DMH Newsletter is a vital news hub with crucial updates & narratives and trends

Today you will find Alpha on:

Spotlight

Updates & Upgrades in DeFi

Alpha by Threadors & Good Reads

OnChain & Macro & News

Exploits & Bugs

Spotlight Project: Kyberswap

Multichain #DeFi exchange & aggregator on 13 chains⚡Swap at the best rates⚡LPs earn more | $KNC alpha: http://Discord.gg/kyberswap | TG: http://t.me/kybernetwork

🙍♂️ Followers: 295k

KyberSwap Description:

My friends from KyberSwap are one of the OGs in the space. They launched in 2017 and since then they have built the most integrated DEX aggregator with over 70 DEXes on 14 chains.

They have a unique concentrated liquidity design. Liquidity Providers do get not only high fees from the trading pools but also extra farming rewards on top of them.

Kyber also reworked Discovery Tool into KyberAI which brings a lot of insights about the market but is still in Beta. I will update you when it is available for everyone

Latest Update: 70% reduced gas fees on KyberSwap

With the rise of Ethereum's L2 solutions, managing transaction costs became essential. KyberSwap achieved significant reductions while maintaining the efficiency of their DEX Aggregator system.

Key achievements include:

Calldata size reduction: 37.4% reduction for swaps using KyberSwap Elastic pool

Eliminating padding: Savings up to 60.87% in certain instances.

Further call data optimizations were implemented.

Benchmarking against 50 real transactions showed an average gas fee saving of 59.96%, reaching up to 68.26%.

More gas-saving innovations are anticipated from KyberSwap as they continue to be your all-in-one DeFi platform.

2/➯ Updates & Upgrades in DeFi

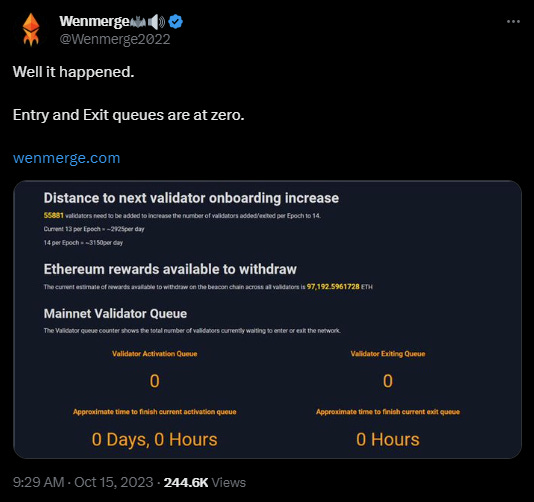

Ethereum staking queue reaches equilibrium:

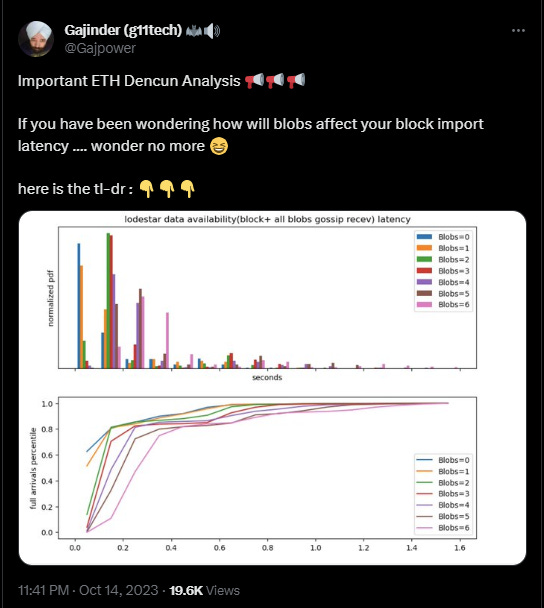

Analysis of Dencun Devnet 9 and blob size:

Stars Arena has relaunched but with a pause on trading functionality:

Swell launch their own vampire attack on stETH:

Kind reminder about Celestia Airdrop:

Trezor Safe 3 - The next generation of Trezor hardware wallets is here:

Uniswap is bringing out KYC Verification in the form of a Hook for Uniswap v4:

Lido On Solana Sunset:

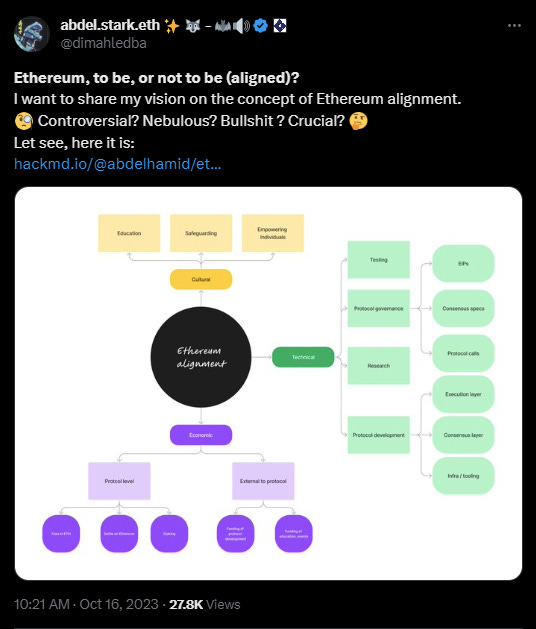

Defining “Ethereum Alignment”:

Ether.Fi - decentralization roadmap:

Rabby Desktop:

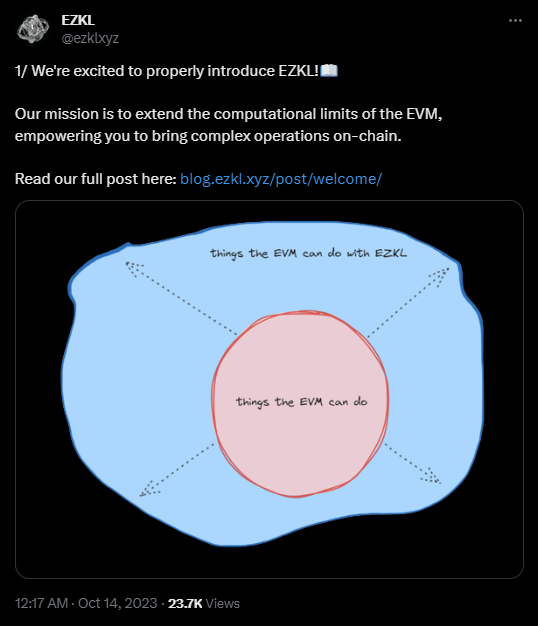

EZKL - tool for moving complex on-chain computations off-chain in a verifiable fashion using zk:

3/➯ Alpha by Threadors & Good Reads

Pendle and RWA:

The non-stablecoin RWA sector exploded to $2.5B TVL in 2023:

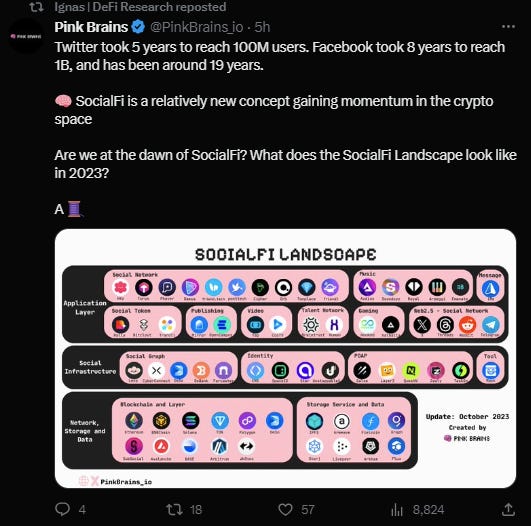

Overview of SocialFi:

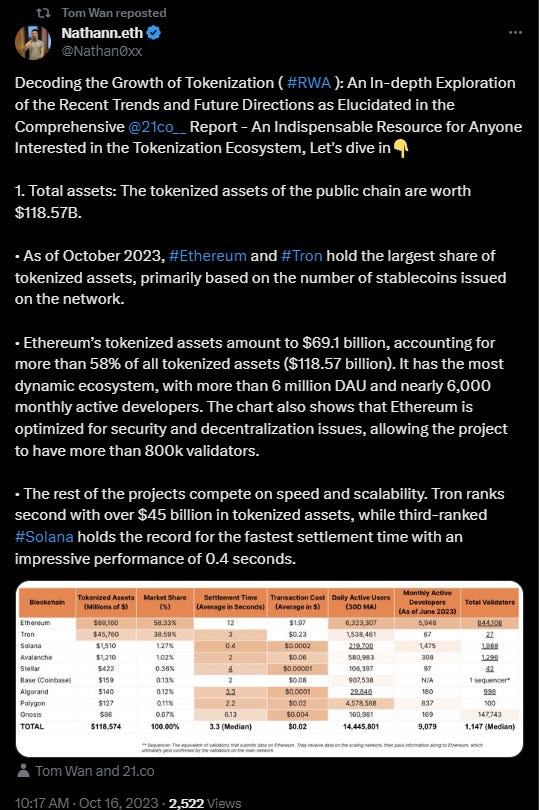

Decoding the Growth of Tokenization RWA:

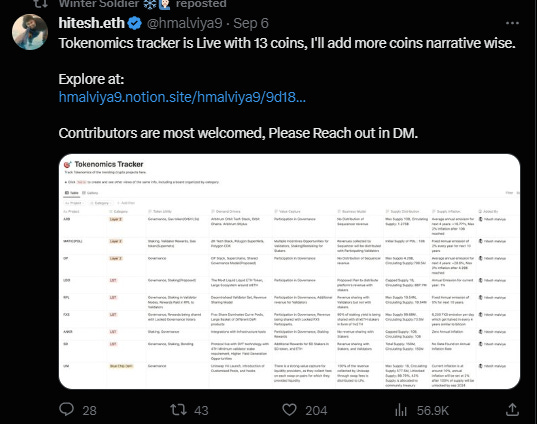

Tokenomics tracker:

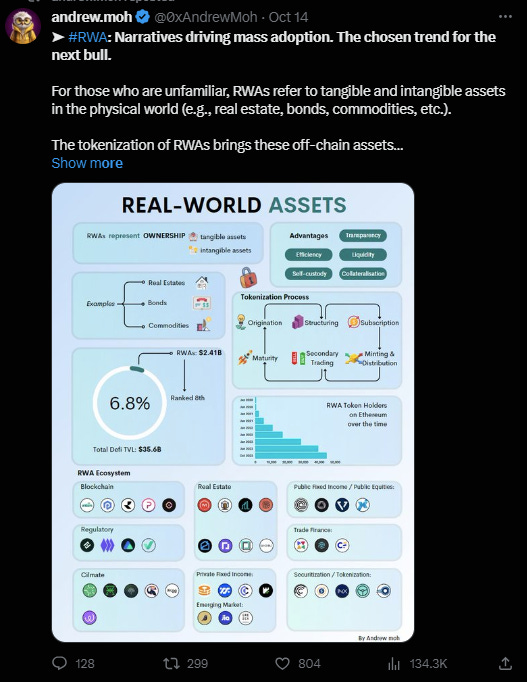

RWA: Narratives driving mass adoption. The chosen trend for the next bull:

4/➯ VITAL NEWS📰₿

The Australian government has announced a new regulatory regime for crypto exchanges:

Grayscale GBTC discount falls to 16% as markets bet on Bitcoin ETF approval:

Rumors about BTC ETF:

Frozen funds on market:

Upbit, a leading South Korean cryptocurrency exchange, has received preliminary approval for a Major Payment Institution (MPI) license:

Investor Demand for Ether Staking Yields Has Slowed: Coinbase:

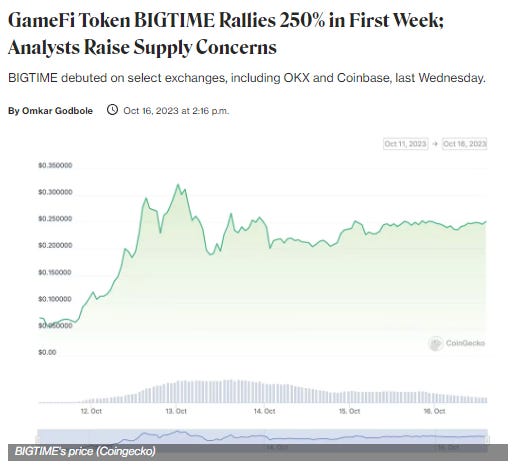

BIGTIME, the native token of the blockchain-based multiplayer game Big Time, has experienced an impressive 250% rally in its first week of trading:

JPMorgan's blockchain-based payment system, Onyx Coin Systems, successfully completed a cross-border payments pilot:

5/➯⛓️On-Chain Data:

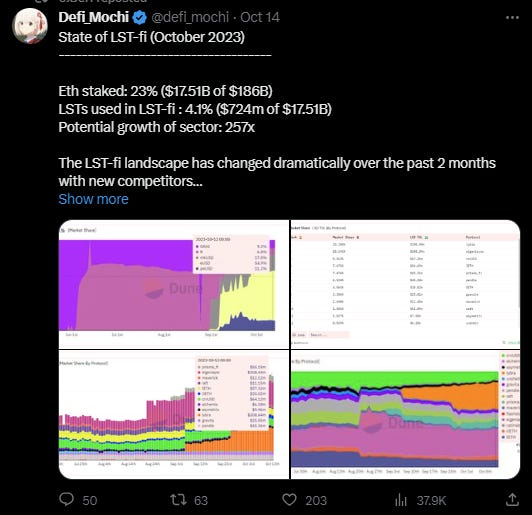

State of LST-fi (October 2023):

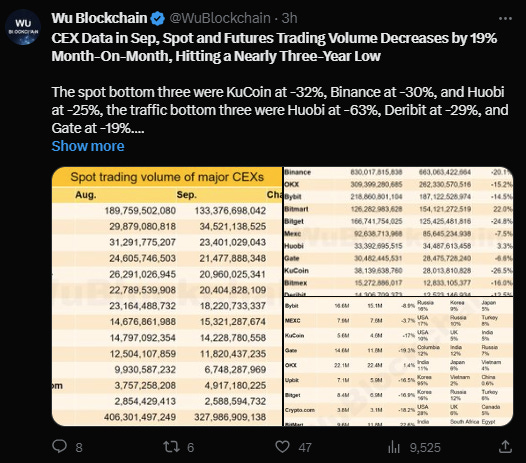

CEX Data in Sep, Spot and Futures Trading Volume Decreases by 19% Month-On-Month, Hitting a Nearly Three-Year Low:

Lido is shutting down stSOL due to high development costs:

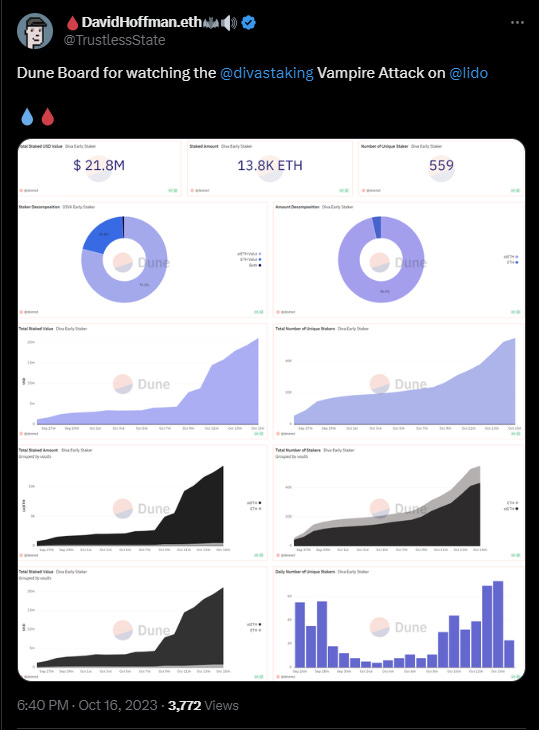

Dune Dashboard to watch Divastaking Vampire Attack on:

Huge on-chain stats in GambleFi:

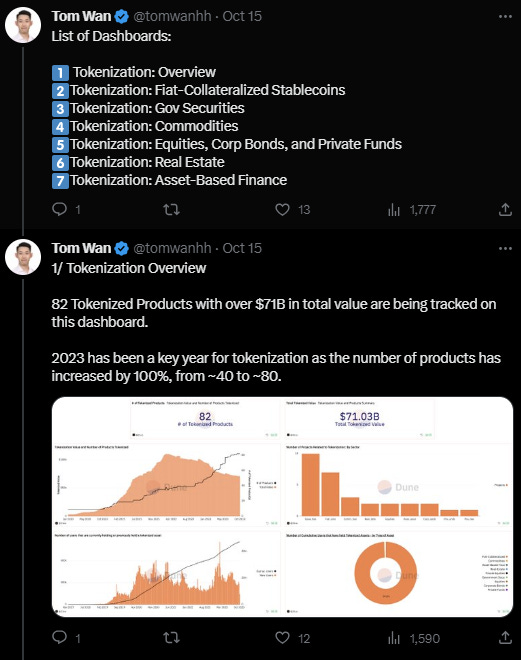

Tom Wan has released 7 new Dune Analytics Dashboards on Tokenization (RWA):

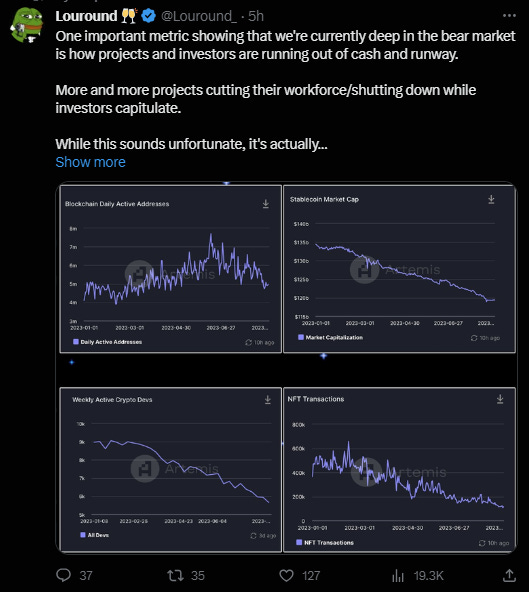

We're currently deep in the bear market:

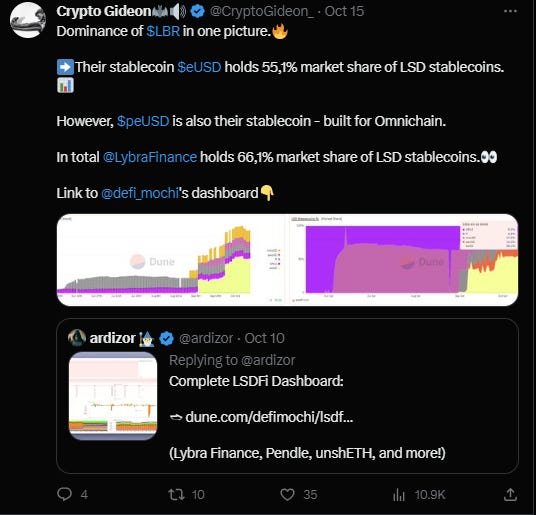

Dominance of LBR:

Spotlight Project - Asymetrix

Asymetrix is the decentralized, non-custodial protocol for asymmetric yields distribution generated from staking. You can deposit stETH into a shared pool which accrues around 5% annually as a staking reward.

🙍♂️ Followers: 3,4k

Asymetrix Description

How it works:

1. Users deposit stETH tokens into Asymetrix protocol, receiving Pool Share Tokens (PST) in a 1:1 ratio.

2. ETH staking rewards accumulate at the Lido APR speed and update every 24 hours.

3. Yield is distributed through random draws, with winners selected using Chainlink VFR. Initial deposits remain for future draws.

4. Winners automatically receive rewards as PST, increasing their chances of winning in future draws.

5. Users can withdraw their initial deposit at any time, exchanging PST for stETH at a 1:1 ratio. Asymetrix is non-custodial.

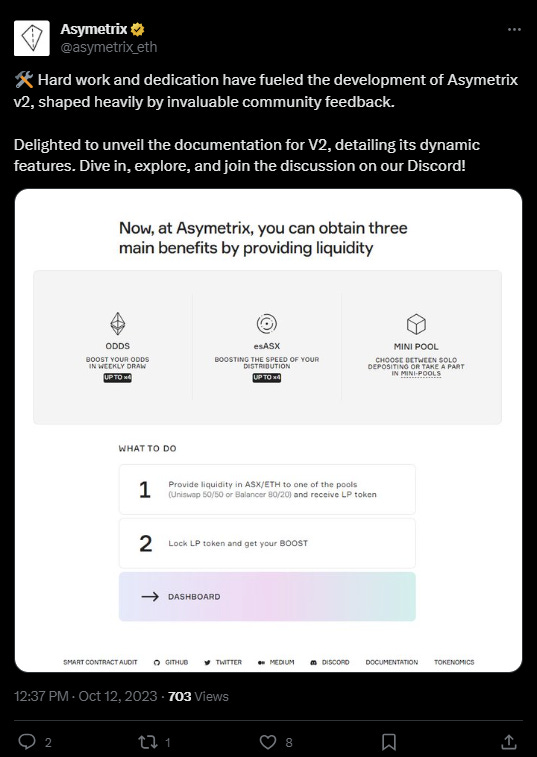

Latest Update: Asymetrix V2

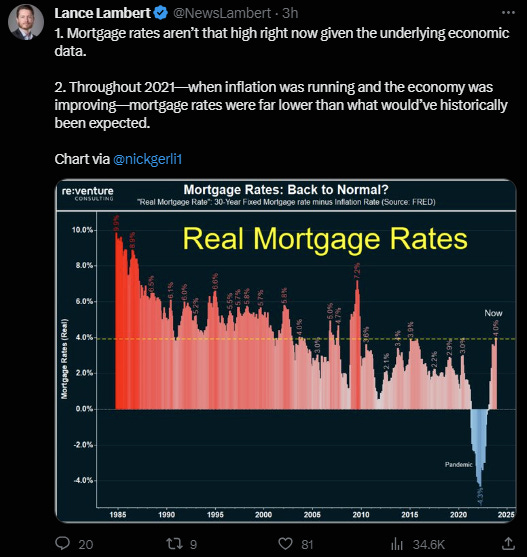

Mortgage rates aren’t that high right now given the underlying economic data:

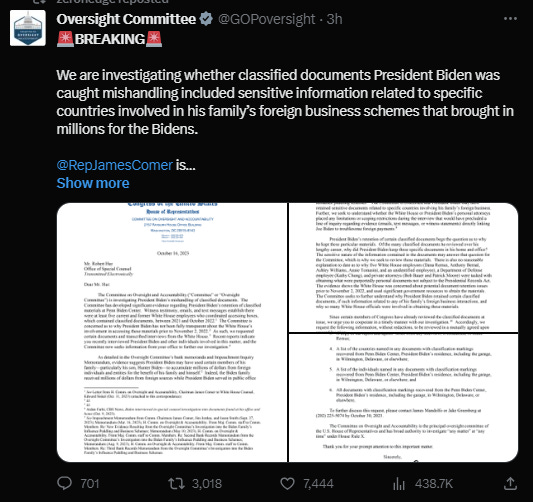

Research about Biden:

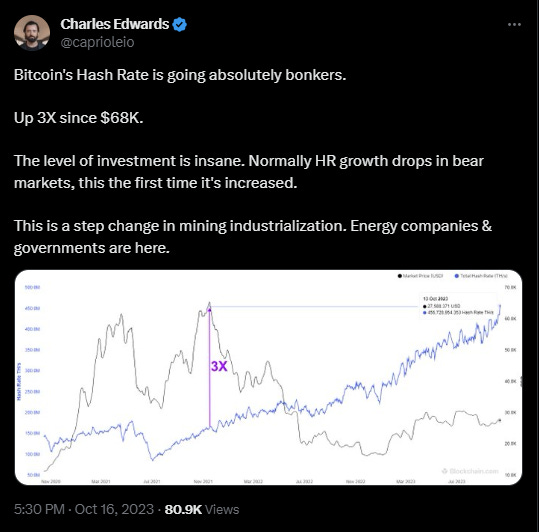

Bitcoin's Hash Rate is going absolutely bonkers

JANET YELLEN: US TREASURY SECRETARY SAYS 'WE CAN CERTAINLY AFFORD TWO WARS':

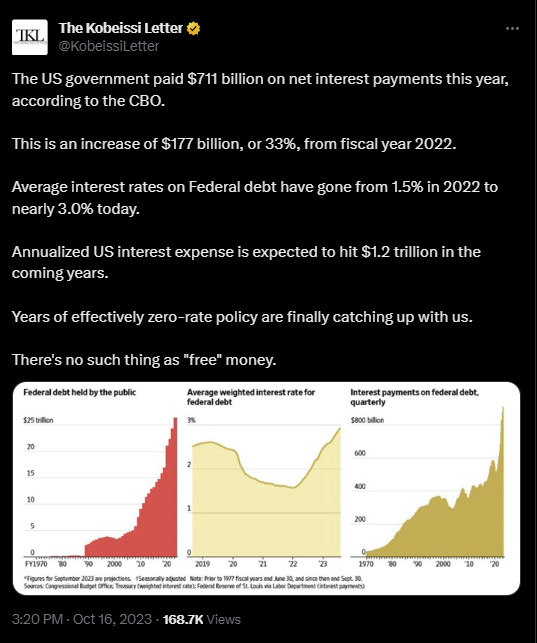

The US government paid $711 billion on net interest payments this year, according to the CBO:

7/➯ Exploits & Bugs

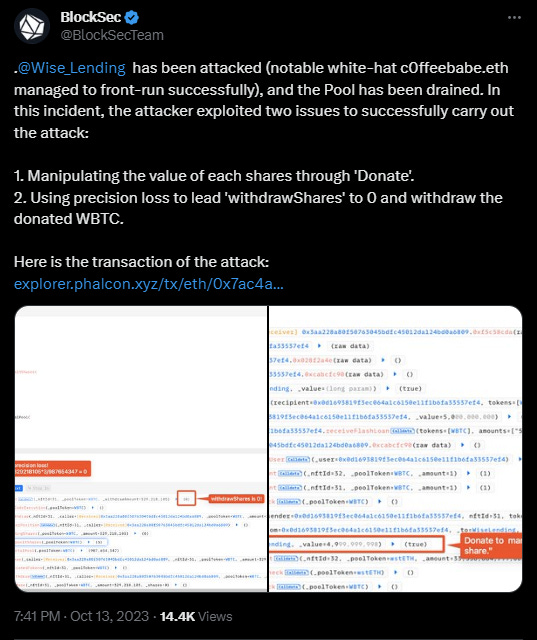

Wise_Lending has been attacked

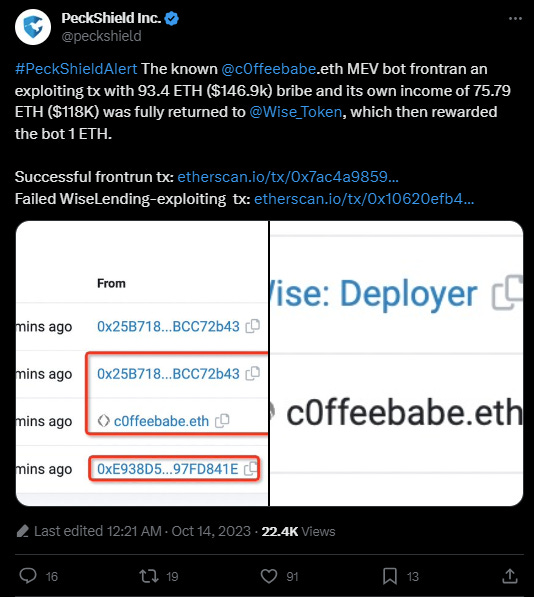

The known c0ffeebabe.eth MEV bot front ran an exploiting tx with 93.4 ETH ($146.9k) bribe

Its own income of 75.79 ETH ($118K) was fully returned to Wise_Token:

That’s it for today frens!

Thank you for staying with us. Your future self will be grateful.

You can follow me on Twitter ➯ DeFi_Made_Here

If you liked this newsletter and love to learn and share knowledge about crypto, you can share this post with your crypto frens!