DMH Newsletter is a vital news hub with crucial updates & narratives and trends

Spotlight Project: HMX

HMX offers up to 1000x leverage on Crypto, Forex, and Commodities. It accepts various crypto assets as collateral with cross-margin collateral support, enabling flexible position and risk management strategies.

Additionally, HMX provides low fees comparable to CEXs. What sets HMX apart are its additional features like subaccount support, instantaneous execution, one-click trading, on-chart trading, and more, which offer a user experience similar to CEXs while still retaining the benefits of decentralization.

Users also have the opportunity to become market makers for traders at HMX by depositing assets into the HLP vault. The liquidity in the HLP vault serves as the market-making liquidity for traders at HMX and the vault is unique because it is built on top of GMX's GM token.

This unique feature allows depositors to earn yields from both GMX and HMX fees, maximizing passive real yields for the same liquidity used in market-making for both platforms.

The current Trading fee discount is 0.02% BTC/ETH, 0.03% other crypto/commodities, and 0.01% FX that really appealing

The collateral factor for the BTC and ETH has been increased to 0.90.

With this change, your $BTC and $ETH collateral will now give you more buying power, allowing you to open larger positions!

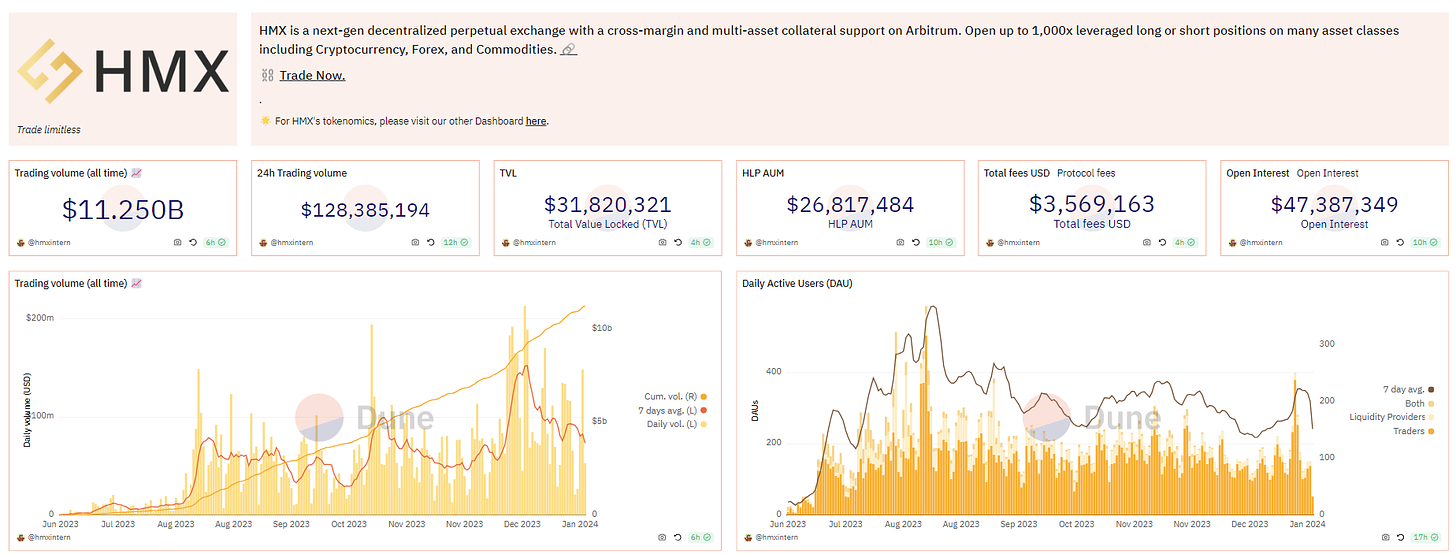

Since its Open Beta launch in late June, HMX has achieved the following statistics:

🔸 ~$11Bn in total trading volume just 2 weeks after hitting the $10Bn milestone

🔸 ~$31.8 Mn in TVL

🔸 ~5,000 unique users

🔸 100,000+ trades supported

🔸 3 audit reports from Foobar, WatchPug, and Cantina

🔸>$3M of revenue distributed to users

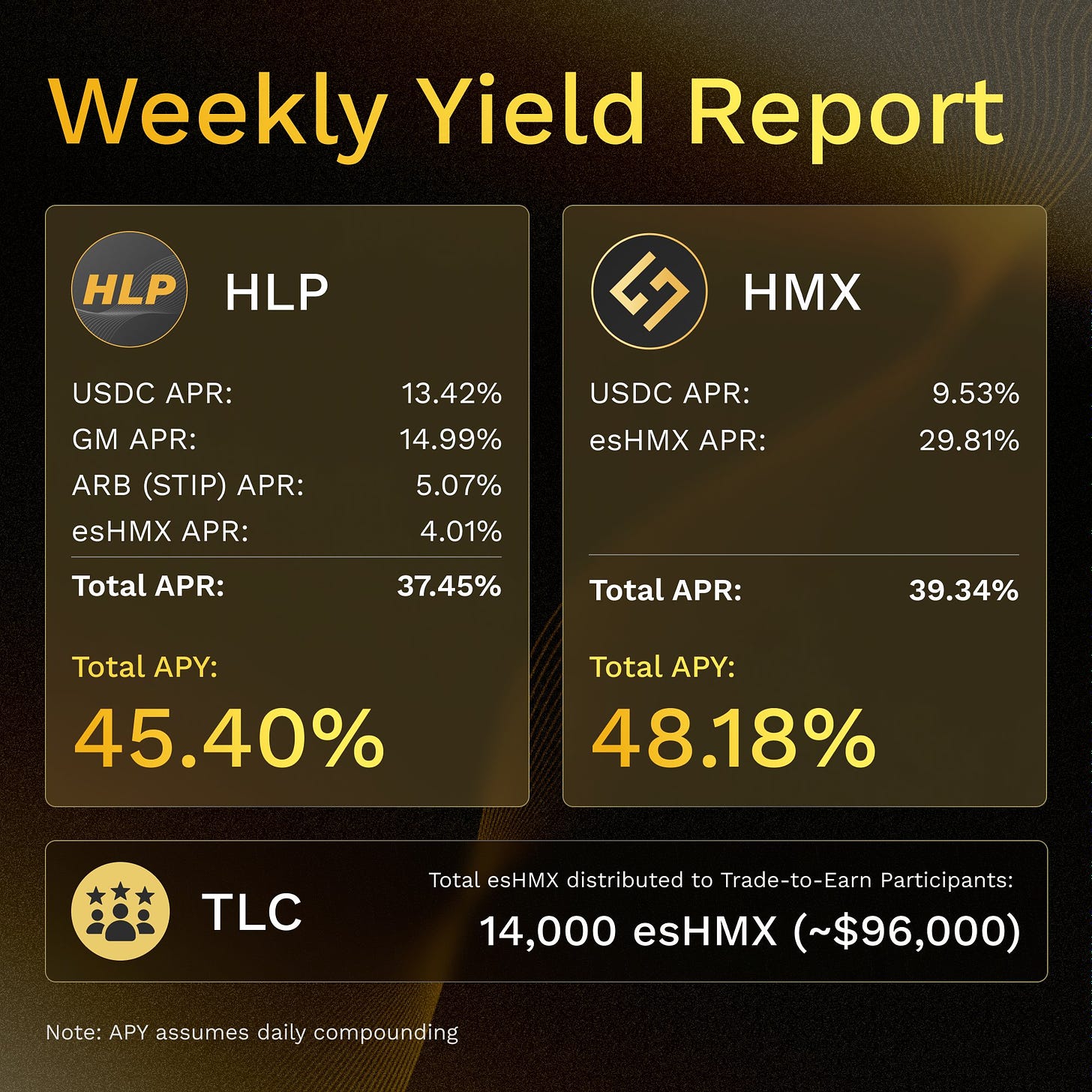

Latest Update: Weekly Yield Report

HMX: 48% APY

HLP: 45.4% APY

Earn now: link

2/➯ Updates & Upgrades in DeFi

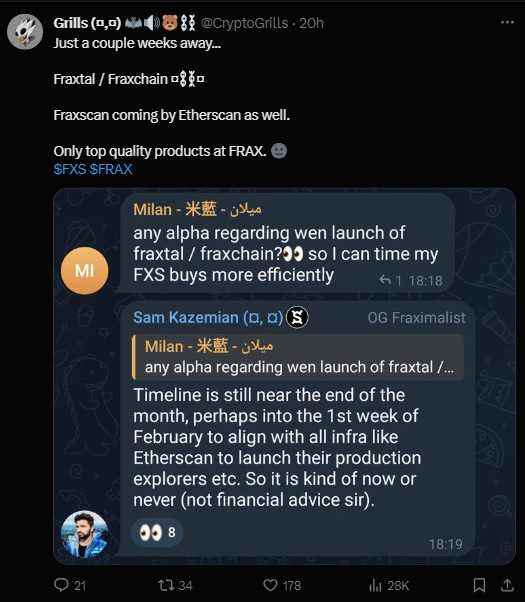

Frax launching l2 blockchain Fraxtal in Feb:

Dusk’s Incentivized Testnet:

~27% APR by staking in the $mPENDLE pool on Wombat

An exciting campaign that is designed for newcomers to get familiar with the Hydra chain:

Join us on this journey link

Ondo Finance TGE:

17% APR: USDT Pool on Radpie:

Weremeow announced that $JUP token will be launching on January 31:

Kindly reminder about Contango 0 trading fees:

SatoshiVM has gathered a lot of hype about their IDO and released the Bitcoin ZK Rollup Layer 2 solution:

Upcoming Blast Testnet:

Congratulations Penpie on its big milestone. Never give up:

Unlocking the Potential of Bitcoin - Conflux Network’s EVM-Compatible Bitcoin Layer 2 Solution:

3/➯ Alpha by Threadors & Good Reads

Overview of EigenDA and technical aspects:

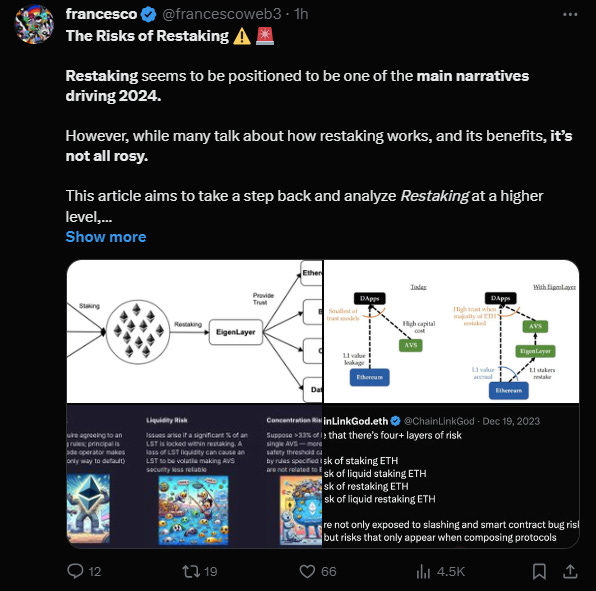

The Risks of Restaking:

The Future of Liquid Restaking:

10 Utterly Brilliant Crypto/Macro Crossover Thinkers You Should Be Following In 2024:

Arthur Hayes revealed arbitrage trading opportunities:

Crypto's Three-Body Problem:

While everyone stakes Tia, staking Pyth is a new narrative to receive multiple airdrops:

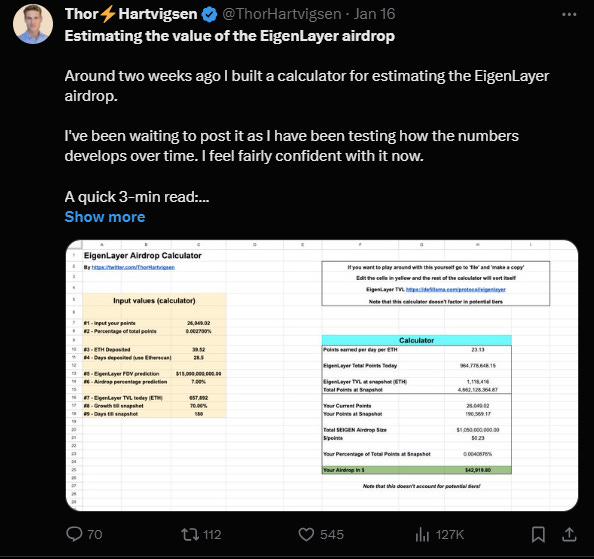

Estimating the value of the Eigen Layer airdrop:

Paradigm’s report about Ethereum's Cancun hard fork:

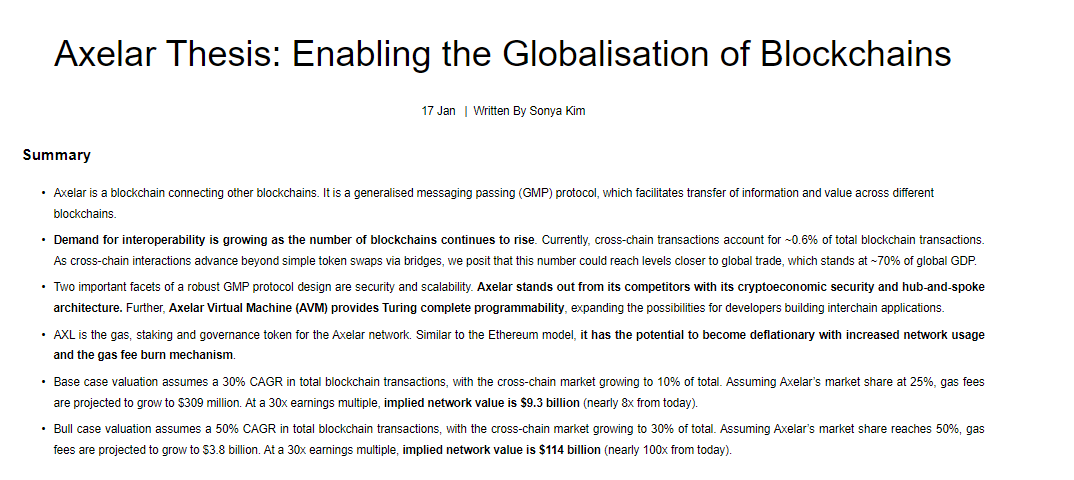

Axelar Thesis - Enabling the Globalisation of Blockchains:

4/➯ VITAL NEWS📰₿

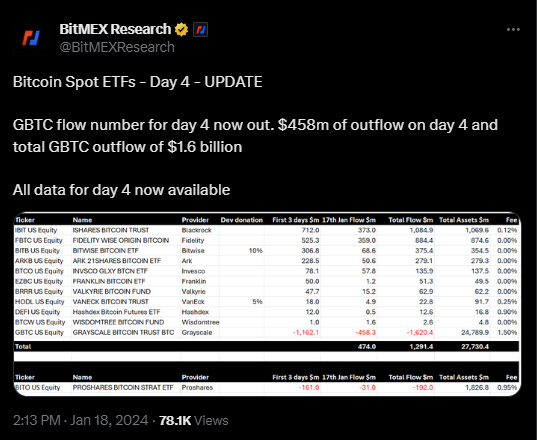

According to BitMEX Research, GBTC had a net outflow of US$458 million on the fourth day, with a cumulative net outflow of US$1.62 billion:

Bitcoin surpasses silver to become the second-largest ETF commodity in the US:

Coinbase Argument with the SEC:

MAS announces BTC ETF cannot be listed in Singapore:

Tether takes fire as UN says stablecoin is ‘preferred choice’ for $17b in Asian crime rackets:

5 /➯⛓️On-Chain Data:

A Bitcoin miner in Texas switched off machines to support the grid during extreme cold weather:

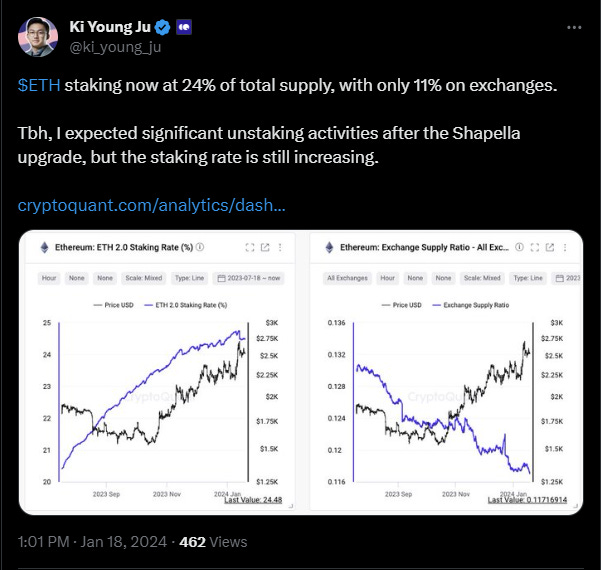

ETH staking now at 24% of total supply, with only 11% on exchanges:

Gorgeous tool to track wallets by Nansen:

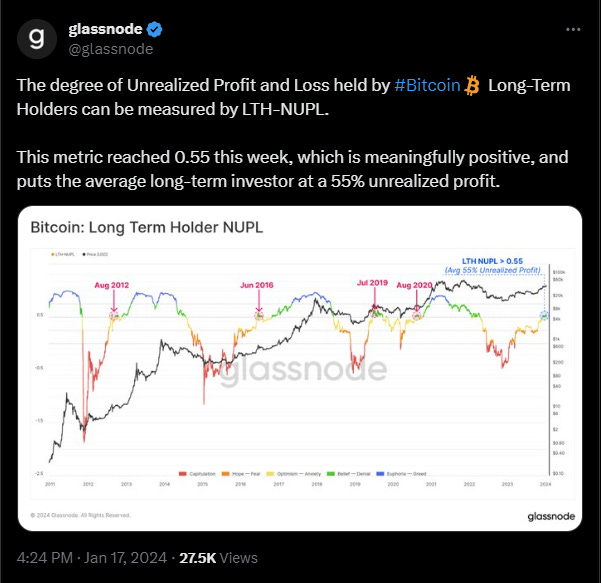

Positive signs on Bitcoin:

LRTs have become a $400m TVL business practically overnight:

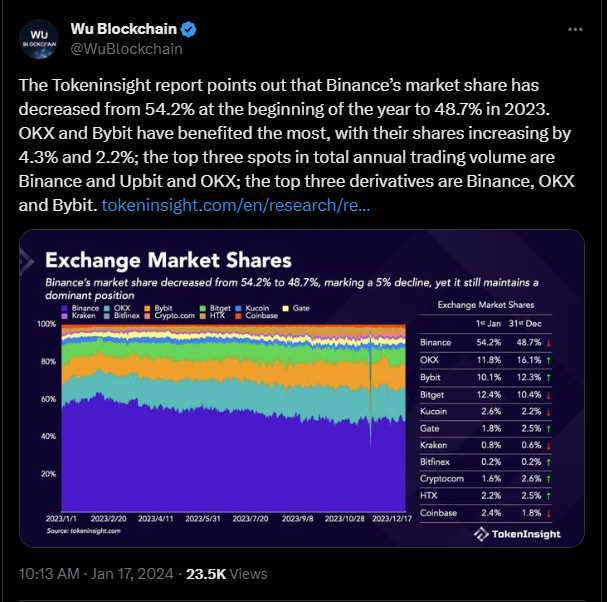

Binance’s market share has decreased from 54.2% at the beginning of the year to 48.7% in 2023:

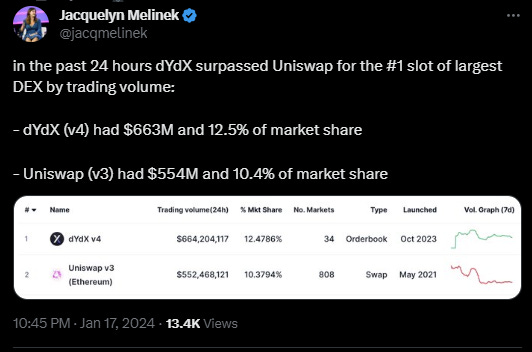

dYdX outperforms Uniswap in trading volume:

Delta-neutral strategy is in full swing - Overview Funding rates on popular assets:

6/➯ Macro Metrics 📈

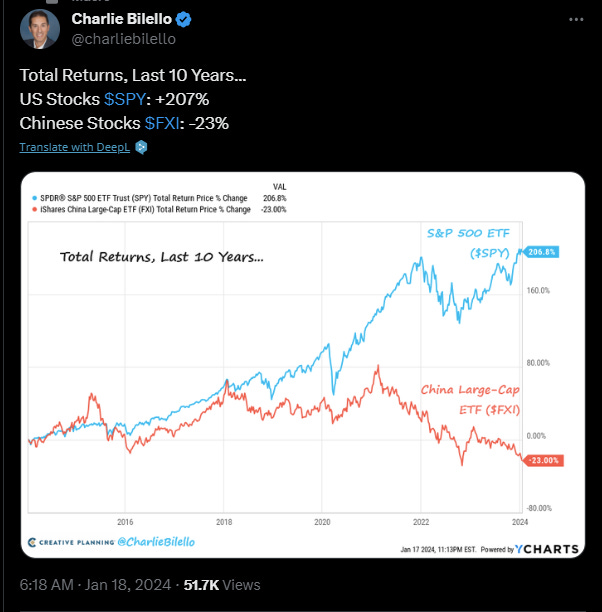

Total Returns, Last 10 Years... US Stocks SPY: +207% Chinese Stocks FXI: -23%:

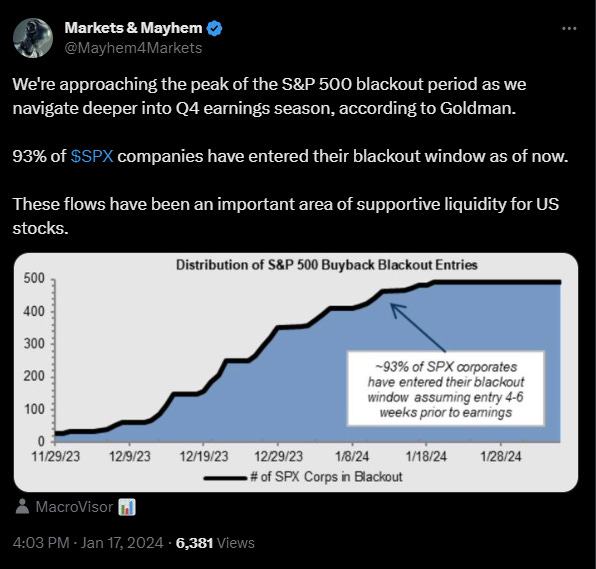

Peak of the S&P 500 blackout period:

EXPLAINER: Why are banks limited in their warehousing capabilities of US Treasuries when they are floated with USD reserves:

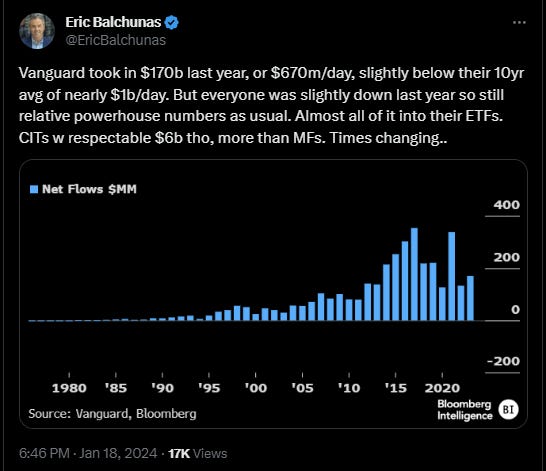

Vanguard: $170b in 2020, $670m/day, slightly below the 10-year average of $1b/day. Still strong numbers despite market downturn:

7/➯ Exploits & Bugs

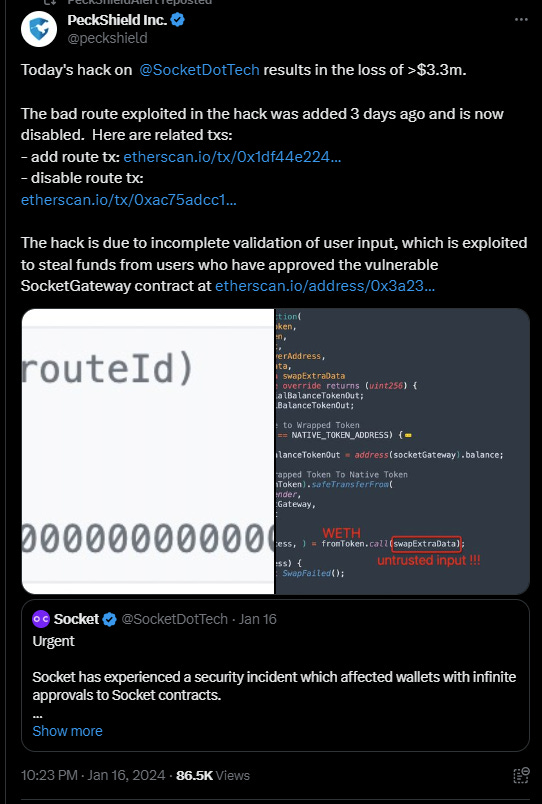

Hack on SocketDotTech results in the loss of >$3.3m:

That’s it for today, my friends!

Thank you all for staying with us. Your future self will undoubtedly be grateful for the knowledge and insights gained here.

For more crypto-related content, feel free to follow me on Twitter ➯ DeFi_Made_Here.

I'll continue sharing valuable information about the latest insights and my thoughts in this fast-paced field.

If you enjoyed this newsletter as much as we did creating it, don't hesitate to share this post with your fellow crypto enthusiasts! Together, let's expand our understanding of this ever-evolving industry.