DMH Newsletter is a vital news hub with crucial updates & narratives and trends

Spotlight Project: HMX

HMX Description:

HMX offers up to 1000x leverage on Crypto, Forex, and Commodities. It accepts various crypto assets as collateral with cross-margin collateral support, enabling flexible position and risk management strategies.

Additionally, HMX provides low fees comparable to CEXs. What sets HMX apart are its additional features like subaccount support, instantaneous execution, one-click trading, on-chart trading, and more, which offer a user experience similar to CEXs while still retaining the benefits of decentralization.

Users also have the opportunity to become market makers for traders at HMX by depositing assets into the HLP vault. The liquidity in the HLP vault serves as the market-making liquidity for traders at HMX and the vault is unique because it is built on top of GMX's GM token.

This unique feature allows depositors to earn yields from both GMX and HMX fees, maximizing passive real yields for the same liquidity used in market-making for both platforms.

HMX was the only top DEX that applied for an $ARB grant from STIP but didn't receive support.

However, HMX remains resilient and maintains a top position in trading volume despite not getting gas support.

It will be interesting to see how HMX performs after the completion of Arbitrum STIP and the leveling of the playing field.

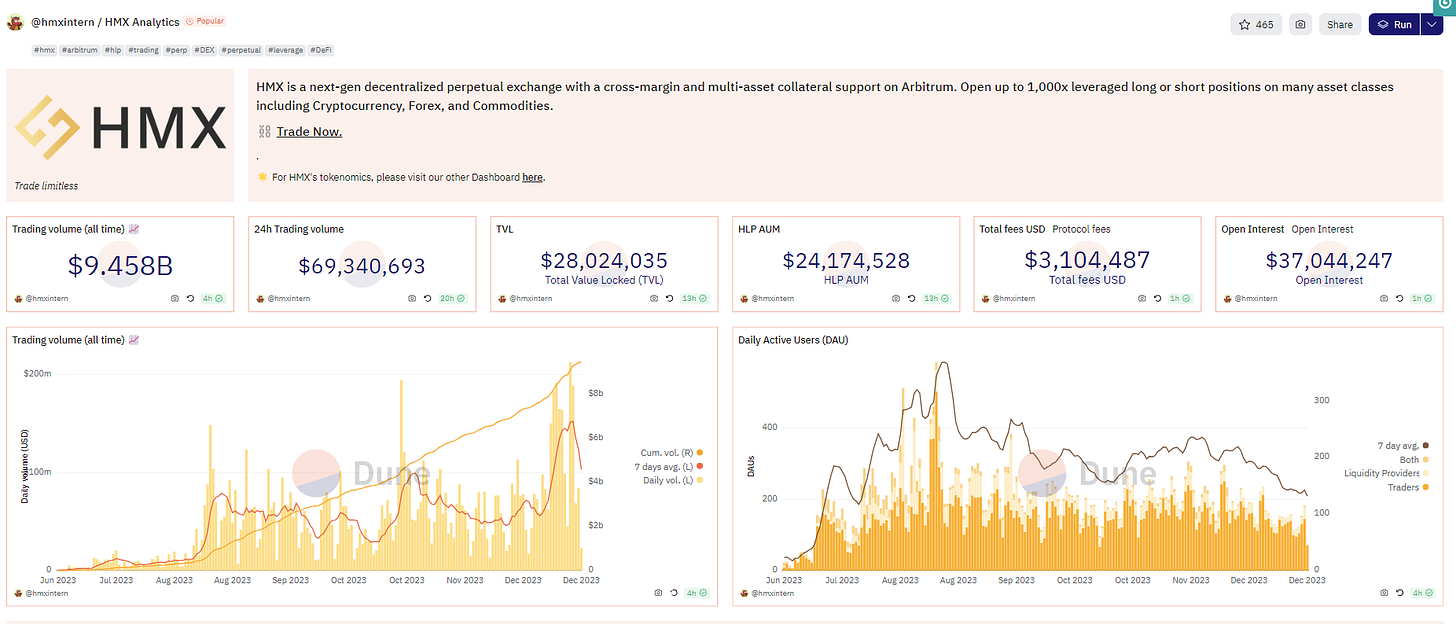

Since its Open Beta launch in late June, HMX has achieved the following statistics:

🔸 ~$9.45Bn in total trading volume

🔸 ~$28Mn in TVL

🔸 ~5,000 unique users

🔸 100,000+ trades supported

🔸 3 audit reports from Foobar, WatchPug, and Cantina

🔸>$3M of revenue distributed to users

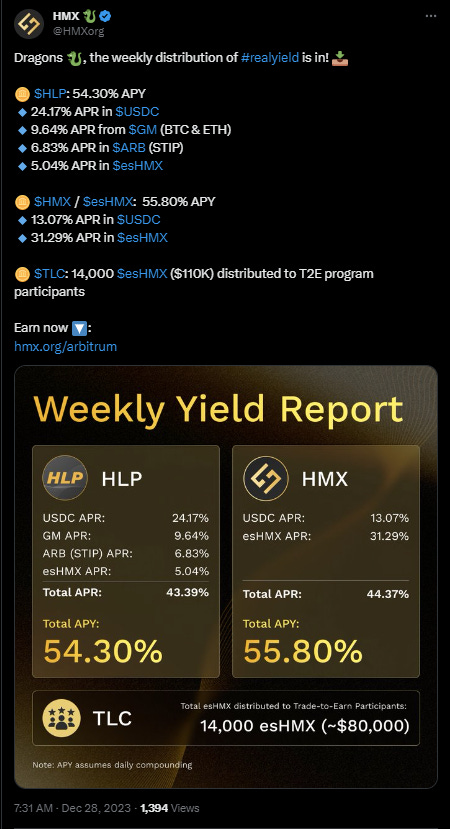

Latest Update: Weekly Yield Report

HLP: 54.30% APY

HMX: 55.80% APY

Earn now: link

2/➯ Updates & Upgrades in DeFi

Neon EVM released Neon Points:

Ordiswap - Infrastructure Unlocking Liquidity on Bitcoin’s Native Layer:

Frax is building an Apple-like vertical stack for base financial primitives:

Dolomite Introduces vARB:

HyperliquidX 50% fee discount for CEX Traders:

WINR Protocol on Solana:

Balancer released a report “8020”:

Juicy APYs ~16% - ~40% APY on Penpie :

Unlocking ONDO - A Proposal from the Ondo Foundation:

Cakepie is officially live on the BNB chain:

3/➯ Alpha by Threadors & Good Reads

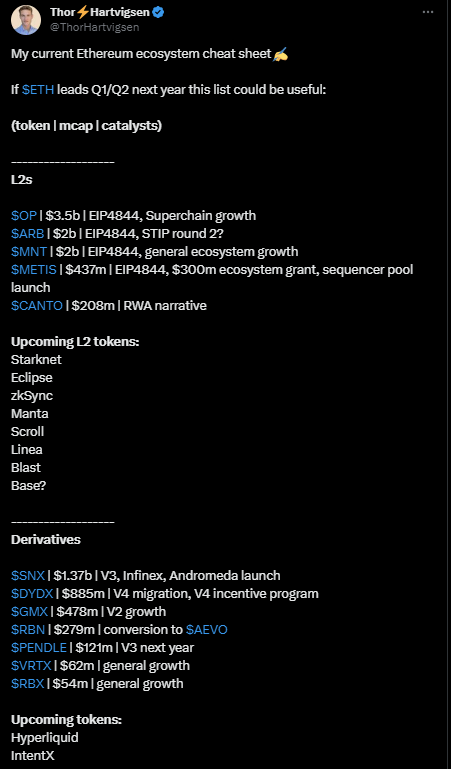

Ultimate Ethereum ecosystem cheat sheet:

10 Trends and Narratives for 2024:

An overview of the crypto industry landscape for 2023: L1 and L2 stress test, LPDFi, LSDFi, RWA:

Solana Groundbreaking Reading List:

MEV Research by Uniswap Foundation including topics like (MEV Cross-chain, Pricing Orderflow, MEV Estimator Research, and Prototype) :

Ethereum is the Only Institution-Friendly Smart Contract Chain:

4/➯ VITAL NEWS📰₿

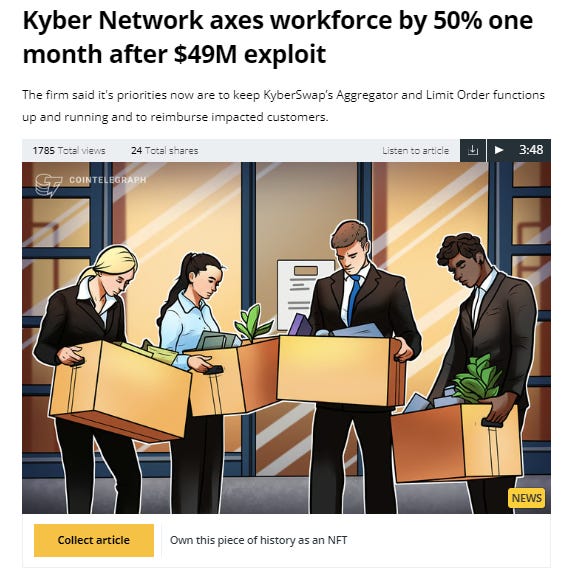

Cyber decreases the team by 50%:

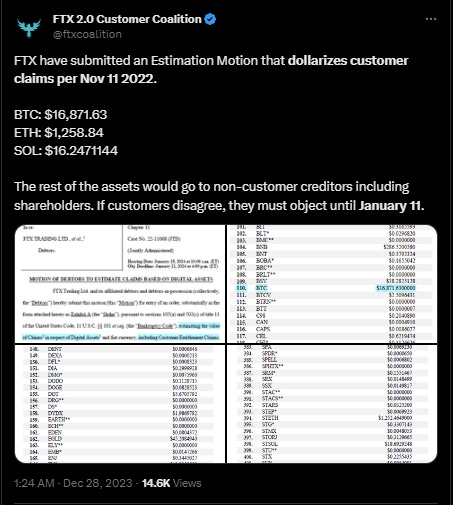

FTX has submitted an Estimation Motion that dollarizes customer claims per Nov 11, 2022:

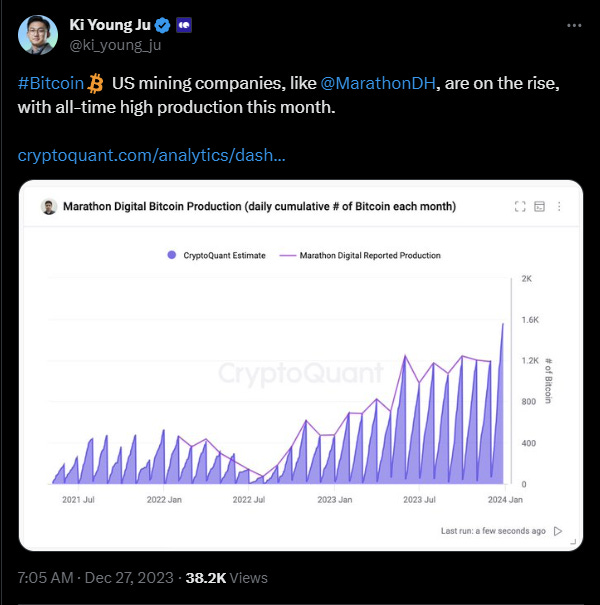

Bitcoin US mining companies, like MarathonDH, are on the rise, with all-time high production this month:

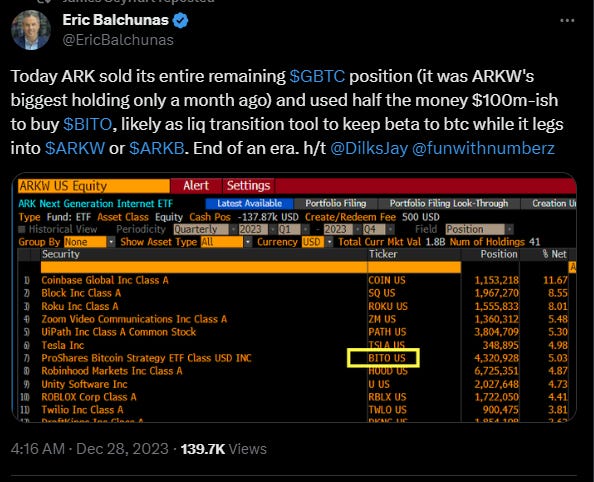

ARK sold its entire remaining GBTC position:

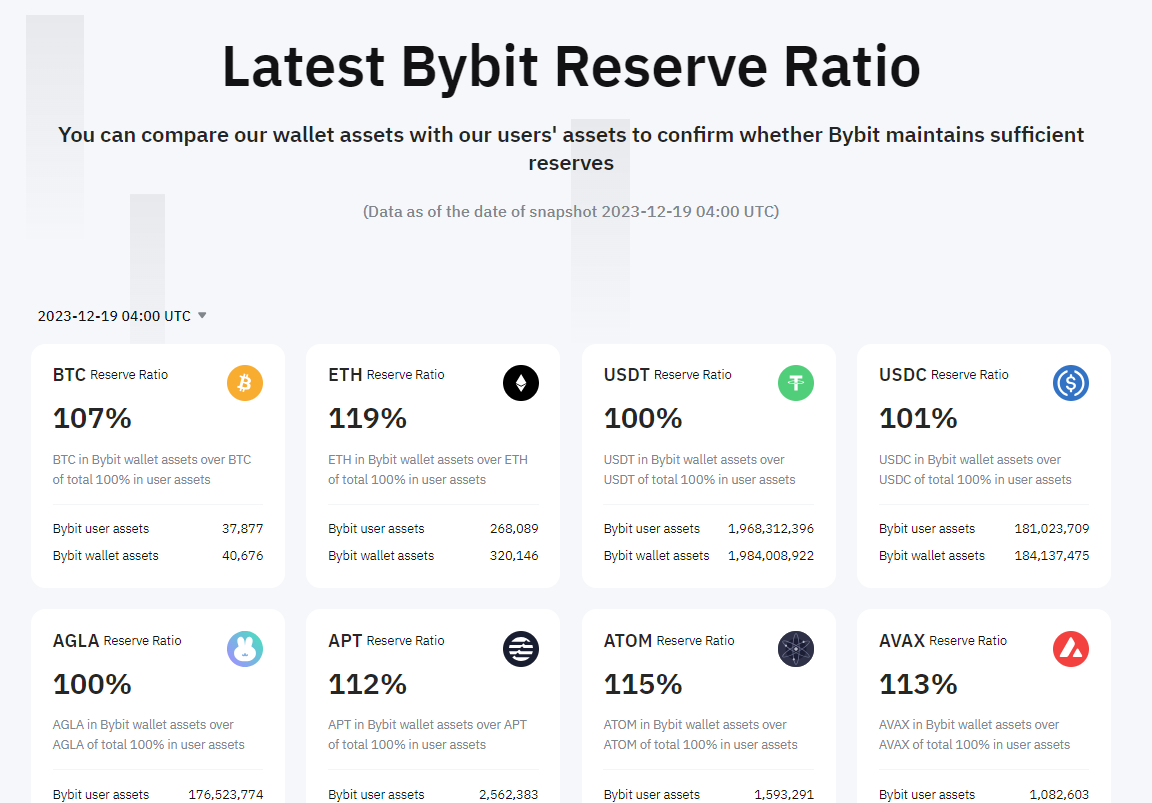

Bybit released its latest reserve report, expanding the number of cryptocurrencies involved to 32:

Currently, users hold 37,877 Bitcoins, 268,089 ETH, 1.97 billion USDT, and 181 million USDC. The user reserves of BTC, ETH, and USDT increased a lot from the last reserve snapshot on October 12

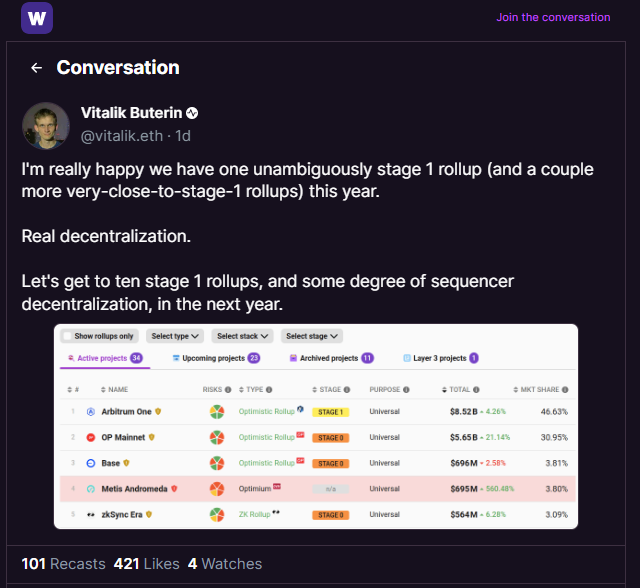

Vitalik is happy we have one unambiguously stage-1 rollup (Arbitrum One) and a couple more very close-to-stage-1 rollups this year :

Coinbase, Galaxy, Polygon, Multicoin, and other top crypto VCs share their 2024 funding outlook:

OpenSea layoffs and Polkadot's strange retreat marked a year of big job losses in cryptocurrency:

Europe Crypto Tracker - Almost 1,000 new crypto entities registered in the EU in 2023:

Hong Kong Regulators Propose Mandatory Licenses for Fiat-Backed Stablecoin Issuers:

5 /➯⛓️On-Chain Data:

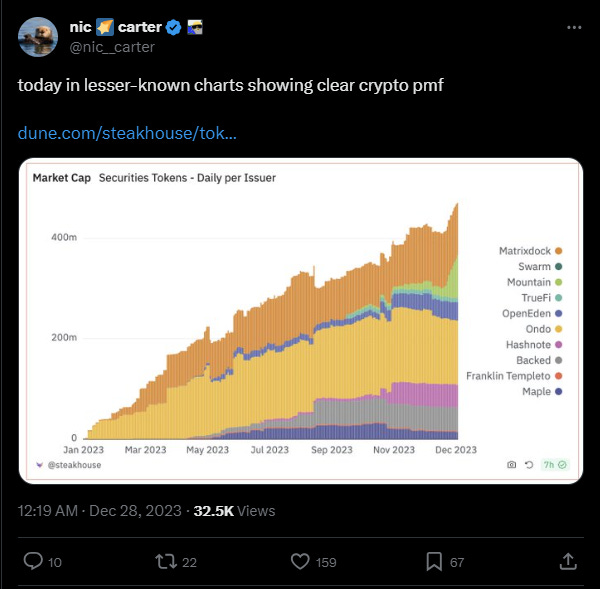

Investigation of Clear Crypto PMF:

2023’s top 5 DeFi protocols by revenue:

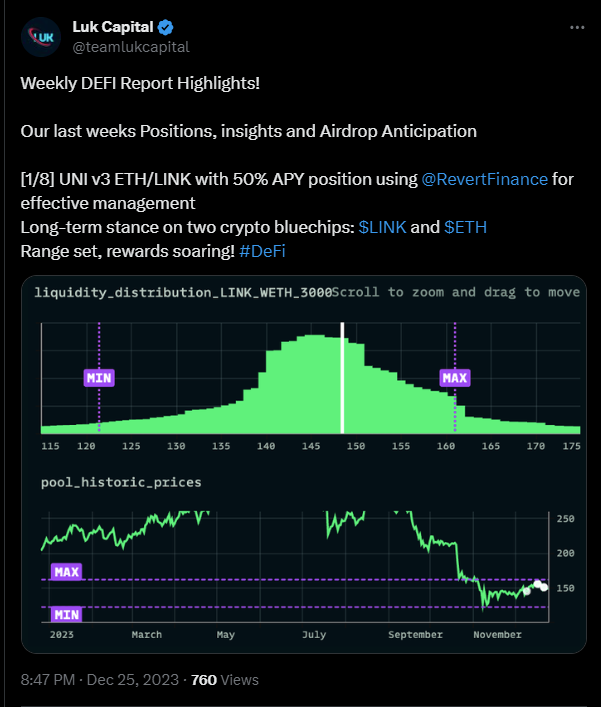

Weekly DEFI Report Highlights:

6/➯ Macro Metrics 📈

GM from Germany where 10y real rates have turned negative again w/nominal 10y yields at 1.92% & 10y inflation expectations at 1.95%:

The 10-year yield declined 11 basis points today to 3.7944%:

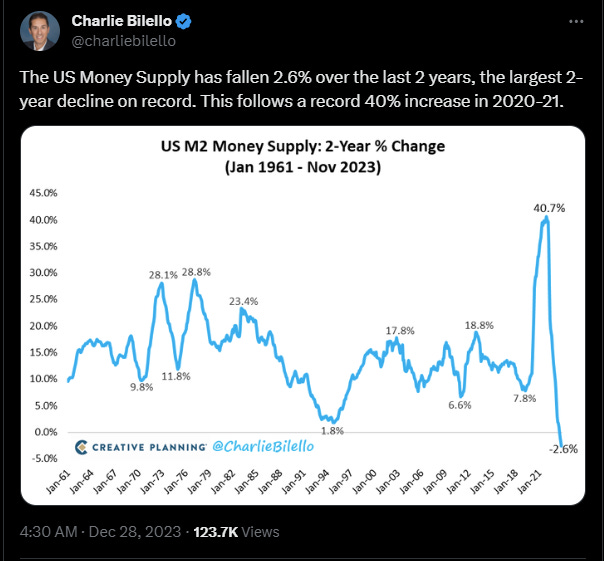

The US Money Supply has fallen 2.6% over the last 2 years, the largest 2-year decline on record:

7/➯ Exploits & Bugs

Update about Thunder Terminal Exploit:

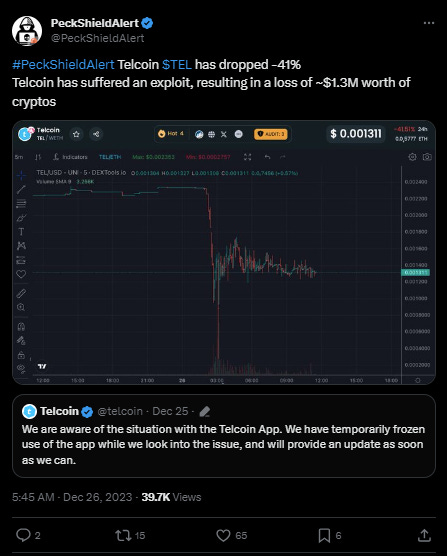

Telcoin TEL has dropped -41% and Telcoin has suffered an exploit:

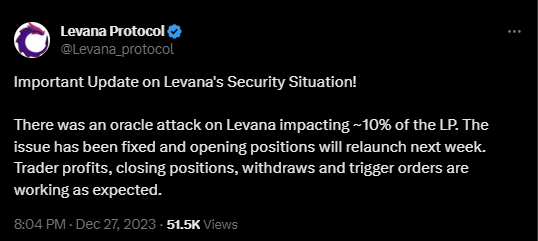

Levana Protocol was compromised:

That’s it for today, my friends!

Thank you all for staying with us. Your future self will undoubtedly be grateful for the knowledge and insights gained here.

For more crypto-related content, feel free to follow me on Twitter ➯ DeFi_Made_Here.

I'll continue sharing valuable information about the latest insights and my thoughts in this fast-paced field.

If you enjoyed this newsletter as much as we did creating it, don't hesitate to share this post with your fellow crypto enthusiasts! Together, let's expand our understanding of this ever-evolving industry.