DMH Newsletter is a vital news hub with crucial updates & narratives and trends

Today you will find Alpha on:

Spotlight

Updates & Upgrades in DeFi

Alpha by Threadors & Good Reads

OnChain & Macro & News

Exploits & Bugs

Spotlight Project: Kyberswap

Multichain #DeFi exchange & aggregator on 15 chains⚡Swap at the best rates⚡LPs earn more | $KNC alpha: http://Discord.gg/kyberswap | TG: http://t.me/kybernetwork

🙍♂️ Followers: 296,5k

KyberSwap Description:

My friends from KyberSwap are one of the OGs in the space. They launched in 2017 and since then they have built the most integrated DEX aggregator with over 200+ DEXes on 15 chains.

They have a unique concentrated liquidity design. Liquidity Providers do get not only high fees from the trading pools but also extra farming rewards on top of them.

Kyber also reworked Discovery Tool into KyberAI which brings a lot of insights about the market but is still in Beta. I will update you when it is available for everyone

Latest Update: Uncover the secrets of KyberSwap's Zap feature

Join on an exhilarating voyage to unlock the secrets of the Zap feature at KyberSwap ⚡️

⏰ Date: Thursday, November 16 at 8am GMT

📍 Venue: KyberSwap Discord (channel #learn-2-earn)

📣 Topic: Zapping in Elastic pools

💰 Prize: $500 $KNC for 20 winners

How to join ⤵️

1️⃣ Join their Discord: [link]

2️⃣ Learn about Zap: [link]

3️⃣ Go to the #learn-2-earn channel by November 16 at 8am GMT and wait for the quiz to start.

Don't forget to read the terms and conditions on the Discord channel and be punctual!

2/➯ Updates & Upgrades in DeFi

Swap tokens on 1inch with 0 fee:

Immutable zkEVM Testnet Regenesis:

Say hello to Uniswap on Android:

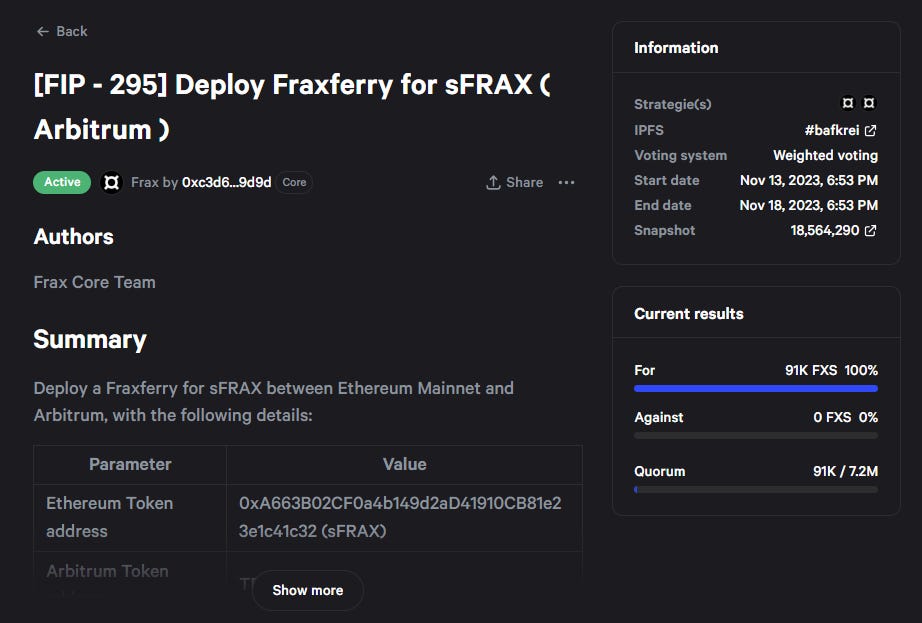

sFRAX proposals to go multichain:

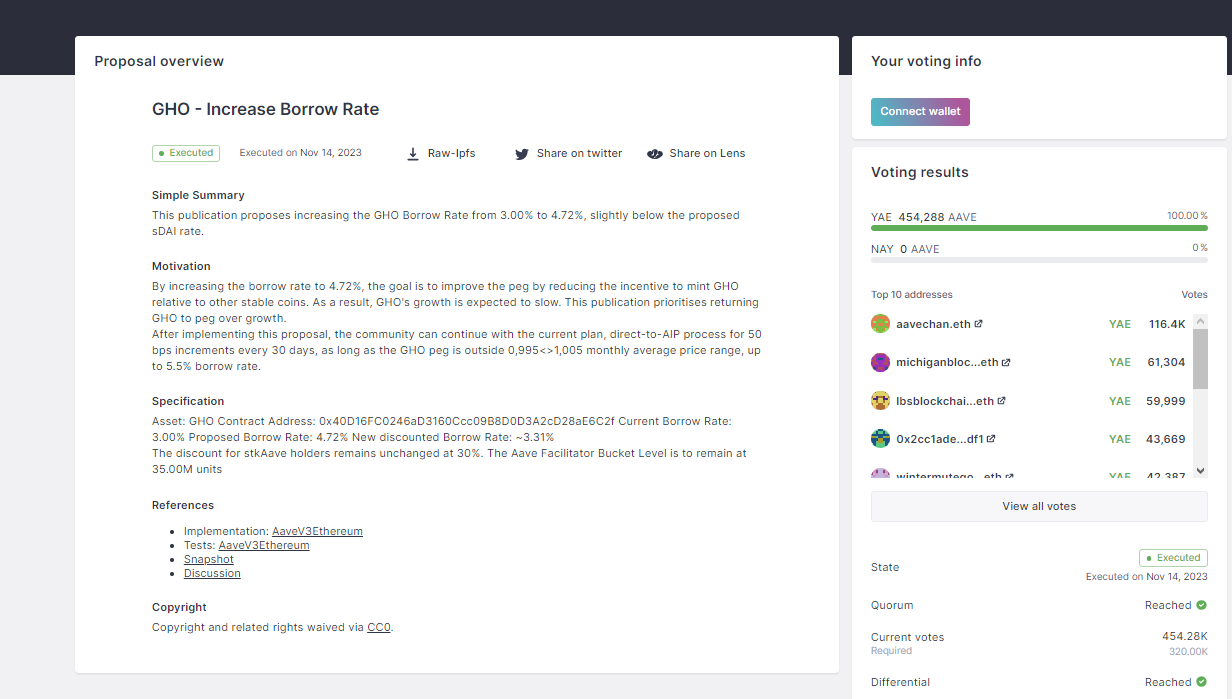

Aave has increased the borrow rate for their multi-collateral backed stablecoin, GHO, from 3% to 4.72% following governance approval , slightly below the proposed sDAI rate:

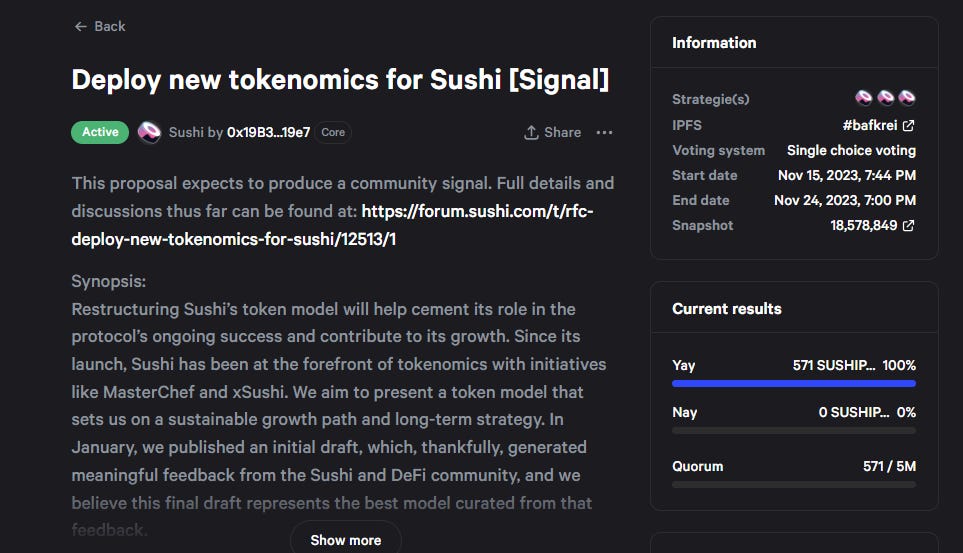

Deploy new tokenomics for Sushi:

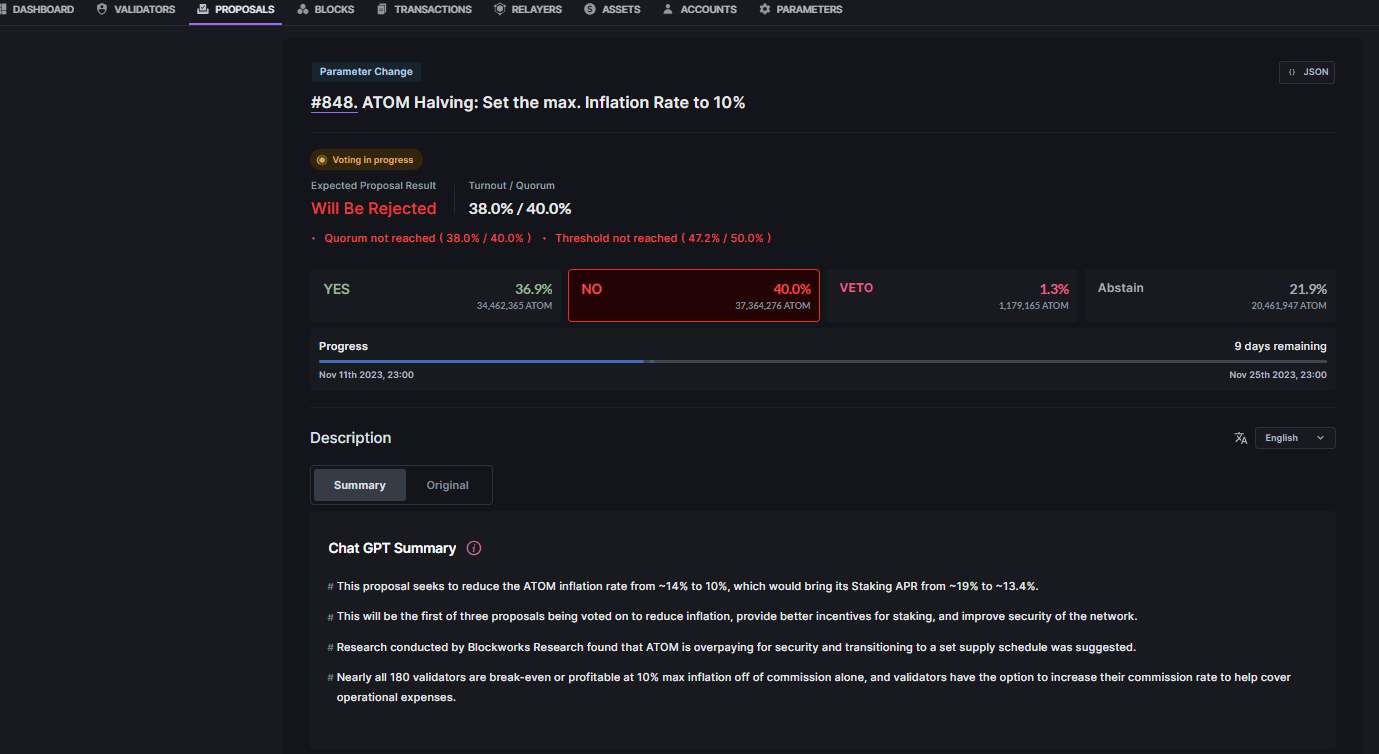

The Cosmos community declared a vote on a proposal to halve the ATOM metric, proposing to reduce the ATOM maximum inflation rate metric from 20% to 10%:

Ankr Launches Rollup as a Service In Partnership With Optimism:

Dopex V2 - CLAMM is live:

The 7th PENDLE RUSH is live on Arbitrum:

Circle's CCTP coming to Noble_xyz:

Taikoxyz introduces Based Booster Rollups:

dYdX Chain trading goes live, enters beta mainnet stage following governance vote:

Update On Pyth Network Retrospective Airdrop:

Introducing Verified USD ($USDV)- The 1st Omnichain Tokenized Treasury-Backed Stablecoin:

Redstone - Cost-effective L2 for onchain games:

IPOR zap-in Campaign on Galxe is up and rolling!

Rewards pool of up to 15,000 $IPOR.

Full details: link

3/➯ Alpha by Threadors & Good Reads

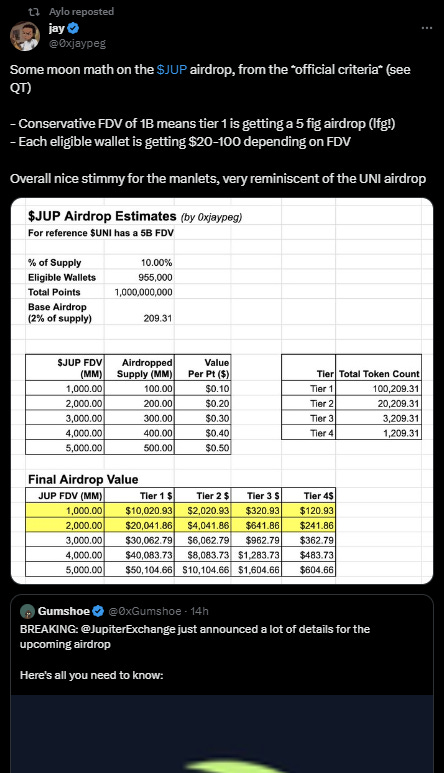

Some moon math on the $JUP airdrop, from the *official criteria* (see QT):

Understanding Celestia - The Modular DA Layer:

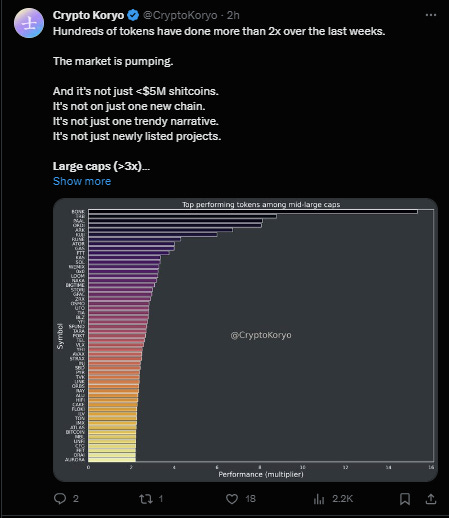

Hundreds of tokens have done more than 2x over the last weeks:

Revealing Frax Finance power:

4/➯ VITAL NEWS📰₿

SEC delays Hashdex BTC ETF:

South Korea's Democratic Party requires parliamentary candidates to disclose ownership of cryptocurrencies:

Tokenization test from PMorgan and Apollo: In a notable "proof of concept", JPMorgan and Apollo are using Axelar, Oasis and Provenance to tokenize funds:

The Philippines will sell tokenized treasury bonds for the first time next Monday, offering one-year tokenized bonds worth at least $179 million maturing in November 2024:

South Korea’s largest investment group National Pension Service purchased approximately US$20 million worth of Coinbase shares in the Q3:

SEC postpones ruling on Spot Bitcoin ETF and gray ether futures applications:

Stablecoin Issuer Paxos Plans New U.S. Dollar-Backed Token for Singapore Operations:

Hong Kong Gaming Company Boyaa Interactive Seeks Approval to Buy $100M in Crypto to Boost Web3 Strategy:

MAS broadens asset tokenization efforts with new partnerships with financial industry players:

Nasdaq files for SEC rule change to allow spot Ethereum ETFs

5/➯⛓️On-Chain Data:

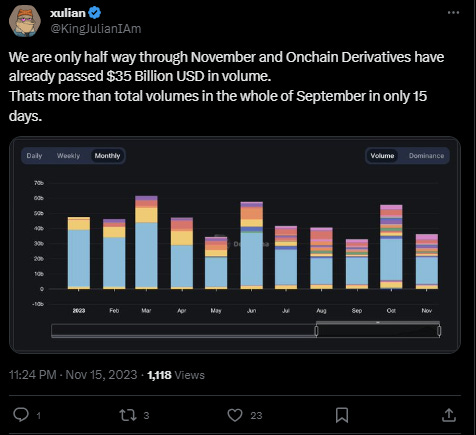

It's only been halfway through November, and Onchain derivatives have already surpassed $35 billion:

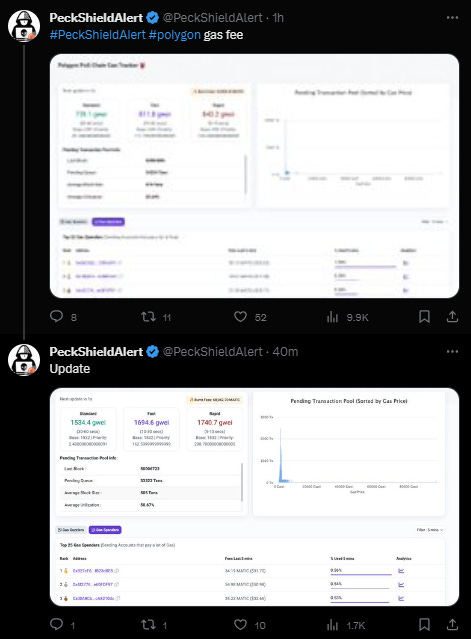

Gas Fee on Polygon 1500 Gwei:

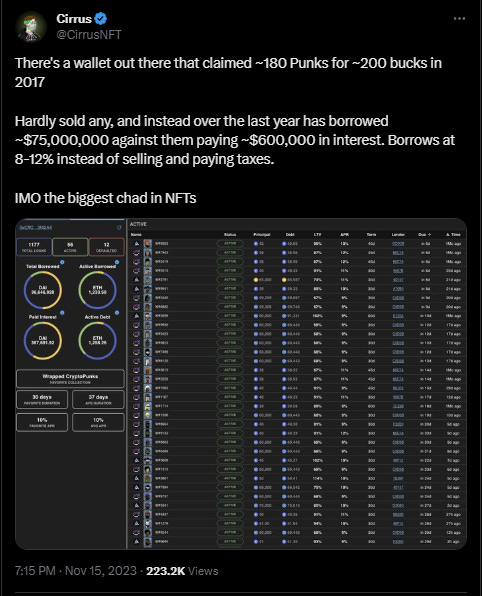

IMO the biggest chad & whale in NFTs:

Sold almost nothing and instead borrowed ~$75,000,000,000 against them over the last year, paying ~$600,000 in interest. Borrowing at 8-12% instead of selling and paying taxes.

THORChain $RUNE is in full swing:

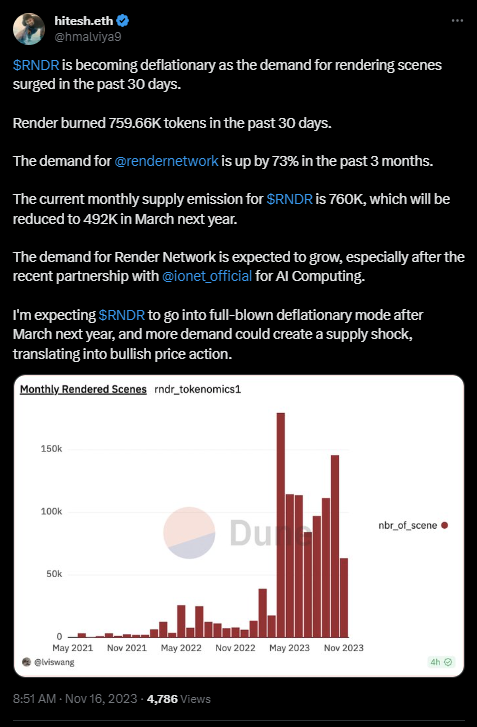

$RNDR becomes deflationary as rendering demand has increased over the past 30 days:

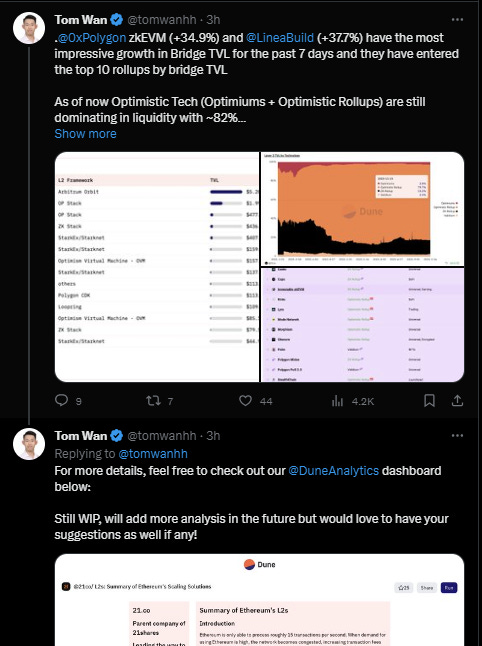

0xPolygon zkEVM (+34.9%) and Linea (+37.7%) have the most impressive growth in Bridge TVL for the past 7 days:

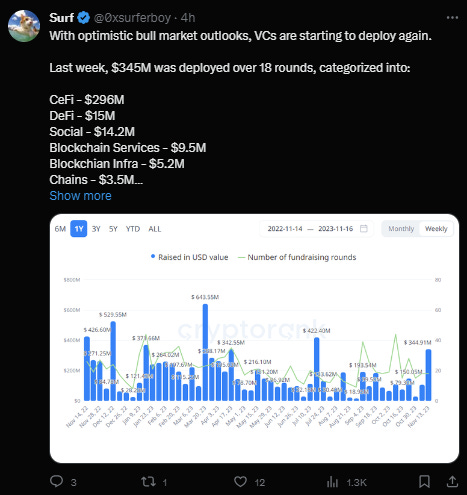

Amid optimistic bull market forecasts, venture capital funds are starting to invest again

Last week, $345 million was placed in 18 rounds:

Memeland not only sells its token, but also earns far more royalties than any other project:

6/➯ Macro Metrics 📈

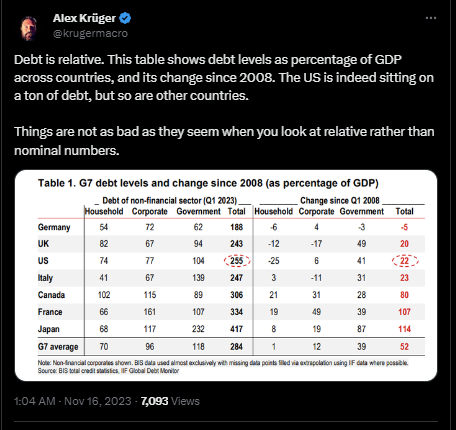

This table shows the level of debt as a percentage of GDP in different countries and how it has changed since 2008. The US is indeed sitting on a pile of debt, but so are other countries.

Thoughts about US Treasure:

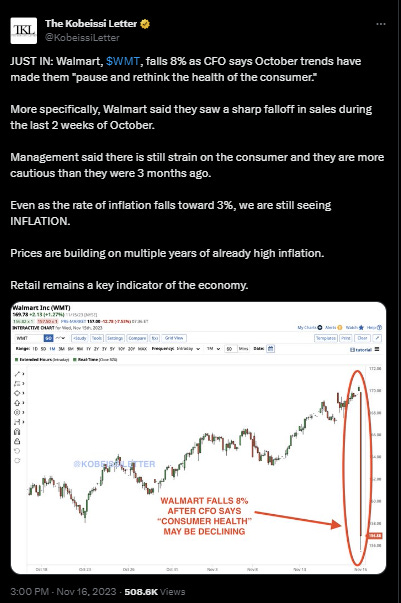

Walmart, $WMT, falls 8% as the CFO said October trends forced them to "pause and rethink consumer health."

7/➯ Exploits & Bugs

Raft - plan of recovery:

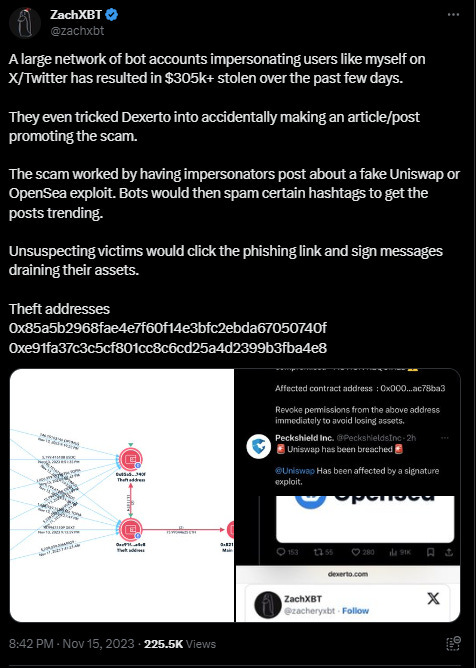

Revealing massive scam history with $305k+ stolen over the past few days:

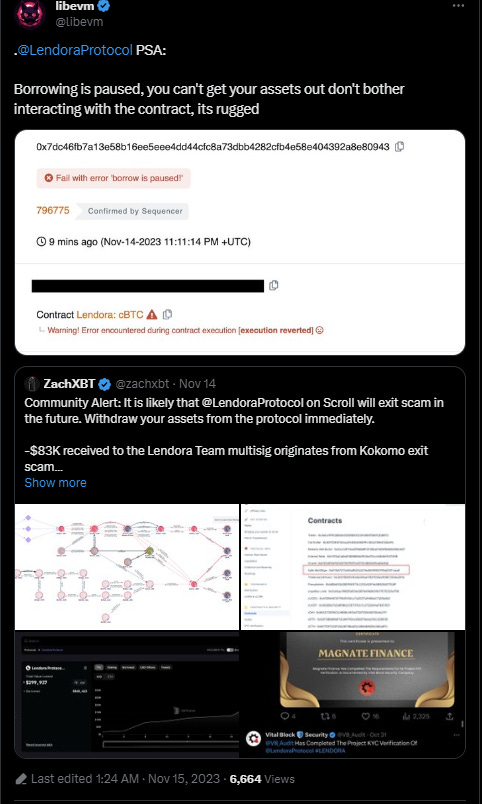

Lendora Protocol rugged - borrowing is paused:

That’s it for today frens!

Thank you for staying with us. Your future self will be grateful.

You can follow me on Twitter ➯ DeFi_Made_Here

If you liked this newsletter and love to learn and share knowledge about crypto, you can share this post with your crypto frens!