DMH Newsletter is a vital news hub with crucial updates & narratives and trends

Today you will find Alpha on:

Spotlight

Updates & Upgrades in DeFi

Alpha by Threadors & Good Reads

OnChain & Macro & News

Exploits & Bugs

Spotlight Project: KTX Finance

KTX Finance Description:

KTX.Finance, an on-chain decentralized derivatives & social trading protocol that offers leverage of up to 100x to the traders.

KTX.finance is built on top of Mantle Network & Binance Chain.

Being the leading perp DEX on Mantle is primed to grow alongside the explosive growth of the Mantle DeFi ecosystem

By using a single multi-asset pool KTX provides high efficiency, low swap fees and also allows mitigation of counterparty risks & up to 100x leverage when traders trade against the KLP pool.

Their purpose is to provide seamless and efficient CEX-type trading while adhering to the principles of decentralization.

🙍♂️ Followers: 37.3k

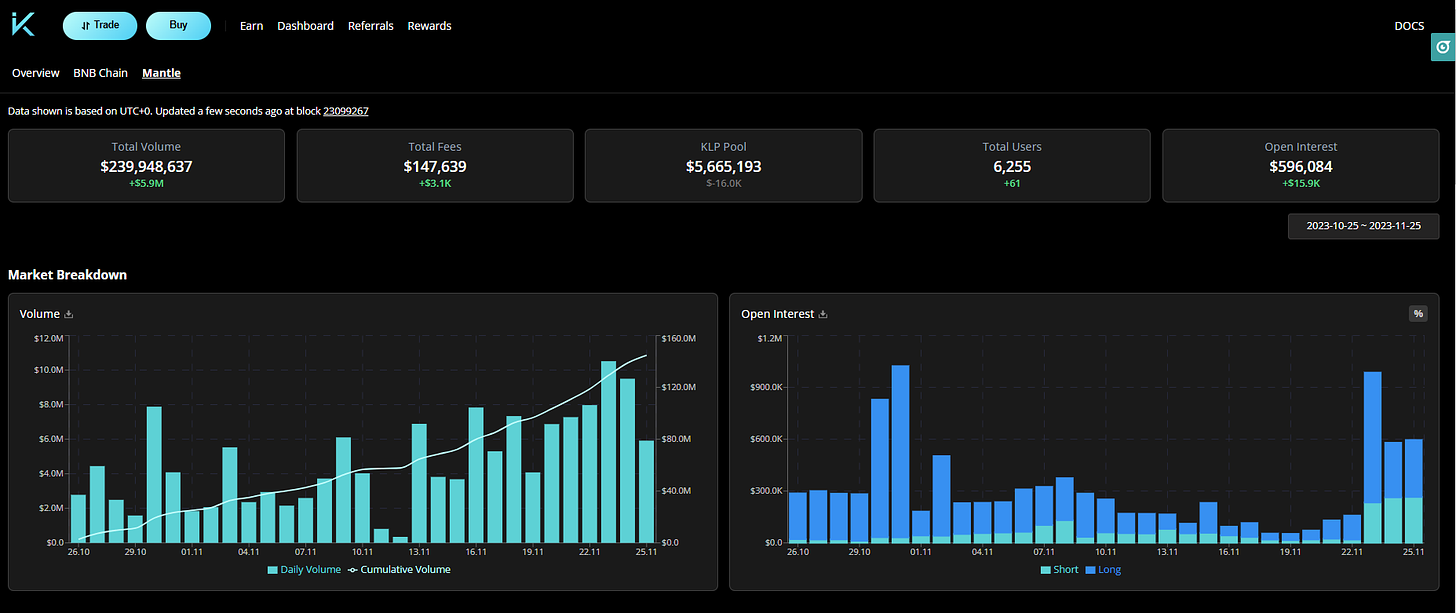

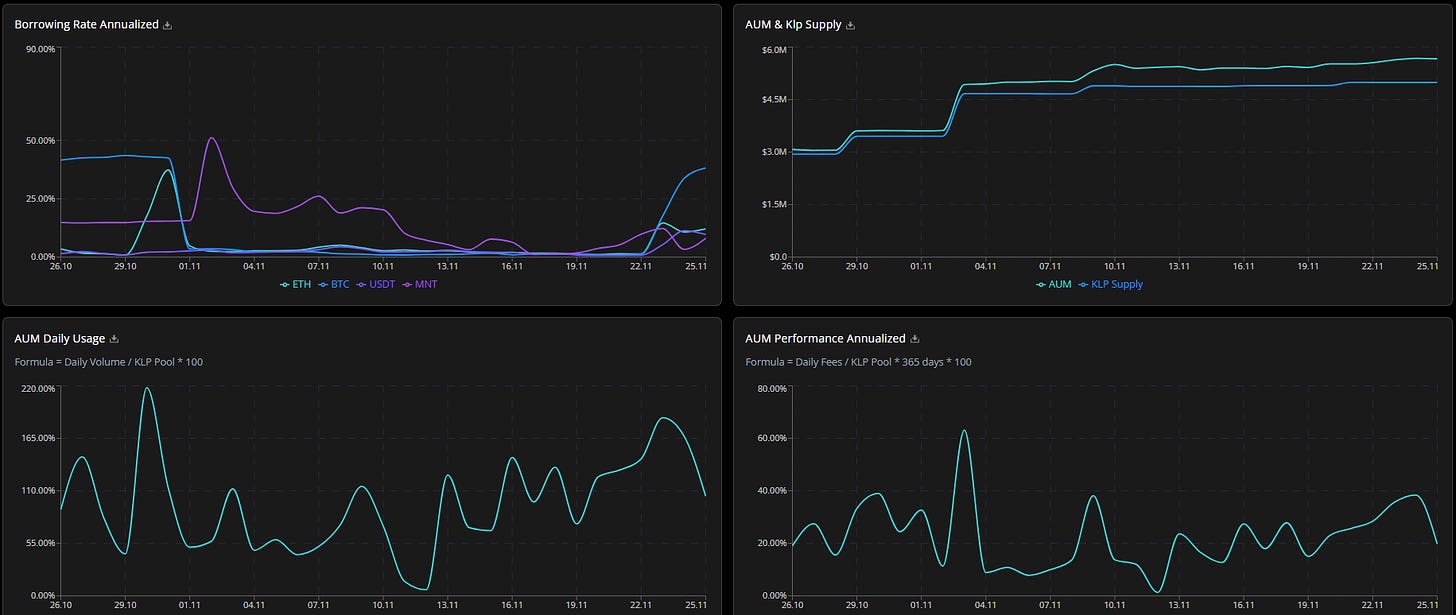

KTX Breathtaking Stats:

$500m : Trading Volume

$1m : Open Interest

10k : Unique Traders

126.60% Boosted APY, the KTX pool on Solv Protocol : The highest yield on $USDT

190% APR for KTC stake on Mantle Network

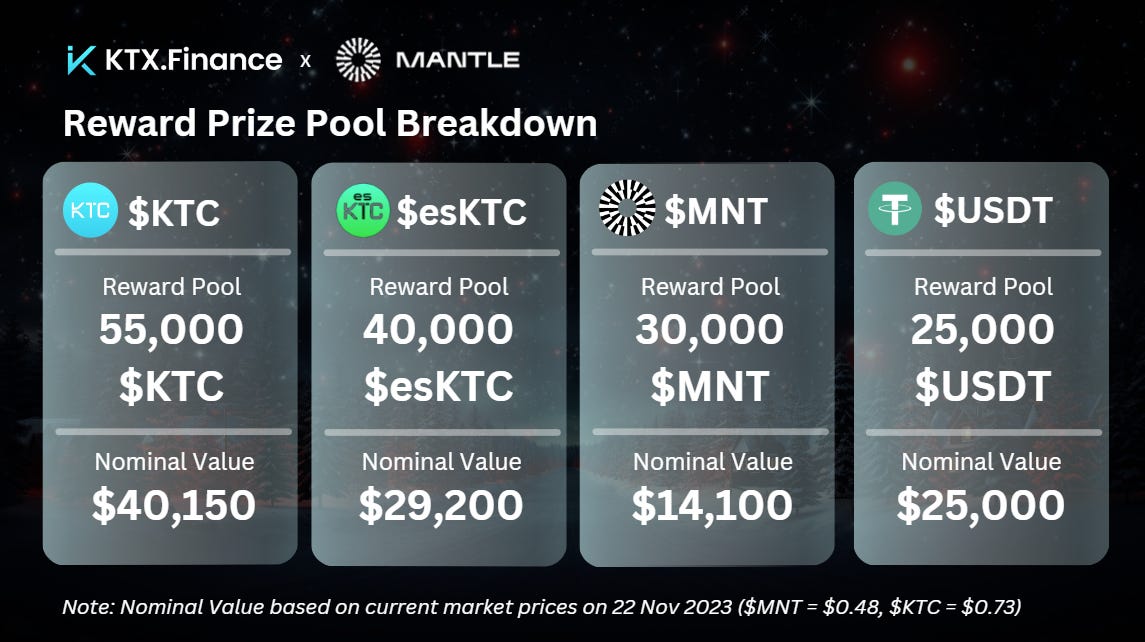

Latest Update: Trade & Earn Campaign

KTX.Finance's trading and earning season is off to a flying start with a prize pool of $105,000.

As a proud recipient of the Mantle Ecosystem Grant, they are eager to share their success with valued community.

The grant received will be used to subsidize a significant portion of trading costs and further increase incentives for our valued users.

Trade & Earn Season Timeline

There will be 4 Epochs to the T&E Season, each spanning a week:

Epoch 1: 25th Nov to 1st Dec 2023

Epoch 2: 2nd Dec to 8th Dec 2023

Epoch 3: 9th Dec to 15th Dec 2023

Epoch 4: 16th Dec to 23rd Dec 2023

The Breakdown of the rewards you'll receive just by trading at http://KTX.Finance so take advantage of it

2/➯ Updates & Upgrades in DeFi

Orbiter Finance announces O-Points for future airdrop:

Chainlink Staking v0.2 is just around the corner:

Arbitrum Campaign on Bungee:

Space community endorses capping atom inflation at 10%:

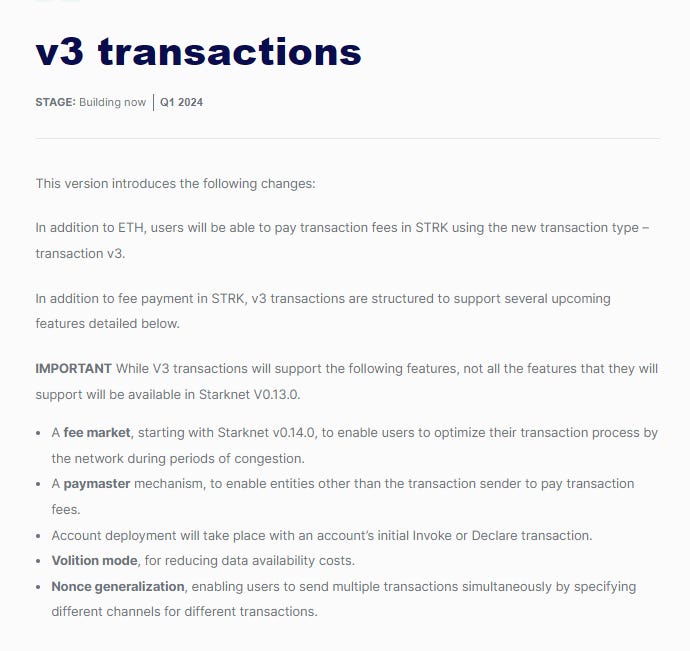

Starknet v3 transactions Q1 2024:

Nansen 2 Public Beta launches tomorrow:

BanklessDAO asking for 1.82M ARB grant:

Galxe is distributing the $500K ARB grant with its ARB STIP Blast program:

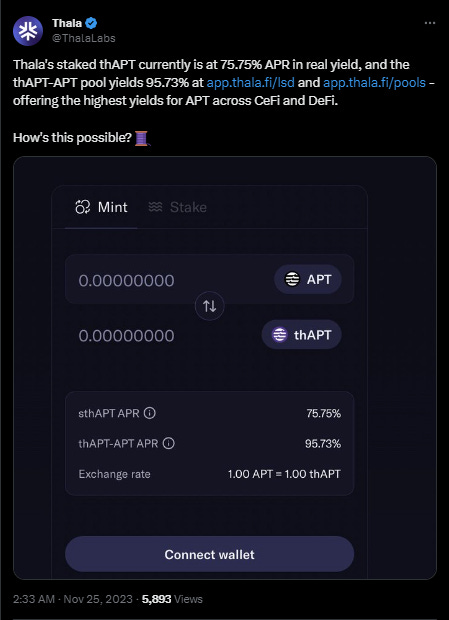

Thala Liquid Staking Live on Aptos:

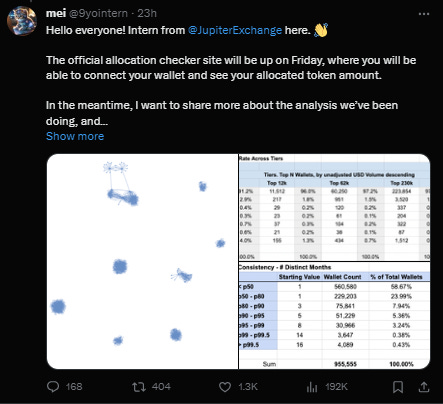

Jupiter will release airdrop checker this Friday:

Introducing $JTO: A New Era of Community-Led Governance:

3/➯ Alpha by Threadors & Good Reads

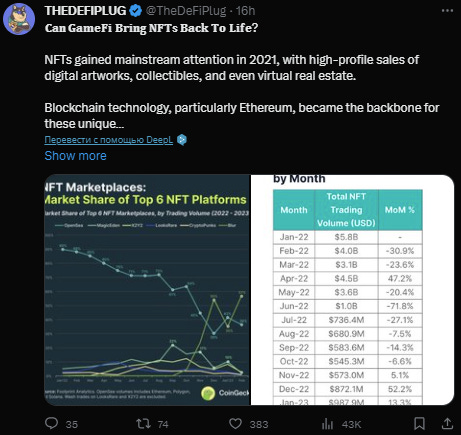

𝐂𝐚𝐧 𝐆𝐚𝐦𝐞𝐅𝐢 𝐁𝐫𝐢𝐧𝐠 𝐍𝐅𝐓𝐬 𝐁𝐚𝐜𝐤 𝐓𝐨 𝐋𝐢𝐟𝐞 : TheDeFiPlug

The current landscape of options on cryptocurrencies: Impossible Finance

Overview of Blast Multisig: Jarrod Watts

The Rise and Fall of Telegram Sniping Bots: Yurii Kyparus

Ethereum's Proto-Danksharding (EIP-4844): Stacy Muur

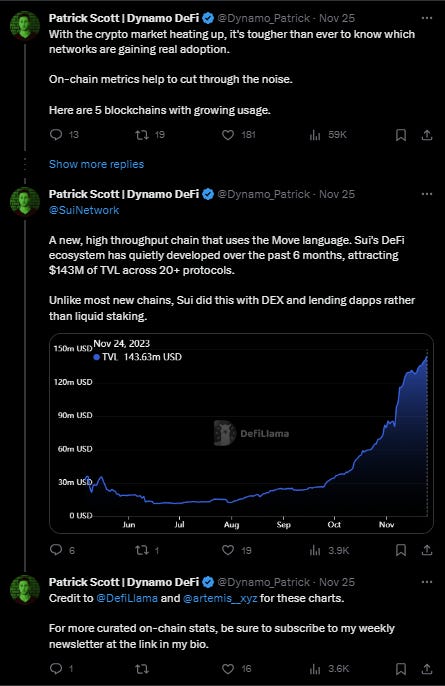

5 blockchains with growing usage : Dynamo DeFi

Deep Dive in Thena: Jake Pahor

The Different Approaches to Privacy On-Chain : Elusiv

Ethereum's criticism of too much Layer 2 is not true : Jesse Eckel:

The Best New Business Model in Crypto:

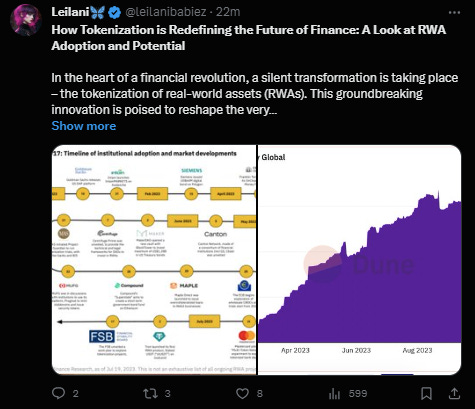

How Tokenization is Redefining the Future of Finance: A Look at RWA Adoption and Potential: Leilani

4/➯ VITAL NEWS📰₿

Hedge fund Nine Blocks has been licensed by the Dubai Virtual Asset Regulatory Authority (VARA):

The Fed is expected to cut rates by 100 basis points next year, according to Deutsche Bank Research:

US crypto regulation is likely 'in a holding pattern' until after the 2024 election: Paradigm Policy Director

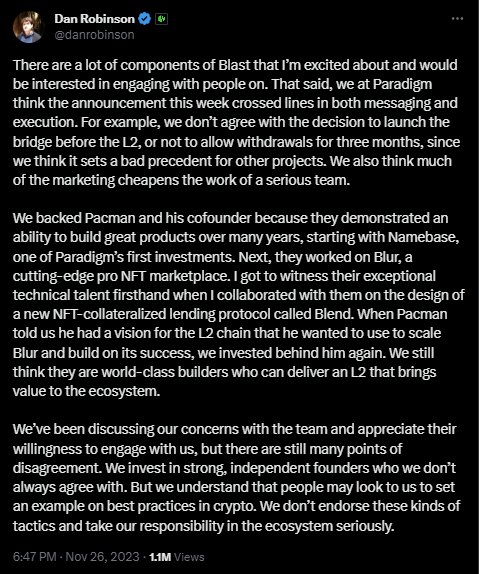

Paradigm announcement about BLAST_L2:

/5 ➯⛓️On-Chain Data:

DyDx unlock 30% of supply:

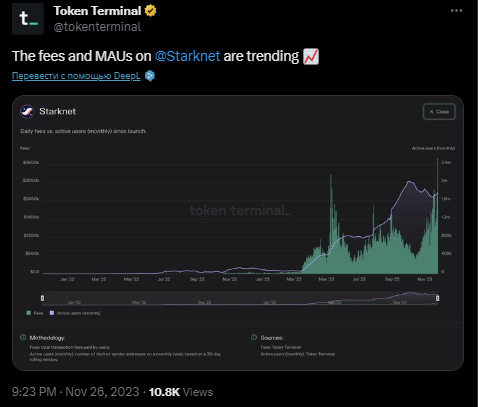

The fees and MAUs on Starknet are trending:

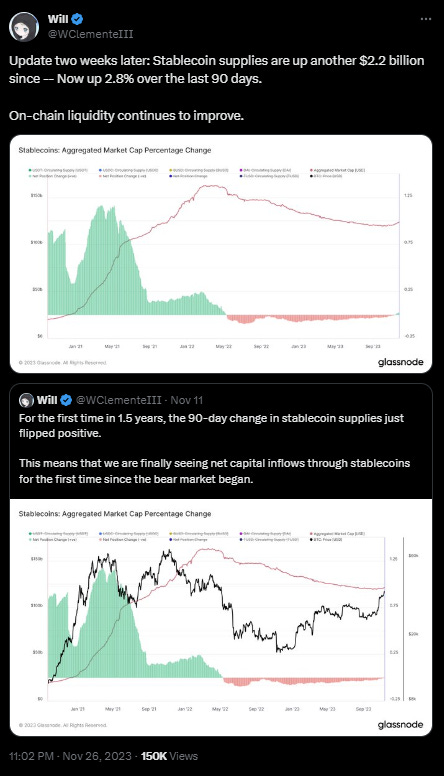

Stablecoin supplies are up another $2.2 billion since -- Now up 2.8% over the last 90 days.

On-chain liquidity continues to improve:

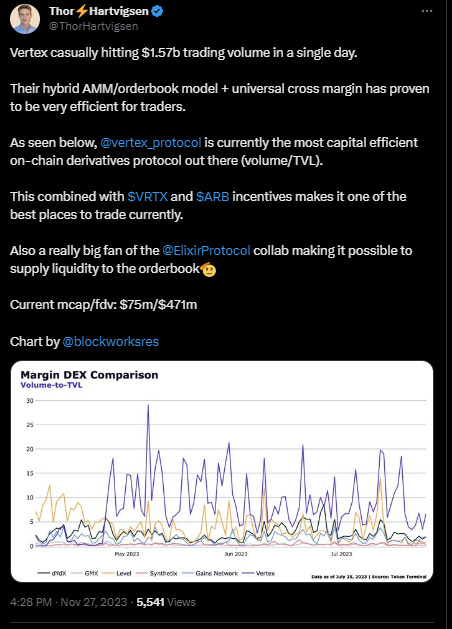

Vertex hitting $1.57b trading volume in a single day:

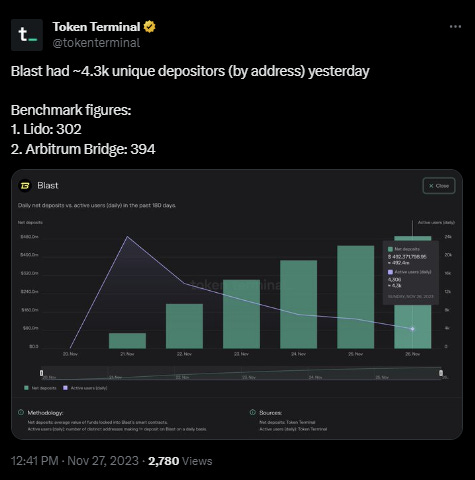

Blast had ~4.3k unique depositors (by address) yesterday

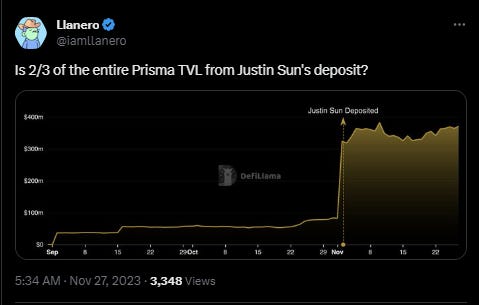

Is 2/3 of the entire Prisma TVL from Justin Sun's deposit ?

6/➯ Macro Metrics 📈

The Fed's preferred measure of core inflation will fall at a slower pace, which should keep interest rates elevated for a longer period of time:

The $GBTC discount is down to 8% on the chart of the ETF, which is quickly becoming one of the top five ETFs of the year

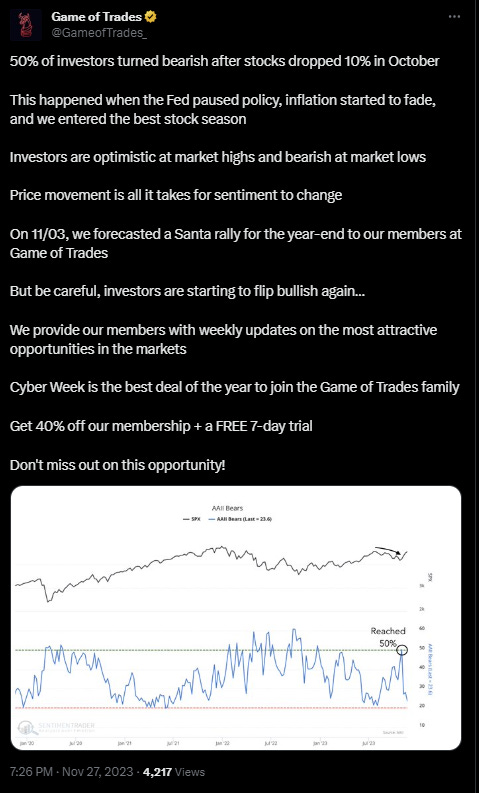

50% of investors turned bearish after stocks dropped 10% in October:

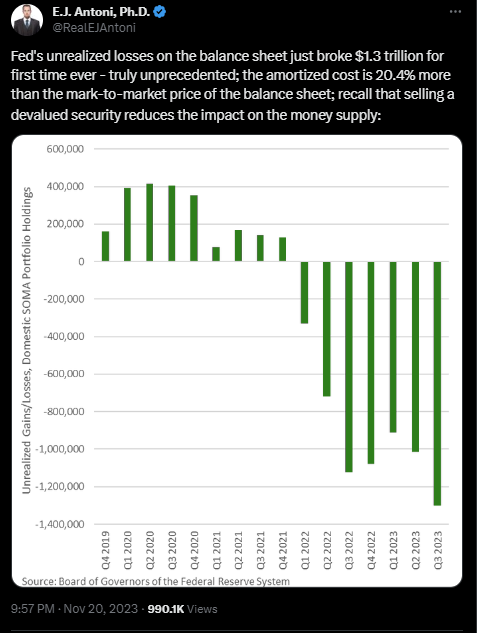

Unrealized losses on the Fed's balance sheet exceeded $1.3 trillion for the first time in history, a truly unprecedented figure:

7/➯ Exploits & Bugs

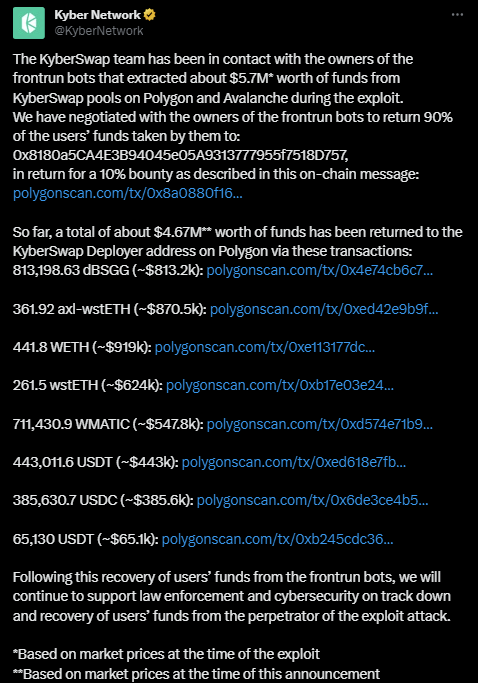

KyberNetwork received $4.67M from frontrunbots (10% Bounty)

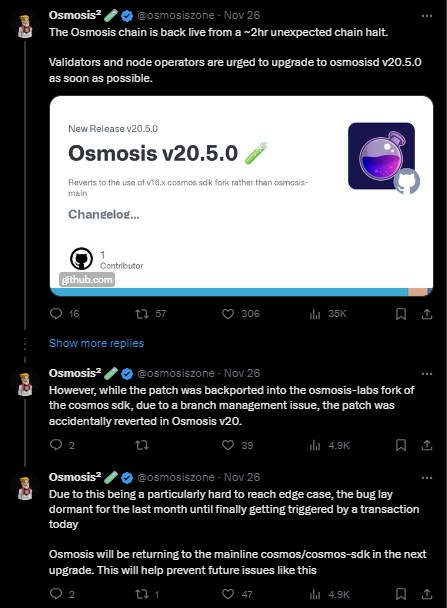

The Osmosis chain is back live from a ~2hr unexpected chain halt:

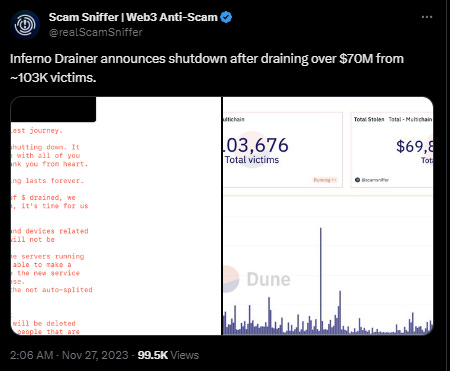

Inferno Drainer announces shutdown after draining over $70M from ~103K victims:

Typical vulnerabilities in LSD protocols:

That’s it for today frens!

Thank you for staying with us. Your future self will be grateful.

You can follow me on Twitter ➯ DeFi_Made_Here

If you liked this newsletter and love to learn and share knowledge about crypto, you can share this post with your crypto frens!