DMH Newsletter is a vital news hub with crucial updates & narratives and trends

Today you will find Alpha on:

Spotlight

Updates & Upgrades in DeFi

Alpha by Threadors & Good Reads

OnChain & Macro & News

Exploits & Bugs

Spotlight Project: Kyberswap

Multichain #DeFi exchange & aggregator on 13 chains⚡Swap at the best rates⚡LPs earn more | $KNC alpha: http://Discord.gg/kyberswap | TG: http://t.me/kybernetwork

🙍♂️ Followers: 295k

KyberSwap Description:

My friends from KyberSwap are one of the OGs in the space. They launched in 2017 and since then they have built the most integrated DEX aggregator with over 70 DEXes on 14 chains.

They have a unique concentrated liquidity design. Liquidity Providers do get not only high fees from the trading pools but also extra farming rewards on top of them.

Kyber also reworked Discovery Tool into KyberAI which brings a lot of insights about the market but is still in Beta. I will update you when it is available for everyone

Latest Update: $axlUSDC Elastic farms with axelarcore is now in full swing on Scroll_ZKP

Farm on Scroll with KyberSwap now!

2/➯ Updates & Upgrades in DeFi

Cross-Chain Settlement Of Tokenized Assets Using CCIP:

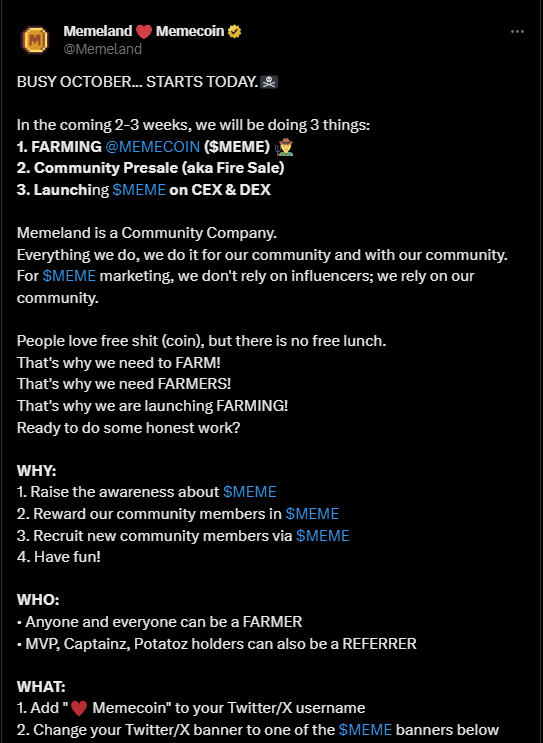

Memeland - Farming event:

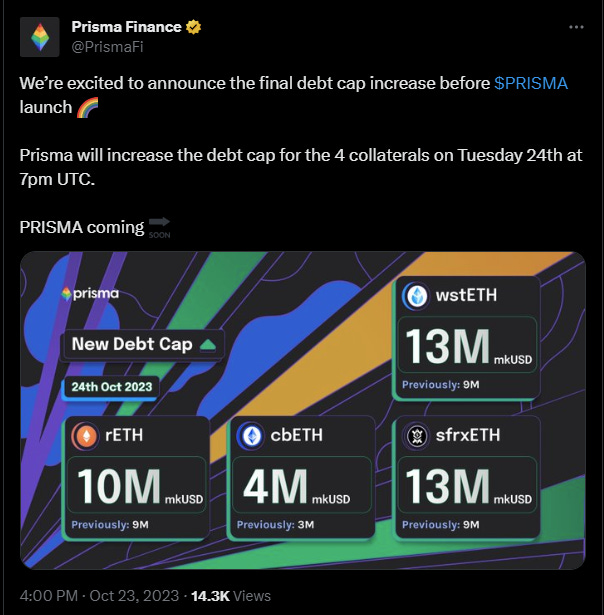

Prisma Finance Increases The Debt Cap For Four Collaterals:

Celestia's genesis will take place on October 31 at 14:00 UTC:

Hybrid crypto exchange GRVT to debut as first 'hyperchain' in zkSync ecosystem:

Coinbase to run a DYDX validator:

zkLend mainnet is live:

Magic Eden on BTC paused BRC-20 trading temporarily:

With #IPORv2 out, what's next?

Description About V2 update:

Custom APRs with zaps

$stETH pool

90d swaps

New architecture

Updated UX/UI

Fully audited

3/➯ Alpha by Threadors & Good Reads

The House Always Wins: A Rollbit Research Report:

LST-Backed Stablecoins and Their Dynamics in the DeFi Space:

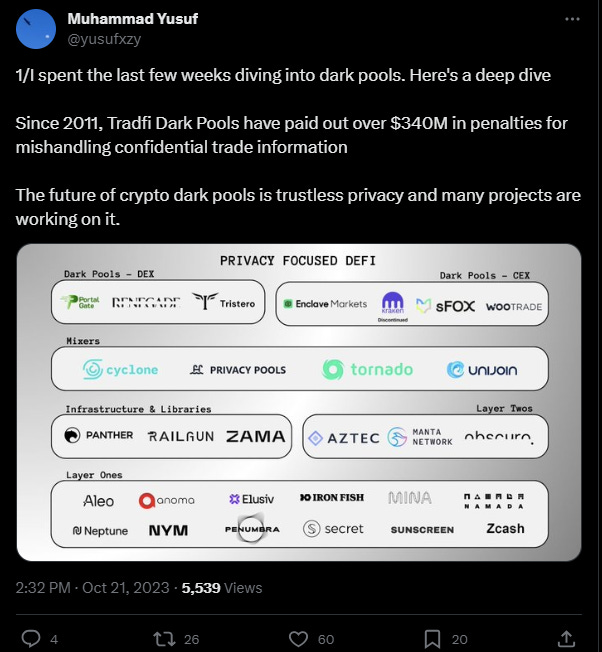

Diving into Dark Pools:

Frax is the Swiss Army Knife of DeFi:

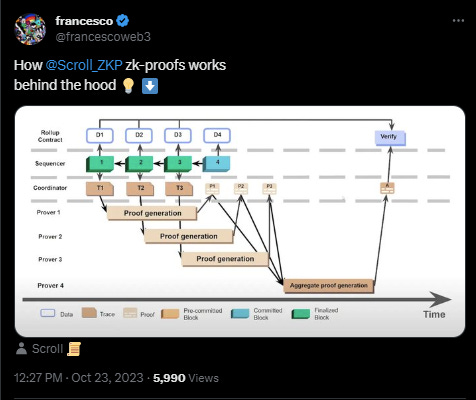

How Scroll_ZKP zk-proofs works:

Research about BitVM on #Bitcoin:

Exploration of OP chains:

How are #Chainlink services monetized and how will this accrue value to LINK?

Arthur Hayes blog: The gobs of fiat money printed and the lightspeed adoption of AI will combine forces and produce the biggest financial bubble EVER

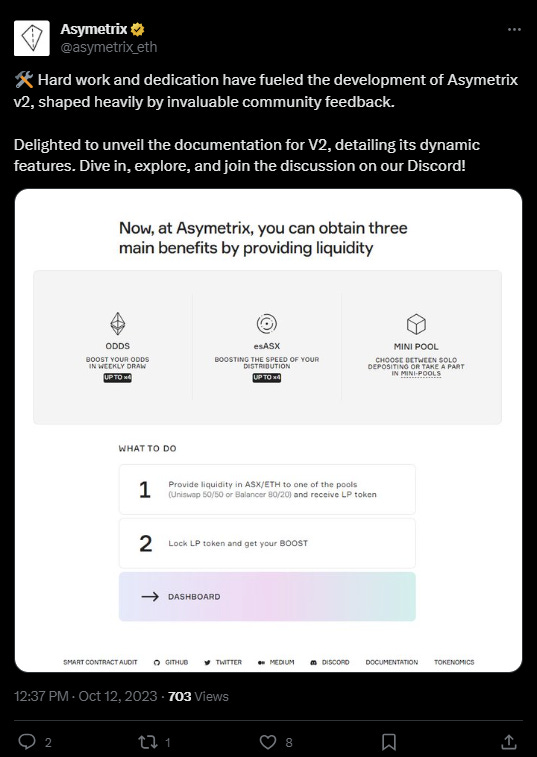

Spotlight Project - Asymetrix

Asymetrix is the decentralized, non-custodial protocol for asymmetric yields distribution generated from staking. You can deposit stETH into a shared pool which accrues around 5% annually as a staking reward.

🙍♂️ Followers: 3,4k

Asymetrix Description

How it works:

1. Users deposit stETH tokens into Asymetrix protocol, receiving Pool Share Tokens (PST) in a 1:1 ratio.

2. ETH staking rewards accumulate at the Lido APR speed and update every 24 hours.

3. Yield is distributed through random draws, with winners selected using Chainlink VFR. Initial deposits remain for future draws.

4. Winners automatically receive rewards as PST, increasing their chances of winning in future draws.

5. Users can withdraw their initial deposit at any time, exchanging PST for stETH at a 1:1 ratio. Asymetrix is non-custodial.

Latest Update: Asymetrix V2

4/➯ VITAL NEWS📰₿

Security researcher and developer Antoine Riar is leaving the Lightning Network development team, citing security concerns and fundamental problems with the Bitcoin ecosystem:

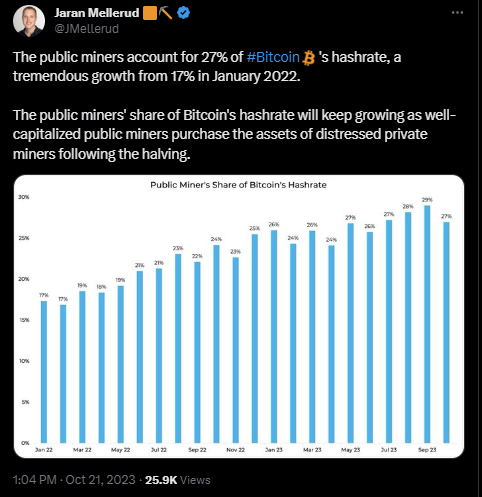

The public miners account for 27% of Bitcoin's hashrate, a growth from 17% in January 2022

Web3 Security Firm Blockaid Raises $27M to Help Tackle Industry's 'Never-Ending' Challenges:

Sam Bankman-Fried trial moves to final stages:

Tether's new CEO, Paolo Ardoino, aims to boost transparency by revealing real-time reserve data in 2024:

Swiss City Lugano to Accept BTC for Taxes, Grant $50m to Crypto Startups:

5/➯⛓️On-Chain Data:

ONE bullish weekend and what we get is:

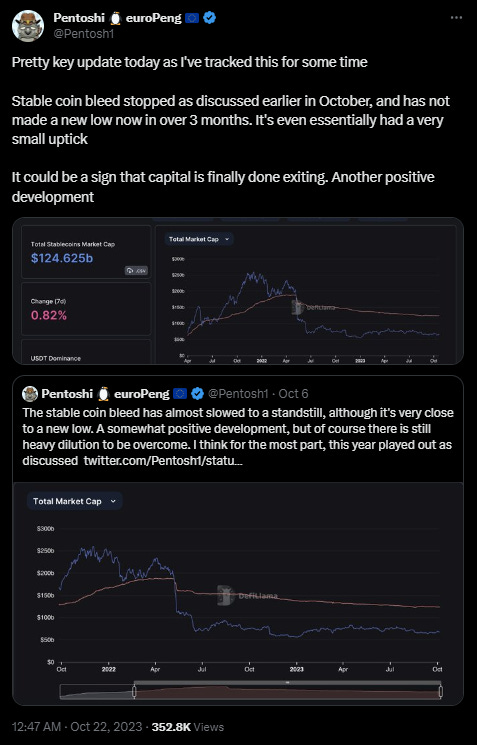

Сapital is finally done exiting. Another positive development:

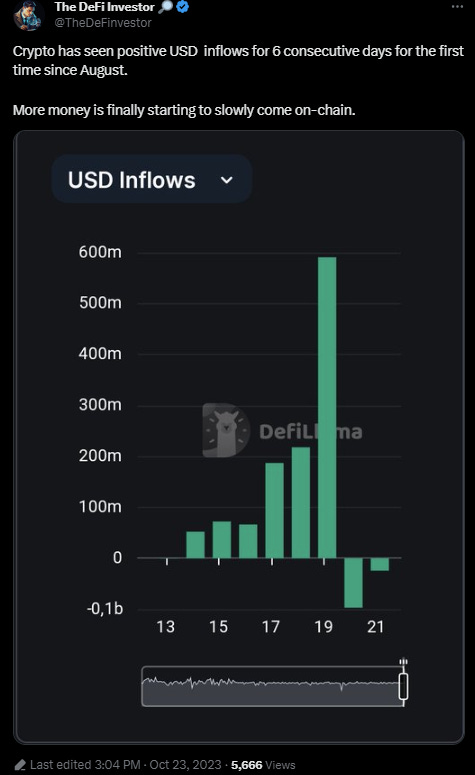

Positive USD inflows for 6 consecutive days:

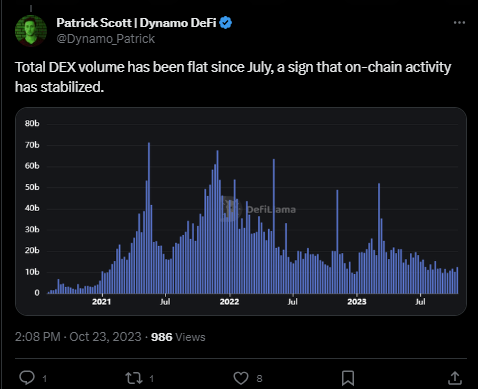

Total trading volume on DEX has remained unchanged since July, indicating stabilization of activity in the network:

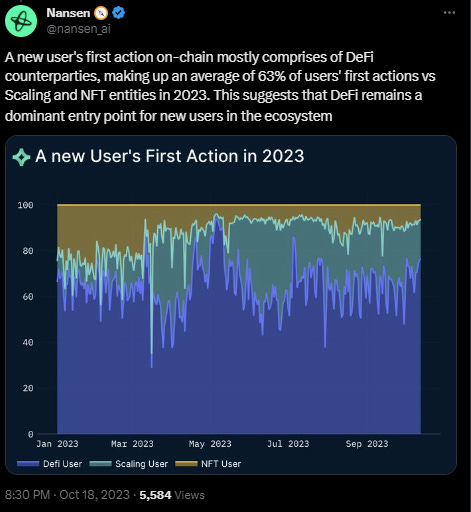

DeFi remains the dominant entry point for new users into the ecosystem:

Chainlink is up 23% in the past week:

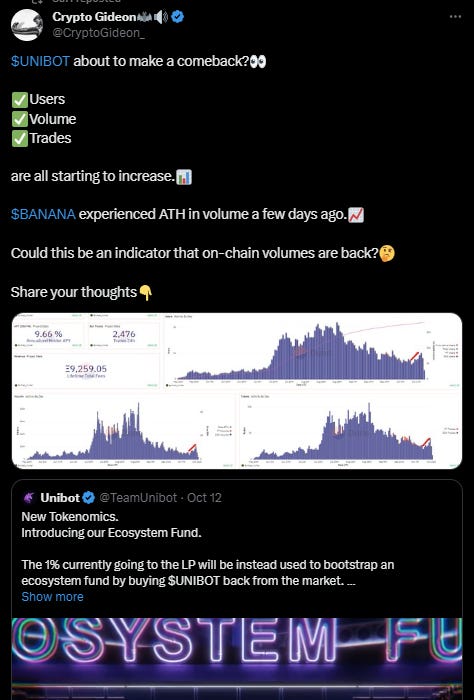

Is UNIBOT about to make a comeback?

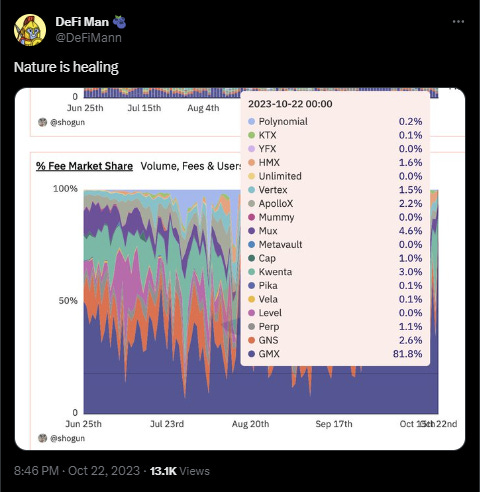

Nature is healing:

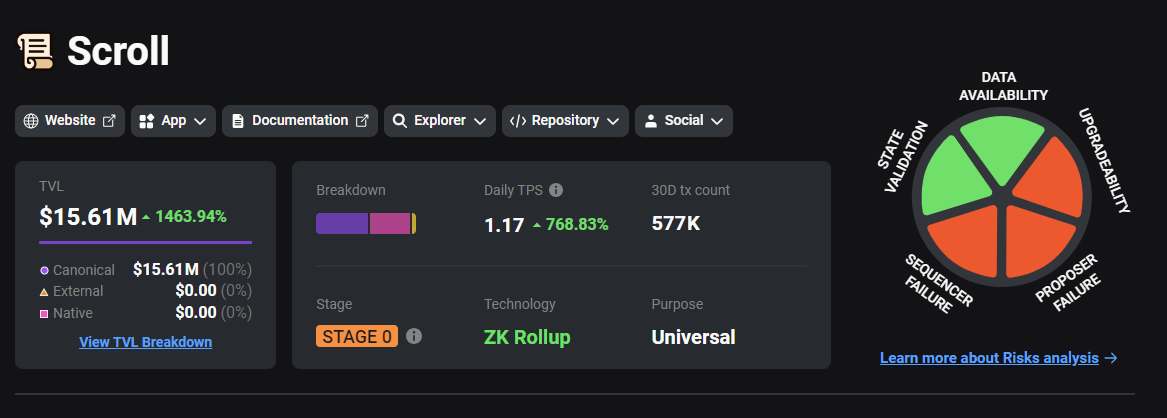

TVL on the Scroll chain has reached $15,6 million:

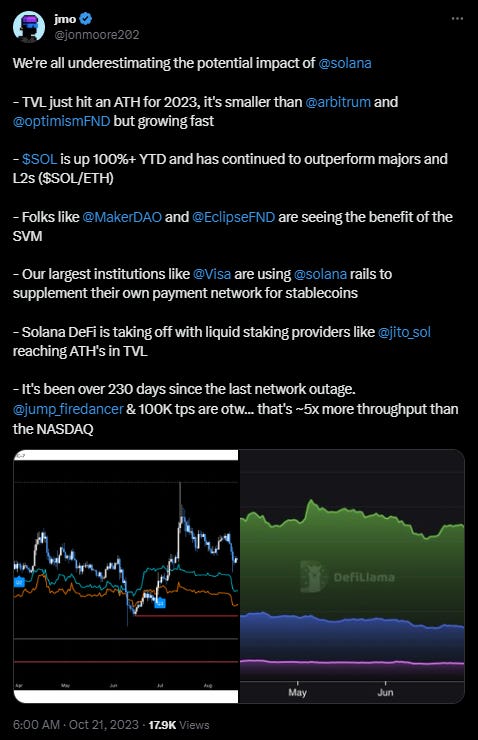

All underestimating the potential impact of Solana:

6/➯ Macro Metrics 📈

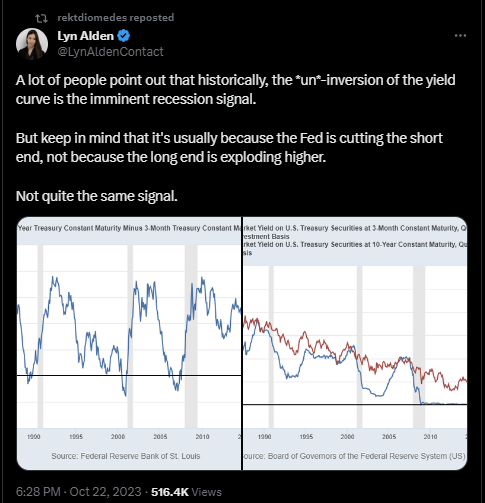

*un*-inversion of the yield curve and Fed is cutting the short end:

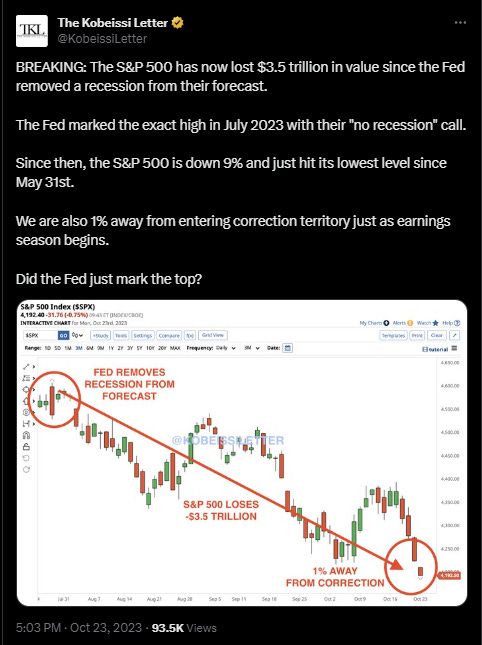

The S&P 500 has now lost $3.5 trillion in value since the Fed removed a recession from their forecast:

The 8% mortgage rate is back in the US for the first time since 2000:

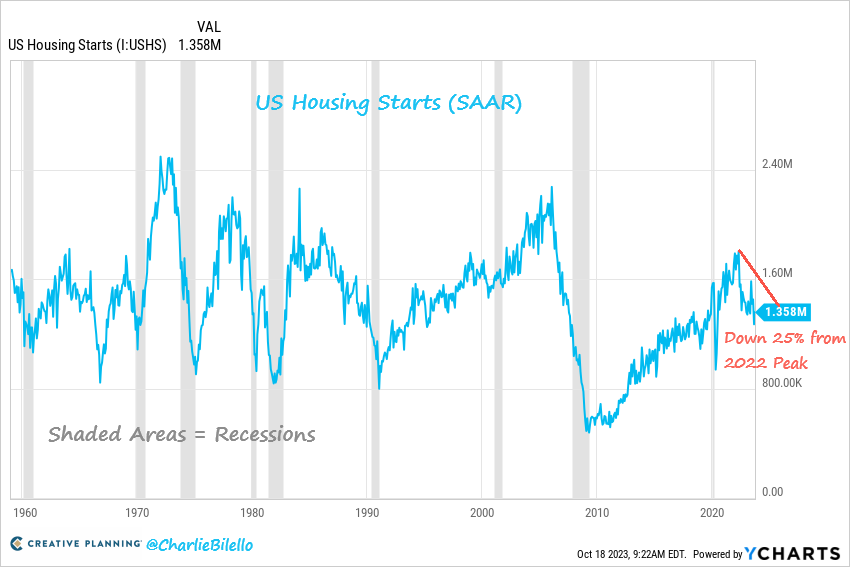

The decline in builder confidence was reflected in a decline in construction starts, which were down 7% year-over-year and 25% from their peak in 2022

CHINA SET TO PROVE $137 BILLION IN EXTRA SOVEREIGN DEBT ON TUESDAY:

7/➯ Exploits & Bugs

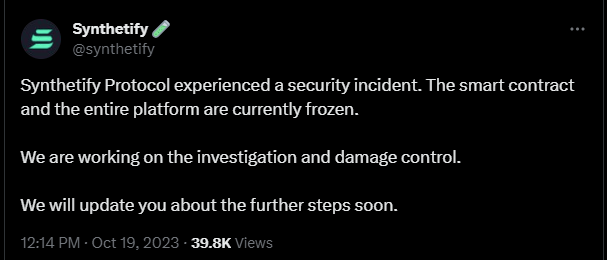

Synthetify exploited:

A total of $7.21B has been lost to hacks and rug pull in DeFi:

Coins. ph appears to have lost 12.2 million XRP in a possible exploit:

That’s it for today frens!

Thank you for staying with us. Your future self will be grateful.

You can follow me on Twitter ➯ DeFi_Made_Here

If you liked this newsletter and love to learn and share knowledge about crypto, you can share this post with your crypto frens!