DMH Newsletter is a vital news hub with crucial updates & narratives and trends

Today you will find Alpha on:

Updates & Upgrades in DeFi

Alpha by Threadors & Good Reads

OnChain & Macro & News

Exploits & Bugs

1/➯ Updates & Upgrades in DeFi

Ondo Finance has launched tokenized US Treasuries on Injective:

LayerZero is live on Astar Substrate:

Introducing rDPX v2 on Dopex:

Introducing zkRisk for Perpetual Futures on Vest Exchange:

Ipor_io introduces Stake Rate Swap (SRS):

Total addressable market

Utility for LPs, traders, & institutions

Top user groups

Asymetrix V2 is live:

The 2nd dLP RUSH is now live on Radpie:

The GOOD ENTRY Token Launch:

Introducing Uniswap v4 template:

Tapioca_dao TGE delayed for Feb 24 2024 due to extra auditing:

Rain.fi Introduced the first custom Peer-to-Peer loans for DeFi on Solana:

Hashflow points to 2.0:

Ethereum Layer 2 Kinto migrates to the Arbitrum ecosystem:

The Boosted Rewards for Kwenta usage have been distributed in the final round:

Rumor has it that there will be a Black Friday deal tomorrow, so you might want to hold off on using those spins just yet. 🤔

M2 - The First Move-Based Ethereum L2 Using Celestia:

Boosted sUSDC.e pool by Silo Finance is live on Penpie:

Season 2 is COMPLETE on BLur:

Join the CAKE RUSH and convert your $CAKE. into $mCAKE. to unlock $CKP. rewards, access the CKP IDO, and receive an additional 10% points bonus:

Receive your mCAKE right now - link

The Tokenomics of $CMP - an ERC-20 token with a total supply of 10 million and can be locked within Campie as #vlCMP:

CMP IDO Allocation:

mGRAIL holders and stakers - 45%

xGRAIL Launchpad Plugin Allocators - 30%

vlMGP holders - 10%

Liquidity Providers - 10%

MGP/vlMGP burners - 5%

Strarknet Airdrop Update V3:

2/➯ Alpha by Threadors & Good Reads

Crypto Narratives HEATMAP:

Evolution of DeFi since 2017:

Synthetix Deep Dive:

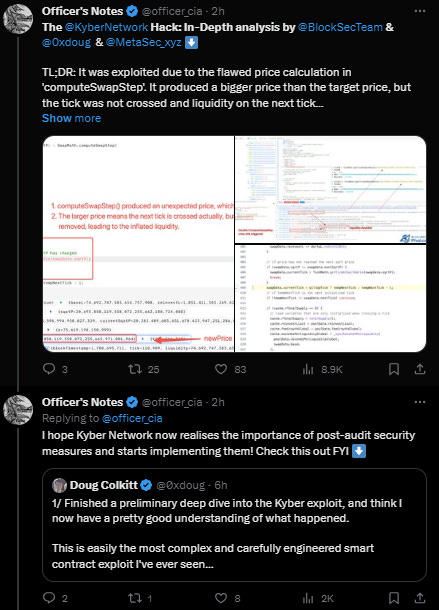

Detailed exploration about Kyber Network Exploits:

Rollbit vs Winr:

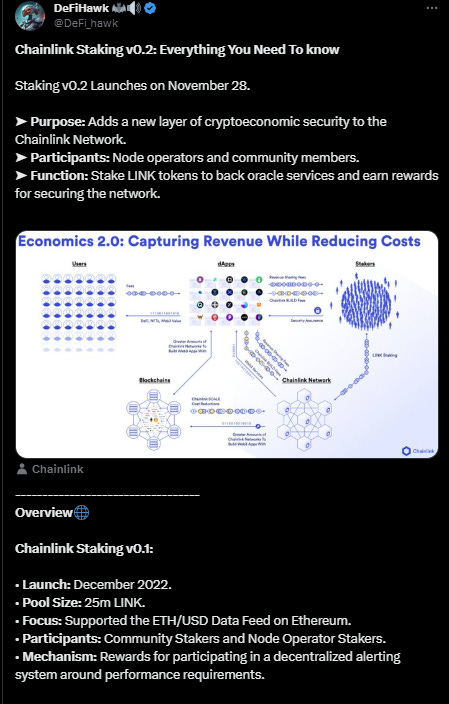

Chainlink Staking v0.2: Everything You Need To know

Report by Nansen about phishing campaign warning:

Portfolio of RWA projects in 2024-2025:

3/➯ VITAL NEWS📰₿

Former Binance CZ CEO 'poses a serious risk of flight', argue prosecutors, asking him to remain in the US:

Justin Sun acknowledged that the HTX, Heco chain has been exploited after suspicious transfers totalling $100m were made:

The AVAX ecosystem will gain $10 million in funding support from the Avalanche Accelerator Colony Lab:

Major Tether freeze - The biggest USDT freeze in history following an investigation by Tether, OKX and the US Department of Justice:

SEC allegations against Kraken: Charged with operating as an unregistered securities exchange

BCB Group CEO steps down following the departure of his fellow executives:

4/➯⛓️On-Chain Data:

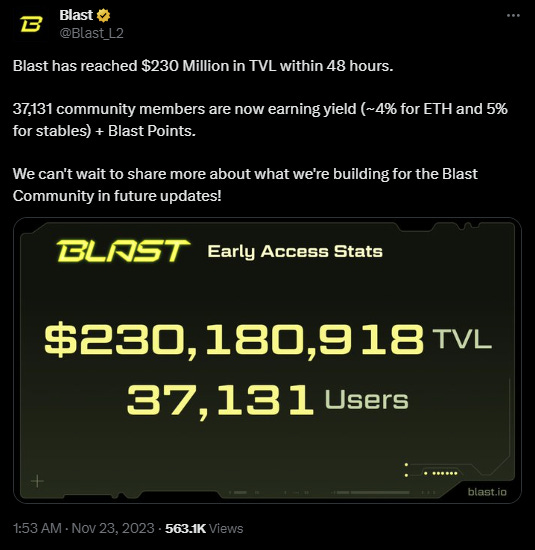

New L2 blockchain Blast, backed by Blur and Jump Trading reached $230m TVL:

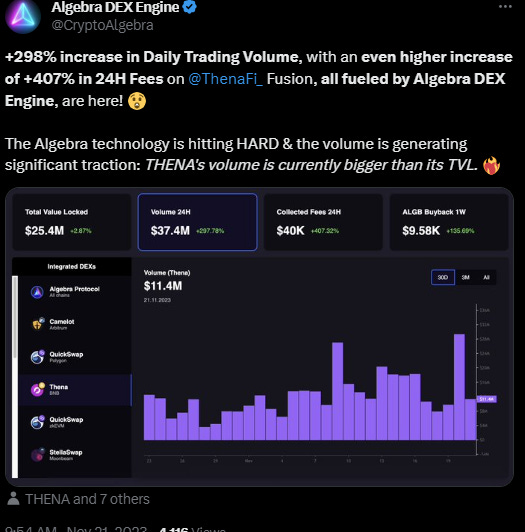

ThenaFi_ reaches $10M in total revenue and a daily record in trading fees:

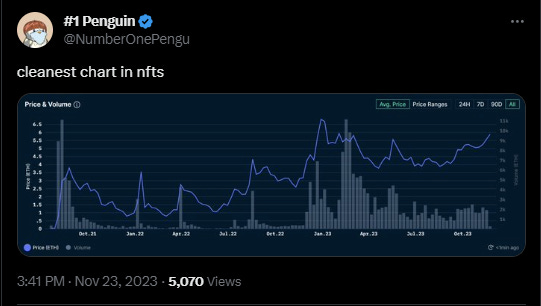

Сhart reflecting NFTs Market:

Someone just paid $3.1m for a single #Bitcoin transaction:

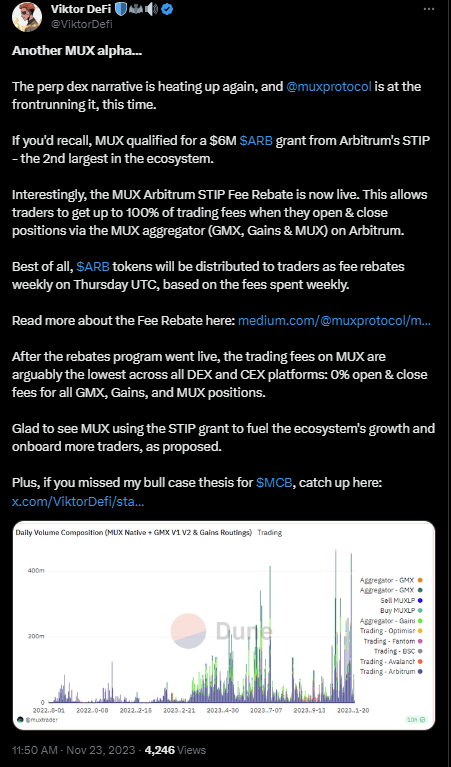

The Perp Dex narrative is picking up again, and this time muxprotocol is at the very leading edge of it:

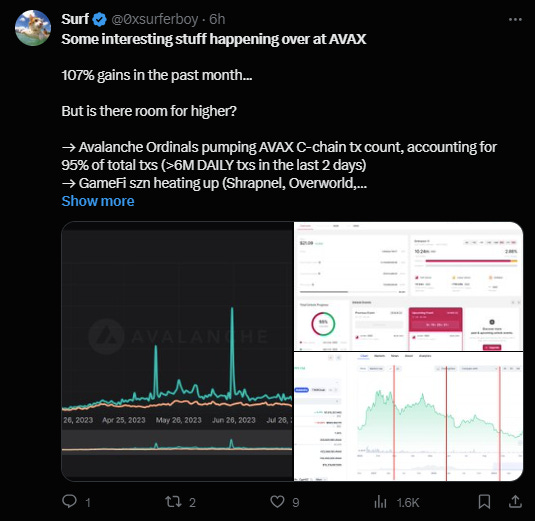

Some interesting stuff happening over at AVAX:

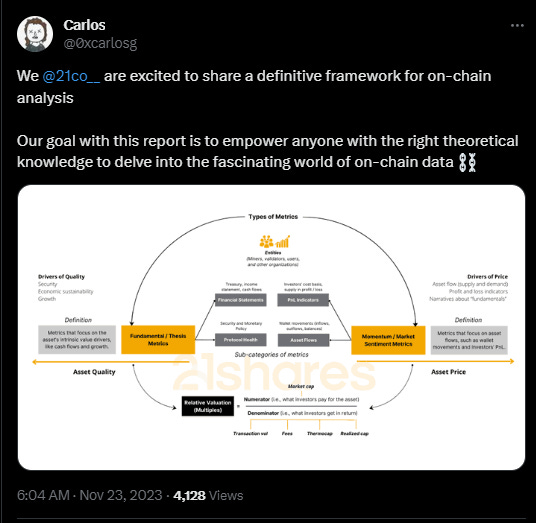

An amazing Framework on On-Chain Data:

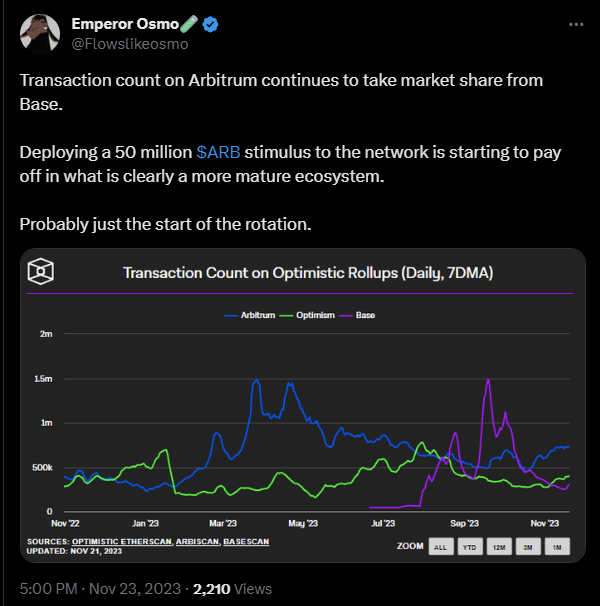

The number of transactions on Arbitrum continues to take market share away from Base:

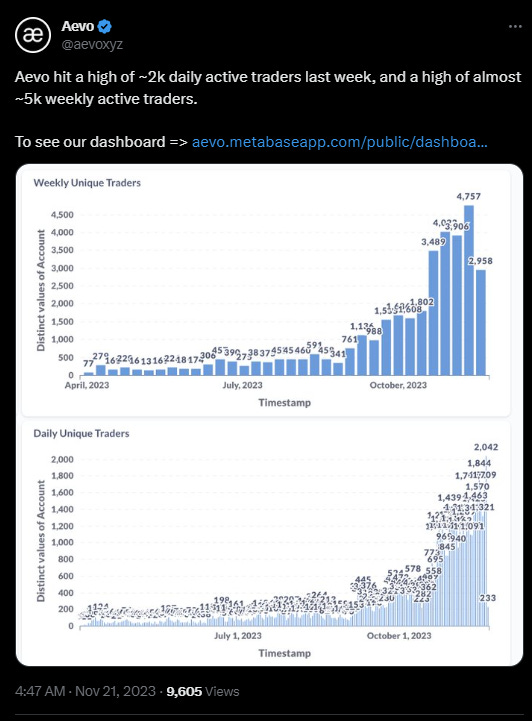

Aevo hit a high of ~2k daily active traders last week:

6/➯ Macro Metrics 📈

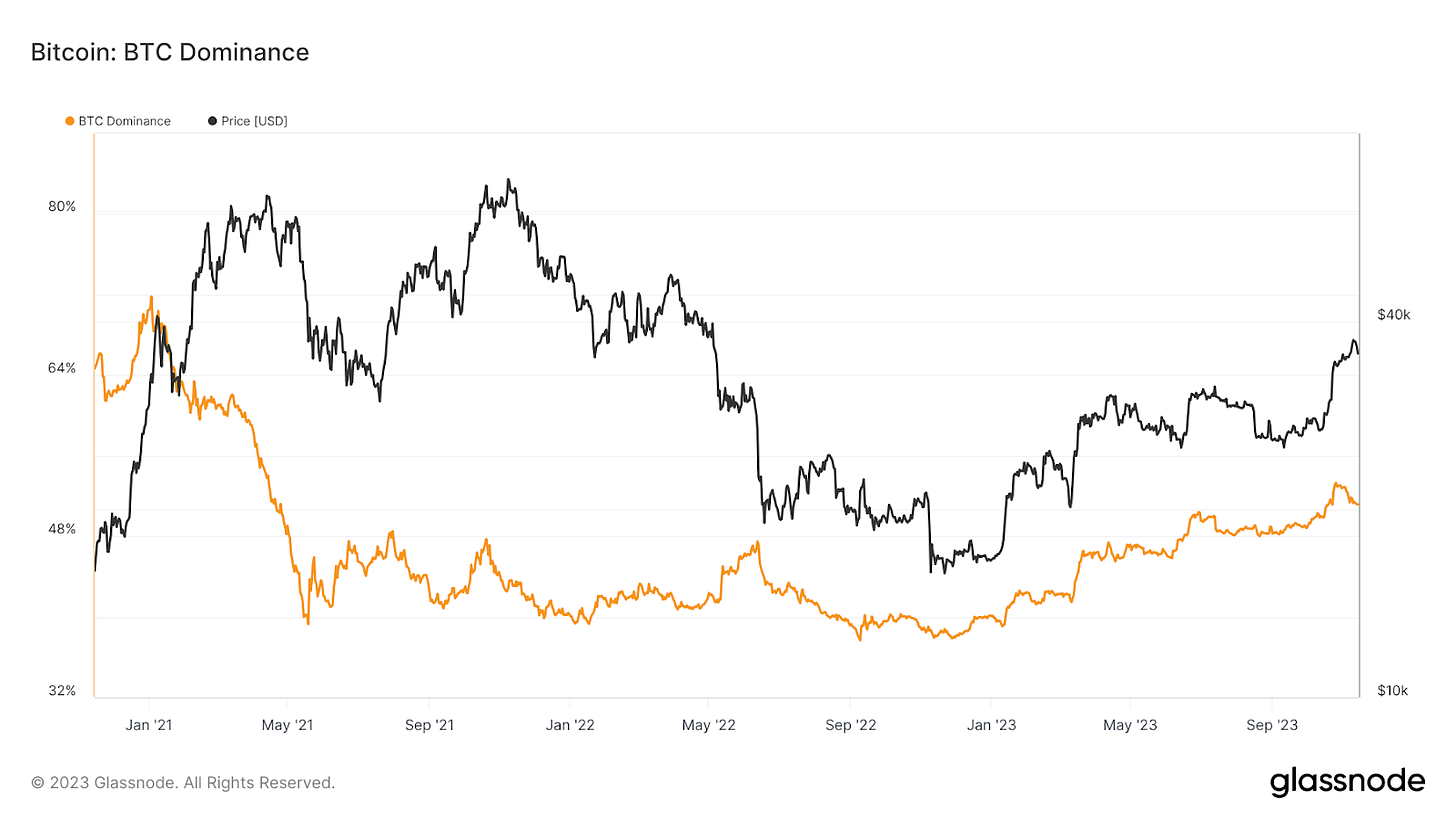

Spotlight on Spot Bitcoin ETFs and Their Impact by Glassone:

Global Markets at a Glance: October Review

October was a pivotal month for the digital asset market. Anticipation of regulatory developments, particularly around Spot Bitcoin ETF approvals, and increased institutional involvement led to a bullish trend.

Bitcoin (BTC) appreciated by over 28% month-over-month, with a year-to-date performance of over 108%.

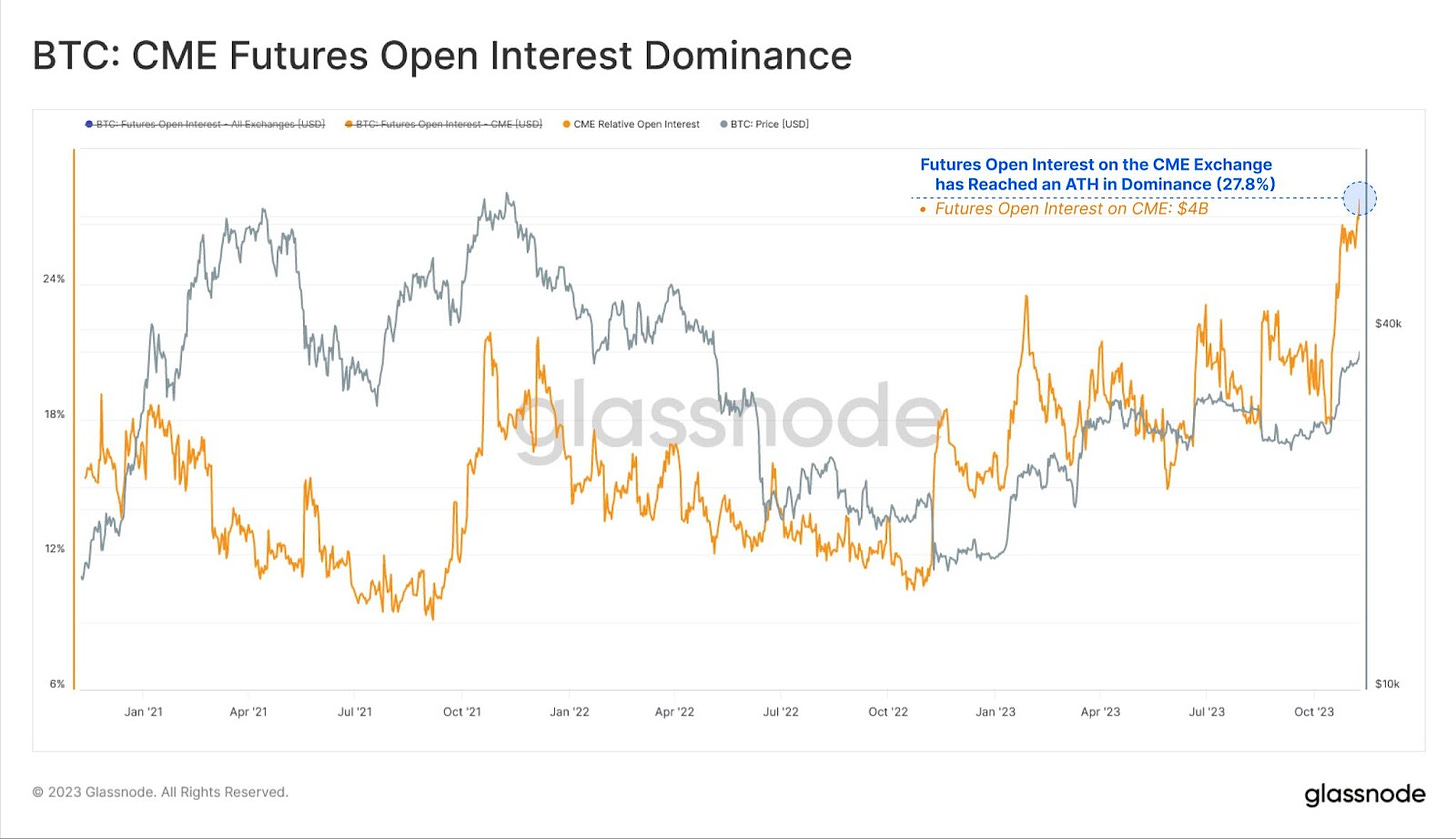

BTC: CME FUTURES OPEN INTEREST DOMINANCE

Market's upward trajectory driven by Spot BTC ETF approvals anticipation. Updates on filings from Invesco and BlackRock significantly influenced market movements. Bloomberg analysis predicts 90% chance of Spot BTC ETF approval by January 10th, SEC's deadline.

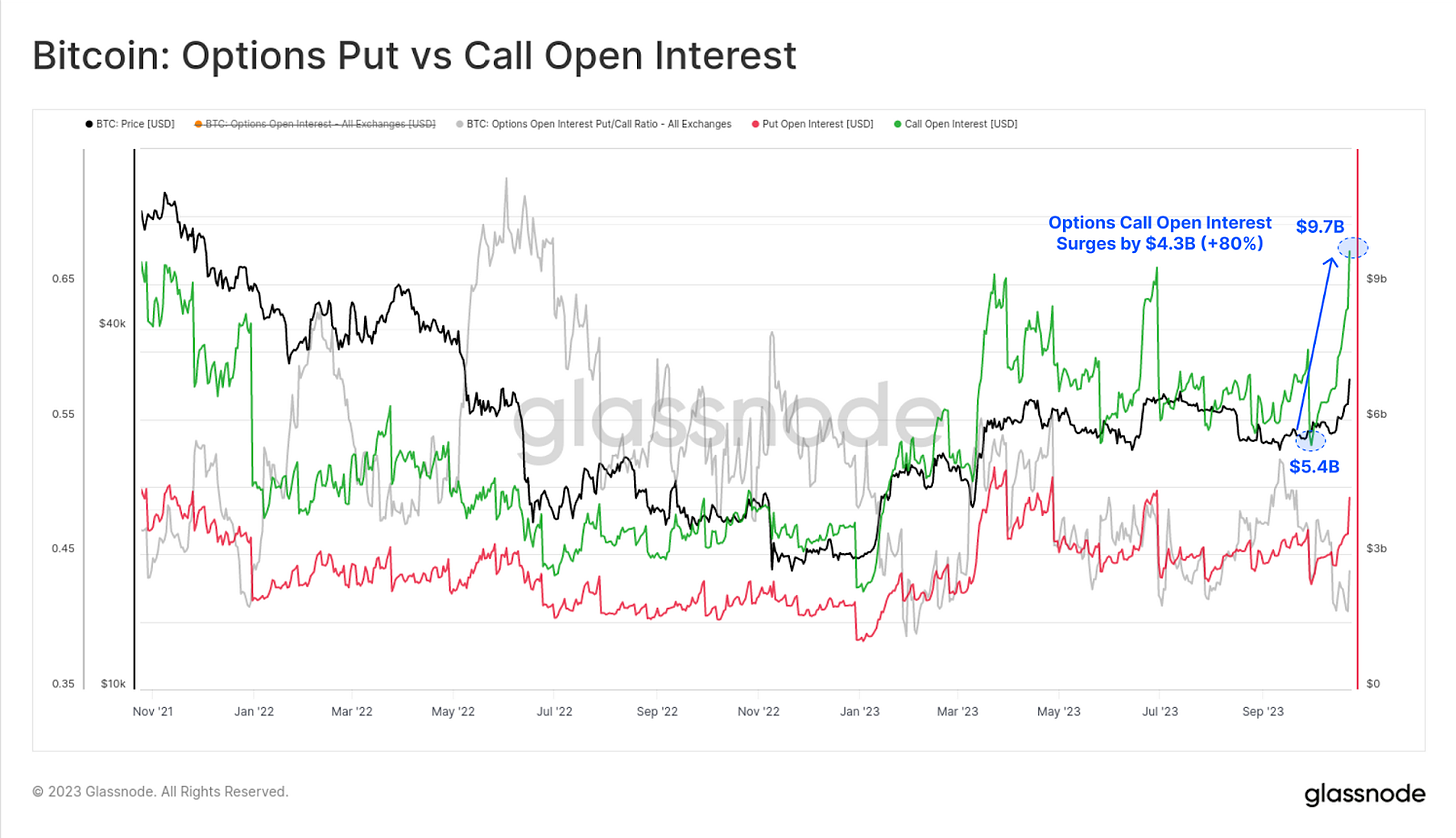

Options Put vs Call Open Interest:

Institutional engagement in the options market is growing. Bitcoin call options saw a surge, increasing by 80% to surpass $9.7 billion in October. This level of activity, comparable to futures, shows the market's maturation.

Professional and institutional traders are using these instruments for long exposure to Bitcoin.

Full issue by glassnode: link

6/➯ Exploits & Bugs

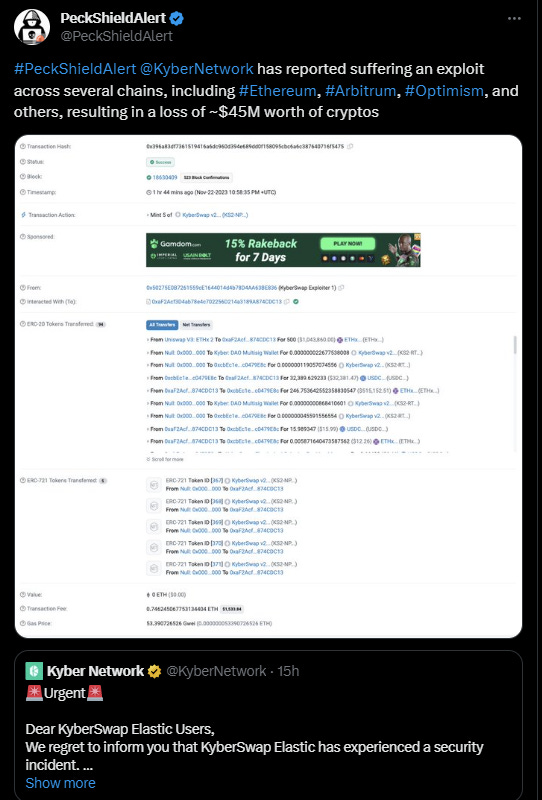

KyberNetwork exploited for $45M:

The Billion Dollar Exploit: Collecting Validators Private Keys via Web2 Attacks:

That’s it for today frens!

Thank you for staying with us. Your future self will be grateful.

You can follow me on Twitter ➯ DeFi_Made_Here

If you liked this newsletter and love to learn and share knowledge about crypto, you can share this post with your crypto frens!