DMH Newsletter is a vital news hub with crucial updates & narratives and trends

Spotlight Project: HMX

HMX offers up to 1000x leverage on Crypto, Forex, and Commodities. It accepts various crypto assets as collateral with cross-margin collateral support, enabling flexible position and risk management strategies.

Additionally, HMX provides low fees comparable to CEXs. What sets HMX apart are its additional features like subaccount support, instantaneous execution, one-click trading, on-chart trading, and more, which offer a user experience similar to CEXs while still retaining the benefits of decentralization.

Users also have the opportunity to become market makers for traders at HMX by depositing assets into the HLP vault. The liquidity in the HLP vault serves as the market-making liquidity for traders at HMX and the vault is unique because it is built on top of GMX's GM token.

This unique feature allows depositors to earn yields from both GMX and HMX fees, maximizing passive real yields for the same liquidity used in market-making for both platforms.

The collateral factor for the BTC and ETH has been increased to 0.90.

With this change, your $BTC and $ETH collateral will now give you more buying power, allowing you to open larger positions!

Current HMX fees still the lowest in the market (0.02% for BTC& ETH, 0.03% for other cryptos & commodities, 0.01% for FX)

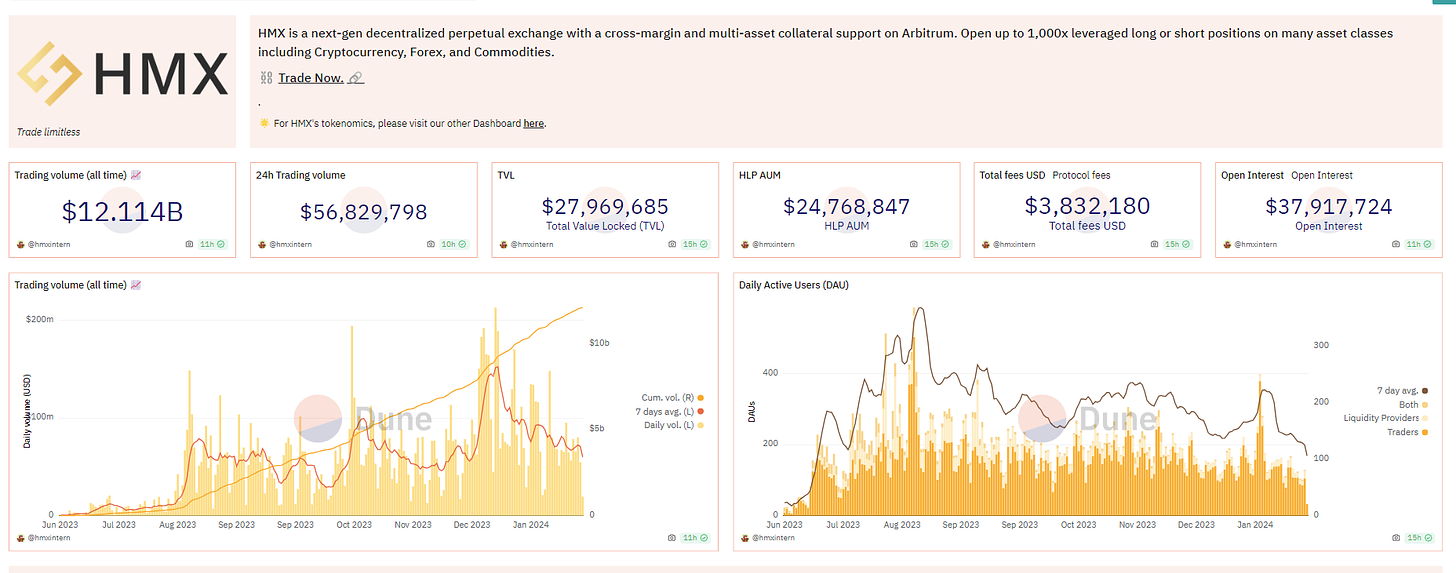

Since its Open Beta launch in late June, HMX has achieved the following statistics:

🔸 ~$12.1 Bn in total trading volume just 4 weeks after hitting the $10Bn milestone

🔸 ~$28.5 Mn in TVL

🔸 ~5,000 unique users

🔸 100,000+ trades supported

🔸 3 audit reports from Foobar, WatchPug, and Cantina

🔸>$3M of revenue distributed to the users

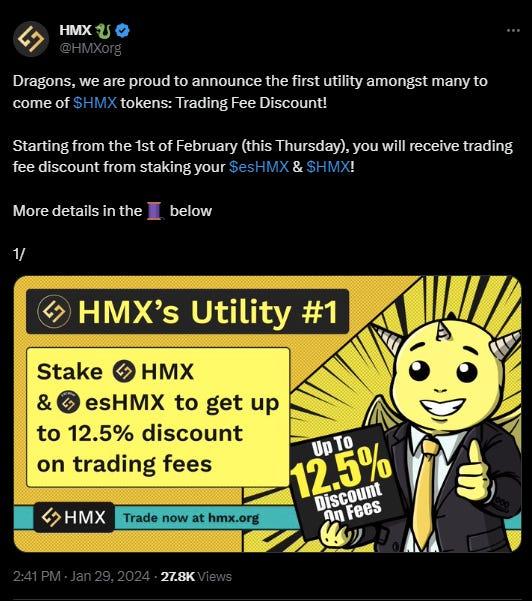

Latest update: trading fee discount for $esHMX & $HMX stakers:

Users can stake $HMX to get even cheaper fees, this is one of multiple upcoming utilities for $HMX

To explore more information about discount fees, read this article

2/➯ Updates & Upgrades in DeFi

LayerZero V2 is Live:

dYdX Chain adds liquid staking support with latest upgrade:

Orbiter Introduces Orbiter Rollup:

ZeroLend announced a points-based campaign with a quest involving the PYTH Governance Token stakers:

VirtuSwap is a DEX with an AI liquidity optimizer:

EigenPie has soared past the $125M TVL milestone:

Immutable zkEVM Mainnet Early Access is live:

Lightning Labs released their latest “Navigating Your Node with Terminal” video:

Over $190,000 in bribes are currently allocated for #vlCKP voters through the Cakepiexyz bribery market:

Take a look at RenzoProtocol ezETH pool on Penpie:

Mode Network released their Mainnet and Airdrop campaign:

3/➯ Alpha by Threadors & Good Reads

The promise and challenges of crypto + AI applications by Vitalik Buterin:

Defi_mochi thread about a16zcrypto's research on ZKP & compliant privacy:

Vingt is a platform that focuses on the relationship between AI and DeFi:

Vitalik's [Crypto x AI] Essay - Distilled Pt. 1:

Report by Coinbase about the State of Bridging:

For those looking to get exposure to Restaking

This thread aims to give you a primer on:

Why L2 blockchains are not ready for mass adoption yet:

Crypto Innovation Watchlist:

4/➯ VITAL NEWS📰₿

Sei bets on ‘EVM parallelization’ to lure Ethereum developers — but it’s not alone:

BlackRock and Fidelity inch closer to becoming two largest Bitcoin holders as ETFs gobble up $5bn

Tether's Q4 Reports $2.85 billion in Profit, Sets New Records in Excess Reserves of Cash and Cash Equivalent Backing Token in Circulation

Fed Leaves Rates Unchanged, Sounds Hawkish Note on March:

5 /➯⛓️On-Chain Data:

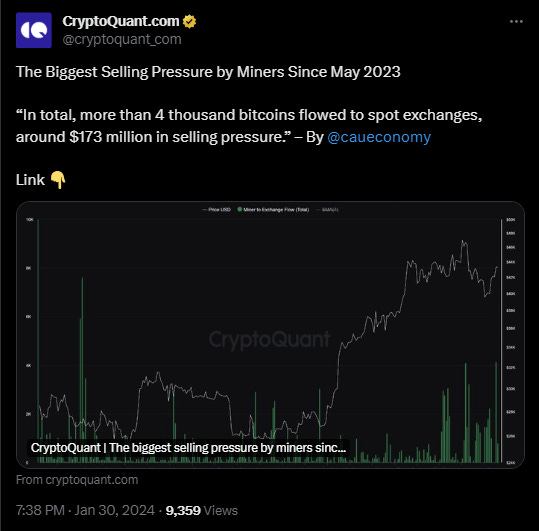

The Biggest Selling Pressure by Miners Since May 2023:

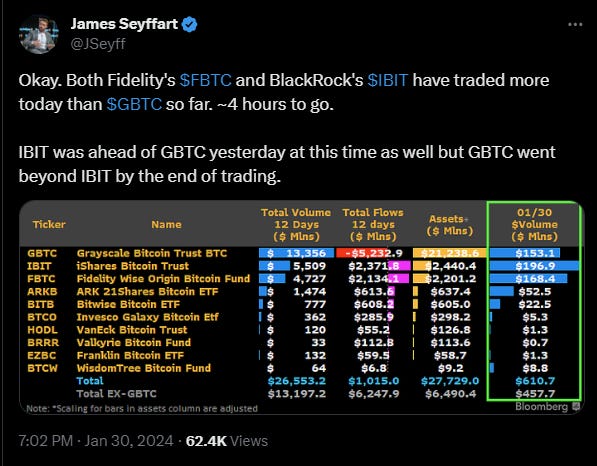

On Tuesday Both Fidelity's FBTC and BlackRock's IBIT have traded more than GBTC so far. ~4 hours to go:

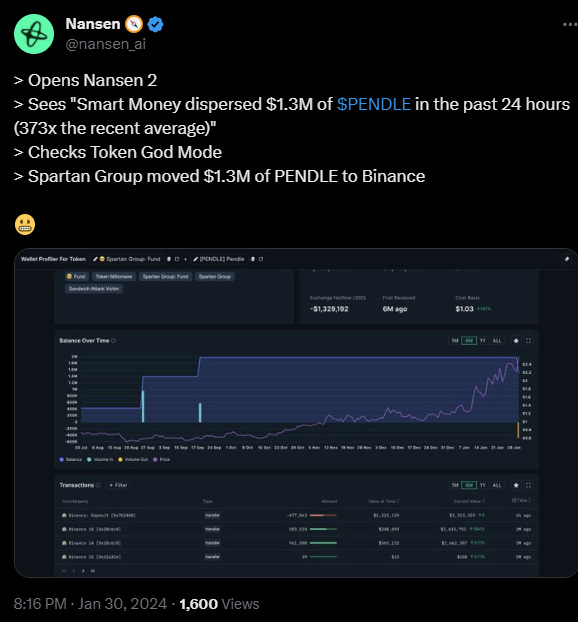

Latest on-chain moves: Smart Money dispersed $1.3 million PENDLE:

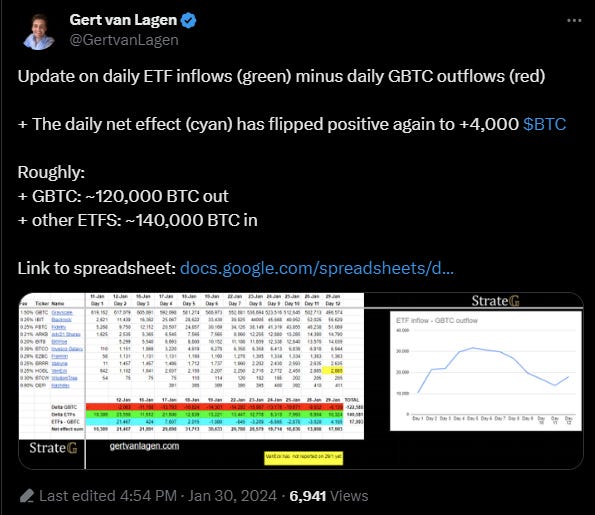

Overview of daily ETF inflows:

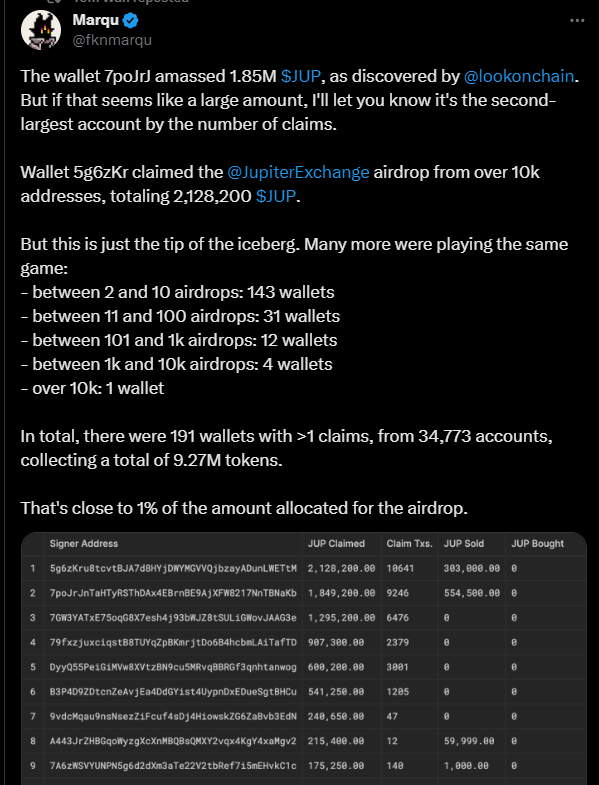

The most prominent wallets that receive Jup airdrop:

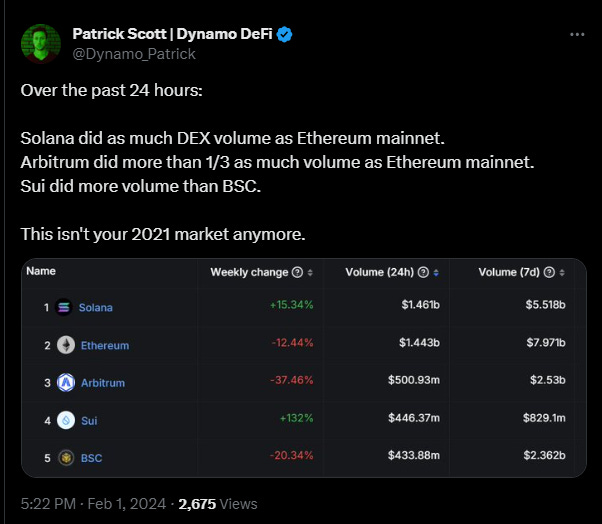

On-chain milestones in recent times:

6/➯ Macro Metrics 📈

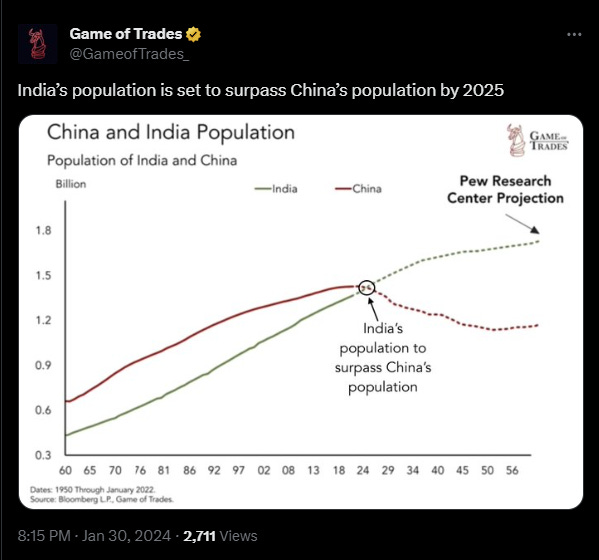

India’s population is set to surpass China’s population by 2025:

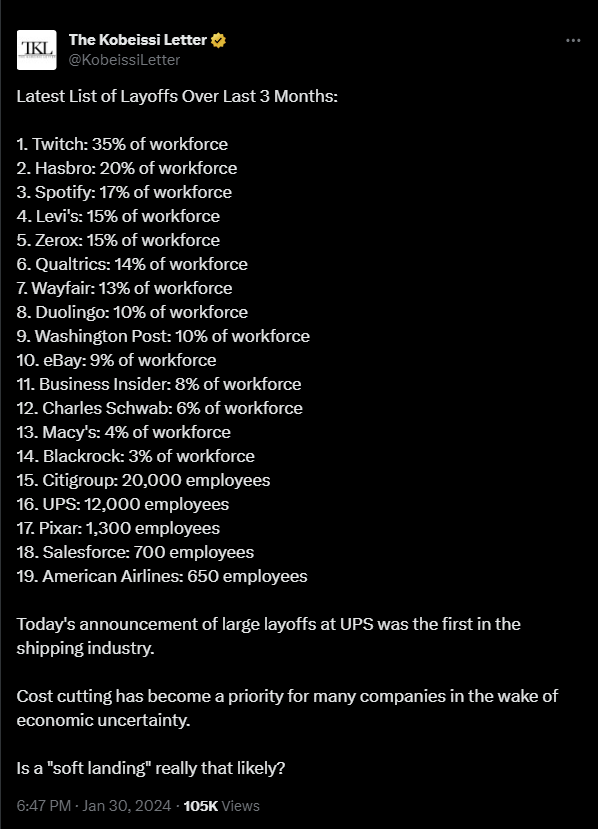

Latest List of Layoffs Over Last 3 Months:

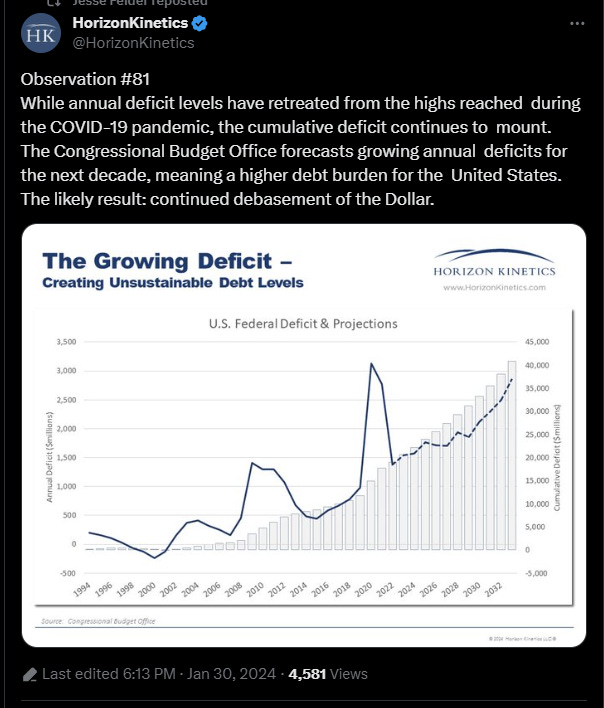

The Growing Deficit - Creating Unsustainable Debt Levels:

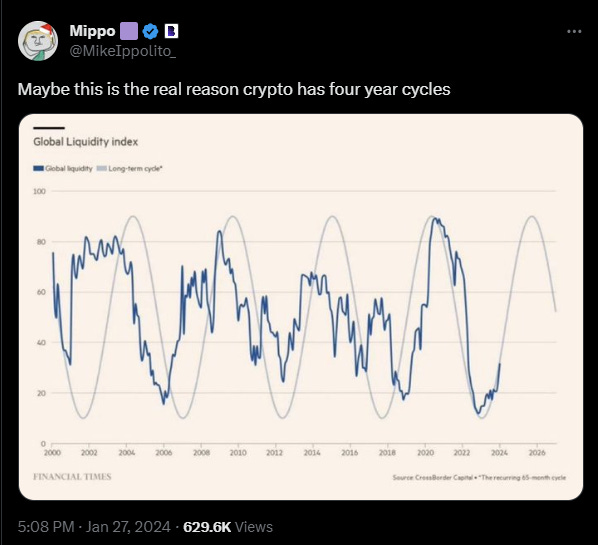

Maybe this is the real reason crypto has four-year cycles:

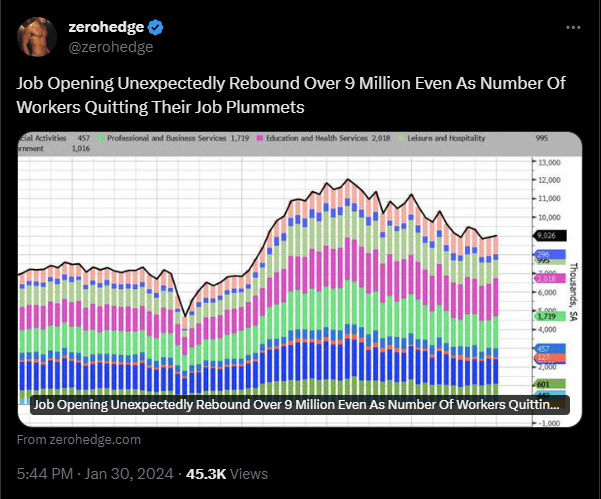

Job Opening Unexpectedly Rebound Over 9 Million:

7/➯ Exploits & Bugs

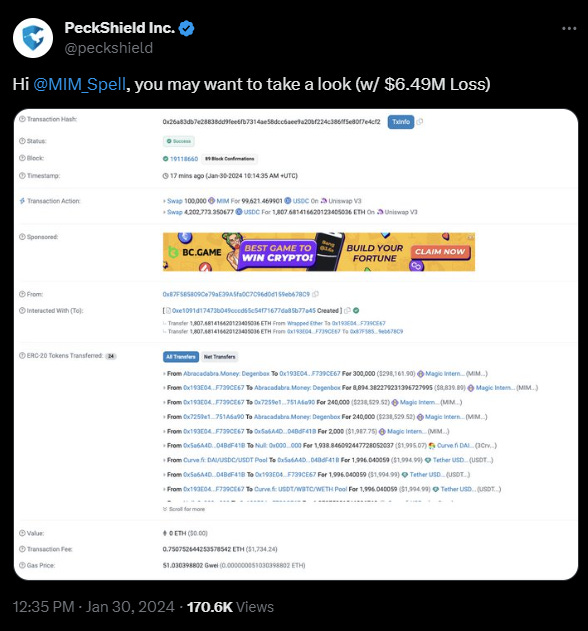

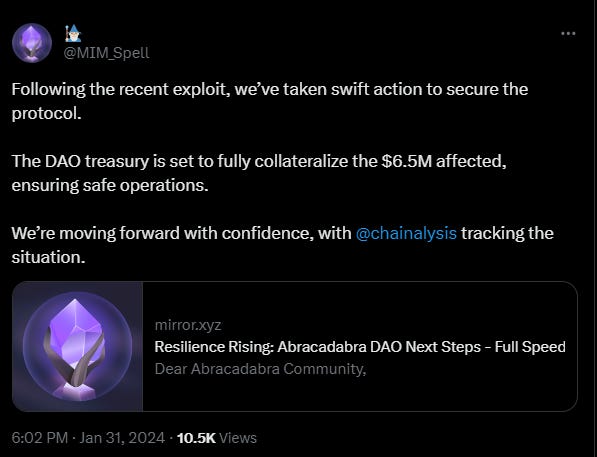

MIM Spell was drained:

Abracadabra DAO treasury prepared to fully collateralize the exploited amount of $6.5M:

That’s it for today, my friends!

Thank you all for staying with us. Your future self will undoubtedly be grateful for the knowledge and insights gained here.

For more crypto-related content, feel free to follow me on Twitter ➯ DeFi_Made_Here.

I'll continue sharing valuable information about the latest insights and my thoughts in this fast-paced field.

If you enjoyed this newsletter as much as we did creating it, don't hesitate to share this post with your fellow crypto enthusiasts! Together, let's expand our understanding of this ever-evolving industry.