Today's Newsletter is brought to you by Avantis

Avantis Finance is a cutting-edge Perp DEX platform on Base for market-making and trading crypto, forex, and commodities with advanced risk management for LPs, loss protection for traders, and access to 100x leverage for crypto and RWAs

- Backed by Pantera Capital, Base and more

- Raised $4M in funding

🙍♂️ Followers: 46.2k

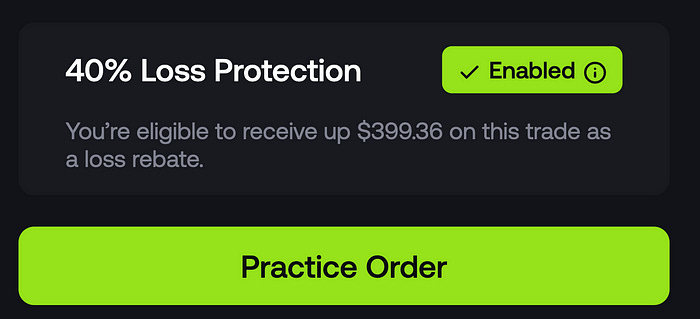

Avantis proudly introduces the loss protection feature, a groundbreaking innovation.

In margin-based perpetual DEXes, trades are priced using oracles. This ensures that the "mark" and "index" prices are always the same, thanks to LPers.

Following this logic, Avantis has removed funding rates and, on the other hand, charges margin fees that are directed toward LPers and has implemented loss protection for traders who balance the OI.

Traders on the less skewed side of the market are eligible for a guaranteed rebate on their trading losses. The amount of these rebates varies depending on the market skew at the time the trade is opened.

I find this approach quite intriguing because it allows traders to effectively "arbitrage" without eliminating the arbitrage opportunity for themselves.

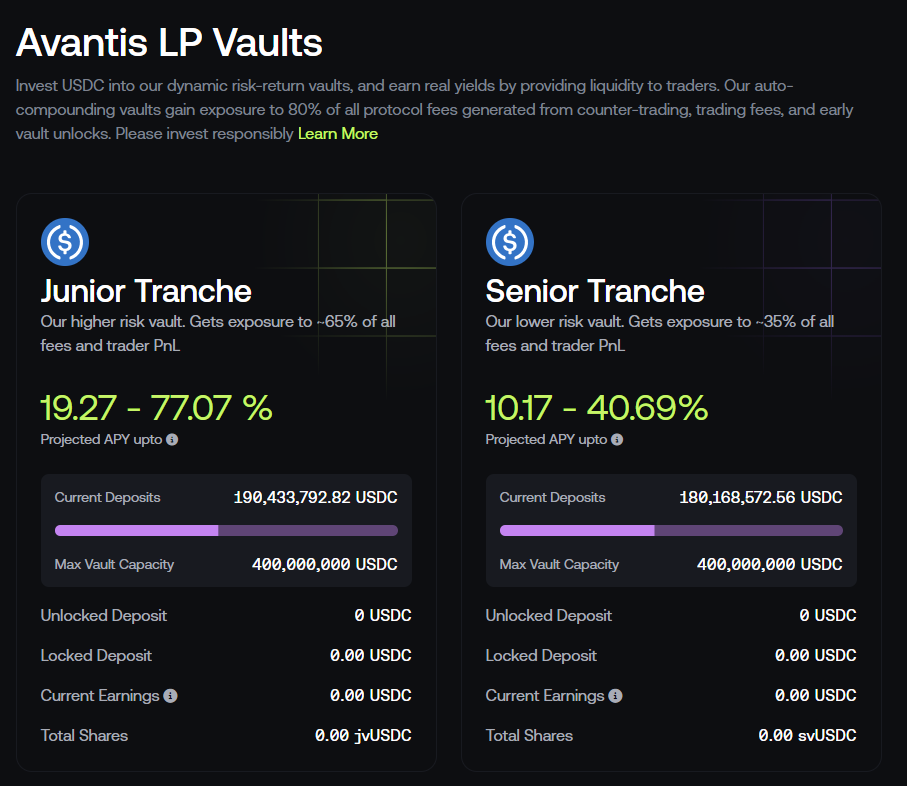

USDC Vault:

As an Avantis liquidity provider, you can earn a yield on stable assets through their stablecoin market-making vault, powered by USDC. It’s accessible leveraged trading for all traders, capital efficient and safe

The vault is the counterparty for all platform trades. Traders' winnings and losses are handled by the vault. In return, the vault receives a portion of trading fees.

Fees are split among avUSDC shares in risk tranches.

Two risk buckets are available: Senior Tranche (low risk) and Junior Tranche (higher risk).

As long as fees earned exceed PnL payouts, stakers earn a positive return. The protocol has risk management measures to protect LPs.

Scalable Trading Leverage for everyone on Avantis

Trade now: link

2/➯ Updates & Upgrades in DeFi

Perp V3 — the Smart Liquidity Framework for Onchain Derivatives:

Introducing SeiDB - a crucial part of the new Sei v2 design:

Restaking vaults are launching on Solana:

Gitcoin revealed the Revolutionary Sybil Defense Passport ETH Stamp:

RARI Chain Mainnet is live:

Router Nitro is live on mainnet:

The LST Pre-Deposits Window is now open on Eigenpie:

Aptos introduces Block-STM:

Upcoming ETROG UPGRADE + Cardona Testnet on Polygon:

USDV-BNB Pool on Cakepie with 208% APR:

3/➯ Alpha by Threadors & Good Reads

Euclid - Omnichain Liquid Restaking Protocol:

The Bitcoin L2 Opportunity:

Polyhedra has huge development: a) Cross-chain bridges b) Privacy protection (zkDID) c) Scaling via ParaPlonk is a distributed proof

Real World Assets (RWAs) and Their Impact on DeFi

10 Key Opinions on [Crypto x AI]:

The Kakarot zkEVM Journey Through 2023:

4/➯ VITAL NEWS📰₿

FTX is selling crypto and stockpiling cash to pay clients with accounts frozen since collapse:

Fraxtal will be the first eth l2 that can connect to other chains like Solana:

Bitcoin ETF ads may appear on Google starting Monday, the community speculates:

This week the Federal Reserve will announce its first interest rate decision in 2024. CME showed 96.9% kept interest rates unchanged

Roughly ‘60% chance’ of spot ETH ETF approval in May: Seyffart:

Confirmed Airdrop in Frax:

On January 26, Harvest Hong Kong, one of China’s largest fund companies, submitted a Bitcoin spot ETF application to the Hong Kong Securities and Futures Commission

5 /➯⛓️On-Chain Data:

Total Value Staked is over 200 000 ETH:

Kamino Lend has reached $200M TVL:

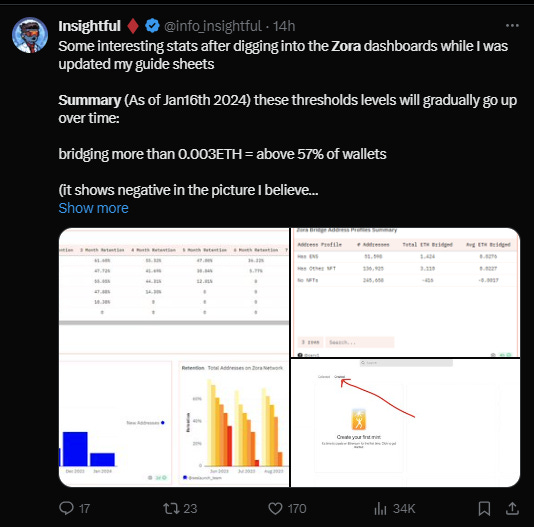

Zora on-chain stats:

- bridging more than 0.003ETH = above 57% of wallets

- more than 0.0172ETH = above 88% of wallets:

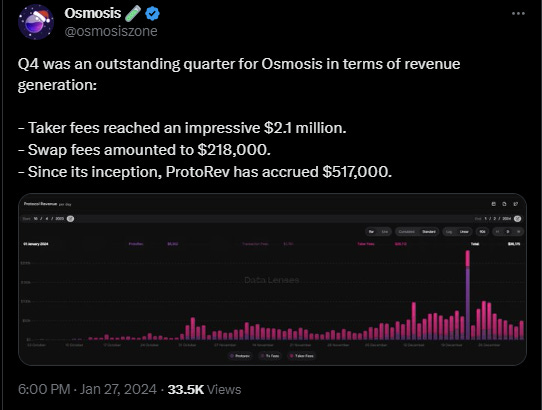

Q4 was an outstanding quarter for Osmosis in terms of revenue generation:

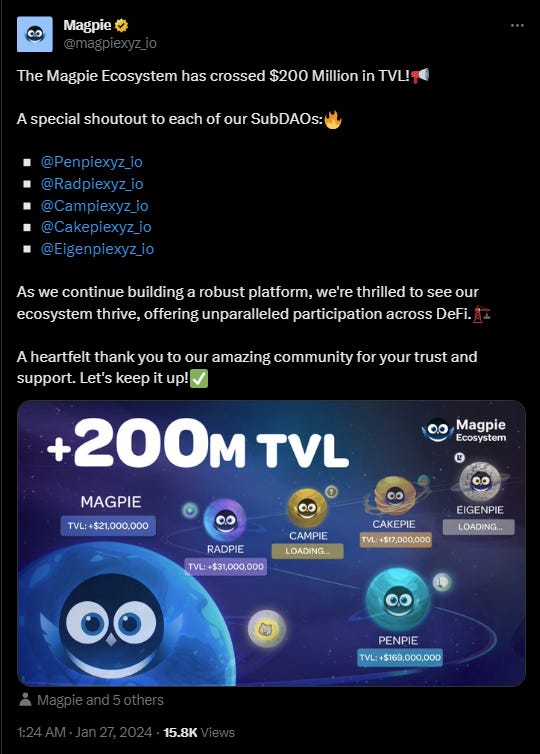

Magpie Ecosystem has crossed $200m in TVL:

6/➯ Macro Metrics 📈

Weekly S&P500 report:

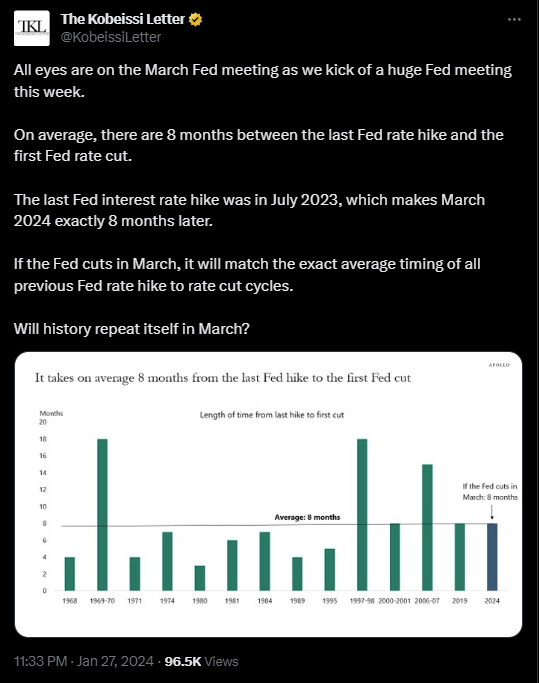

It takes on average 8 months from the last Fed hike to the first Fed cut:

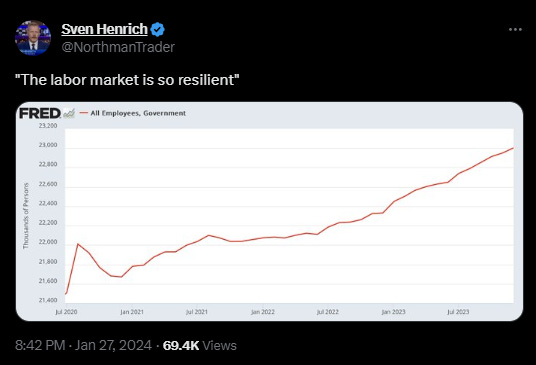

Overview of the labor market:

7/➯ Exploits & Bugs

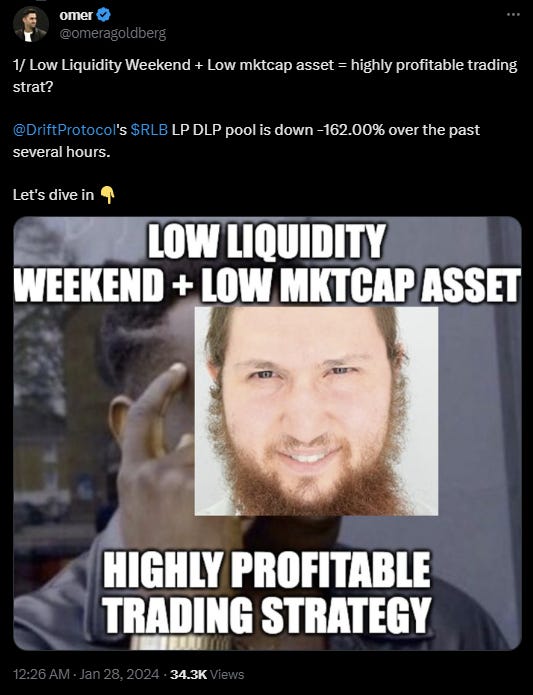

DriftProtocol's RLB LP DLP pool is down -162.00%:

That’s it for today, my friends!

Thank you all for staying with us. Your future self will undoubtedly be grateful for the knowledge and insights gained here.

For more crypto-related content, feel free to follow me on Twitter ➯ DeFi_Made_Here.

I'll continue sharing valuable information about the latest insights and my thoughts in this fast-paced field.

If you enjoyed this newsletter as much as we did creating it, don't hesitate to share this post with your fellow crypto enthusiasts! Together, let's expand our understanding of this ever-evolving industry.

An amazing newsletter, thank you!