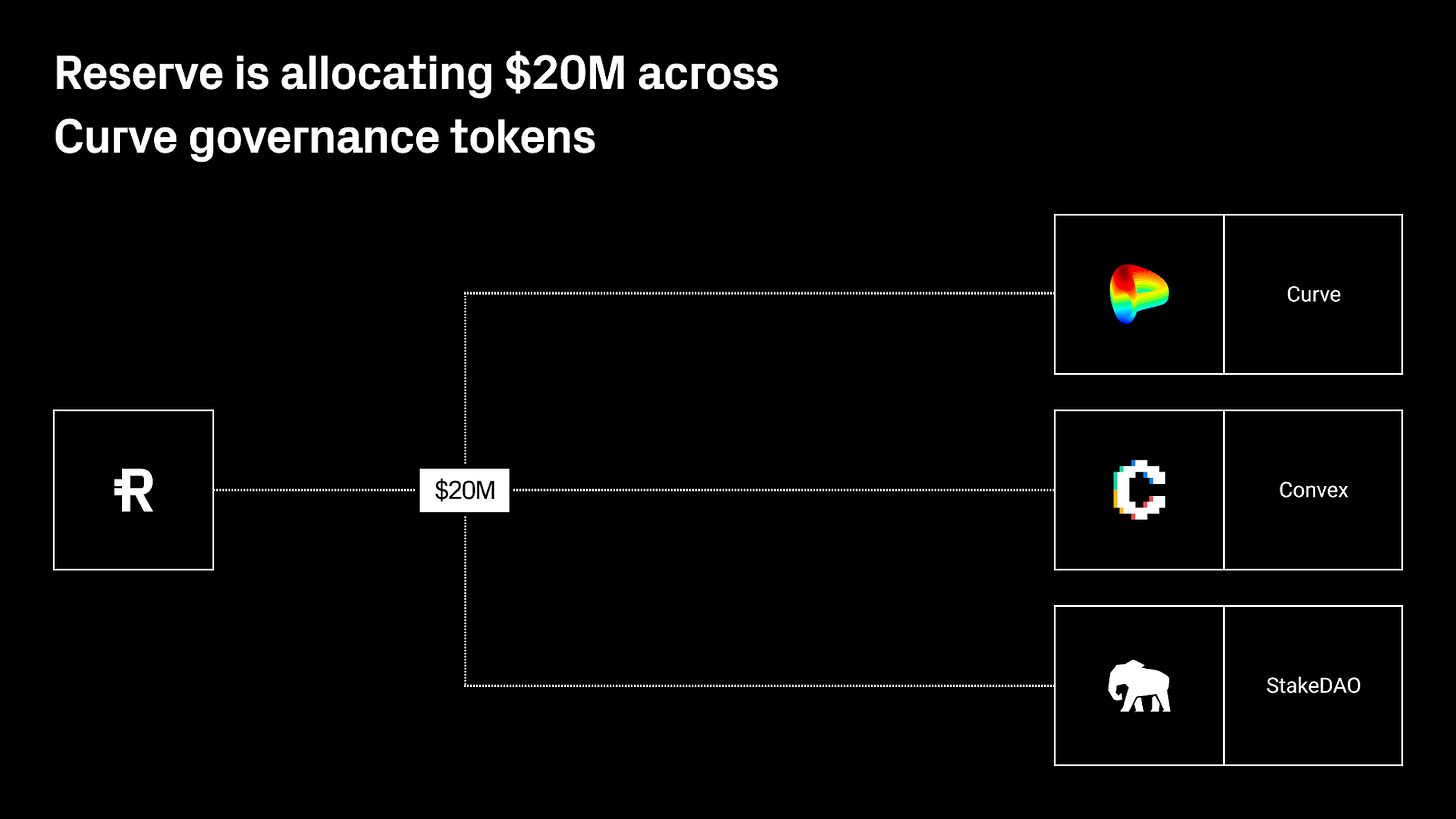

Reserve Protocol announced a $20m investment into the Curve Finance ecosystem

Can Reserve's platform that allows the permissionless creation of assets become a marketplace for asset-backed currencies?

In this article we will go over:

• What is Reserve Protocol

• How it works

• Reason for investment in Curve ecosystem

• Reserve goals

• Limitations

• Conclusion

First of all, what is Reserve Protocol?

Reserve Protocol is a platform that allows the permissionless creation of stable and decentralized assets.

These assets are called RTokens and are backed by user-defined ERC20 tokens.

RTokens backing might consist of yield-bearing tokens including LP tokens (eg LP tokens from Convex Finance)

Or receipt tokens (eg cUSDC from @compoundfinance).

RTokens can also be overcollateralized by staked $RSR (later about it).

In less than 120 days three RTokens are launched and gained ~$23M MC.

• eUSD - Anti-fragile stablecoin, proven during Silicon Valley Bank run.

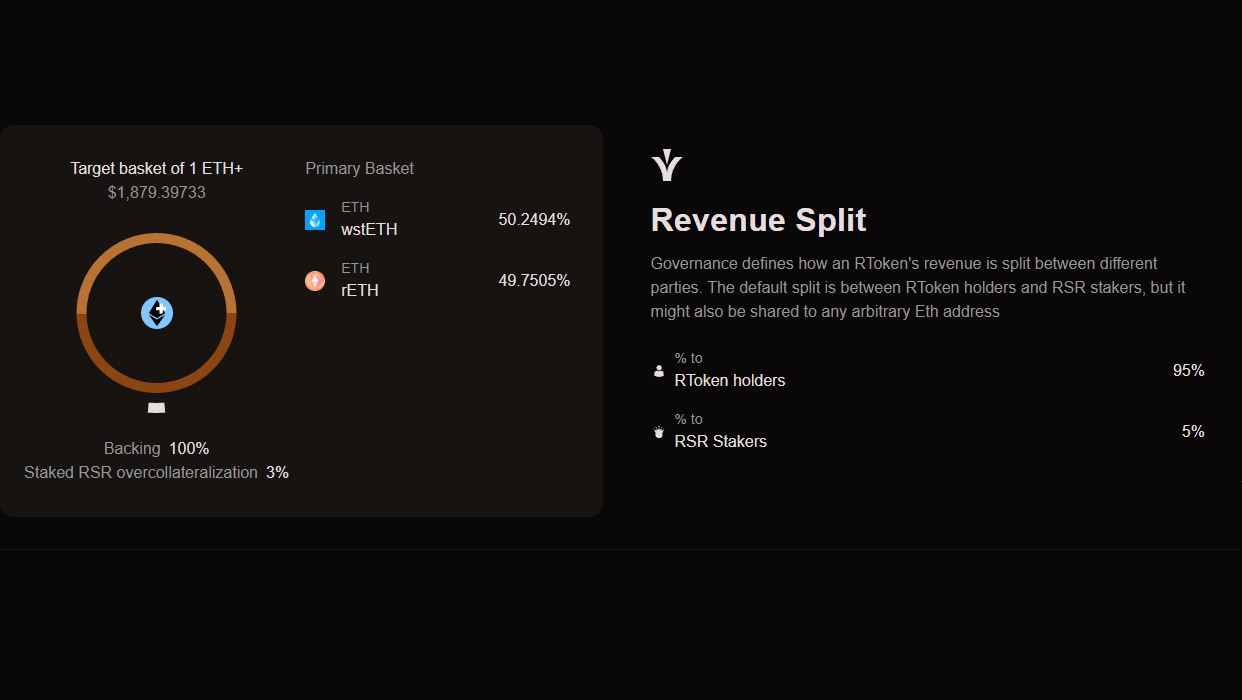

• ETH+ - Diversified ETH staking index with up to 4.5% APY.

• hyUSD - Secure high-yield savings USD with up to 8% APY.

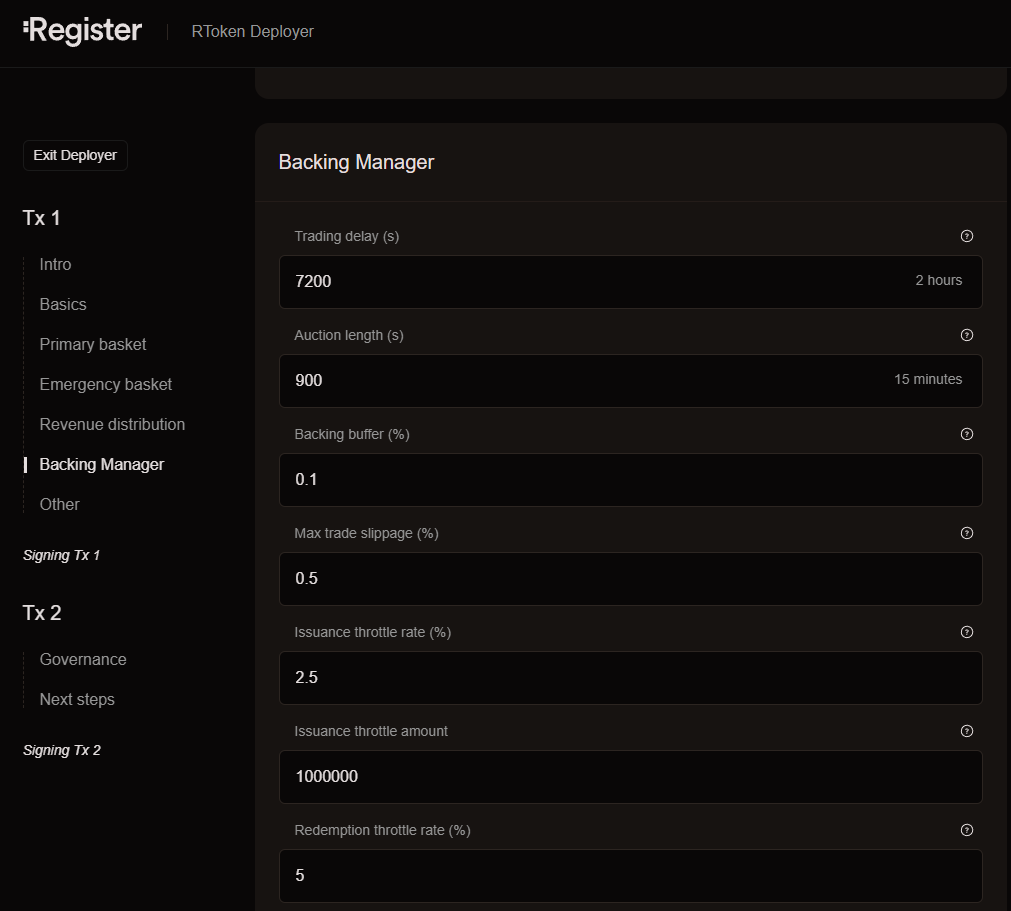

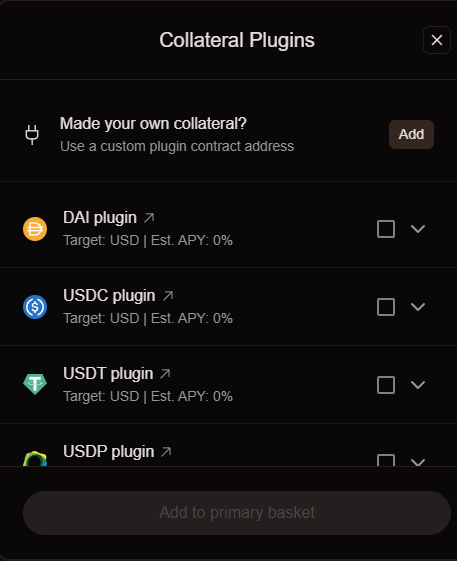

To create your own stablecoin anyone can go to the dApp and configure the parameters such as:

• Token name

• Ticker

• Basket of backing assets

• Emergency collateral

• Revenue distribution

• Etc (21 customizable parameters + 7 governance parameters)

The token deployer can determine how much revenue will go to RTokens holders, other wallets (eg "own treasury"), or $RSR stakers.

$RSR stakers can be incentivized with yield earnings to provide additional over-collateralization of the RToken backing.

stRSR can be slashed in case of collateral default, as happened during the USDC depeg with eUSD.

At that time USDC was swapped for the emergency collateral (USDT) leaving eUSD ~98% backed.

Then stRSR were slashed to fill the 2% gap, before regulator backstop or bank openings.

So why does Reserve invest in the Curve ecosystem?

To answer this question first the need to understand what is the purpose of money:

• Store of value

• Unit of account

• Medium of exchange

Reserve protocol fulfills the first two purposes, but RTokens can not become a medium of exchange without liquidity.

(Even despite RTokens can be redeemed against its backing collateral on-chain 24/7).

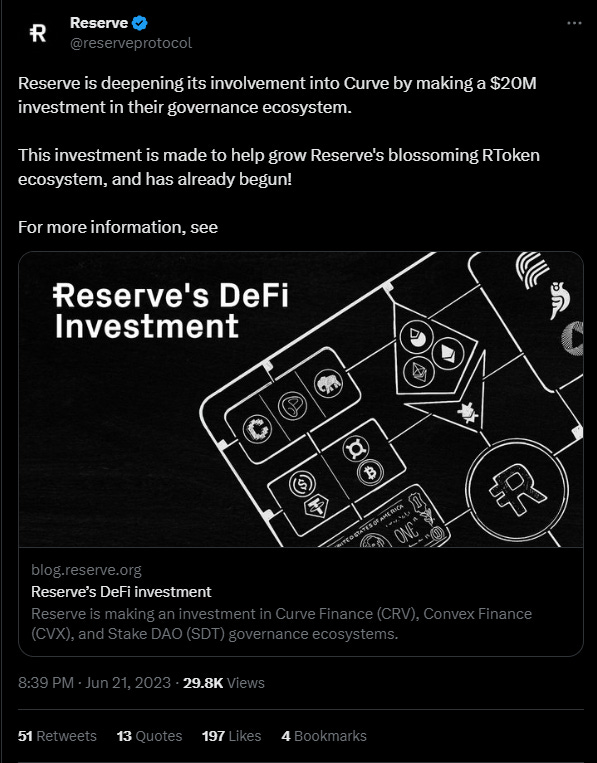

So to make RTokens widely used and adopted Reserve decided to make a $20m investment to support RTokens deployers.

There is no clear guideline yet on who and in what size will get liquidity incentives, but it's likely those who are aligned with Reserve ecosystem values.

Meaning that part of the revenue should be distributed to the $RSR stakers, it should be relatively safe, etc.

Obviously, not all RTokens will get liquidity incentives, and not all of them will succeed in the long run.

Same as not every YouTube channel or Shopify store succeeds.

The goal of the Reserve is to increase the adoption of and expand access to a sustainable, inflation-proof, stable currency.

A permissionless marketplace of experiments can accelerate this.

Who can potentially utilize RTokens?

• Entrepreneurs

• Videogames

• Metaverses

• DAO treasuries

• Hedge funds

• Apps, etc

Any of them can deploy an asset-backed currency with Reserve for their specific needs.

The best example here is eUSD (deployed on Ethereum and MobileCoin L1).

There are 500k+ users of RPay (Latam) and MOBY (borderless) apps.

So eUSD is already a means of exchange for people using these mobile applications.

Mobile Coin is already supported by the Signal App, which has over 100 million downloads.

And I expect once eUSD becomes more popular it may be integrated into Signal.

So the current strategy for Reserve is to support new RTokens until they get mature and can run on their own.

It will help the Reserve ecosystem to grow and allow RTokens to get organic use cases.

However, RTokens do also have some limitations (or strengths, depending on how you look at it) :

• 1:1 asset-backed design

• Incentives

• Curve factor

Design

RToken deployers are only limited to asset-backed design.

Although, the backing assets can be of different designs that de facto make RToken have the same design as the underlying backing.

Incentives

RToken deployers do not have token emissions or ponzinomics to incentivize users to mint RTokens and they rely on unique use cases, organic traction, and Curve liquidity incentives from Reserve Protocol.

Curve factor

Like many stablecoin projects, Reserve fully relies on the Curve ecosystem for liquidity and Curve might or might not exist by the time RTokens reach escape velocity and have self-reinforcing growth flywheels.

Conclusion

I expect that in the nearest future, we will witness rapid growth in RTokens market cap and their number.

RToken deployers can get free incentives and community support from the Reserve ecosystem.

However, there is a long path ahead in creating a fully developed ecosystem where RTokens become widely adopted and serve the purpose of a new reserve currency.