DMH Newsletter is a vital news hub with crucial updates & narratives and trends

Today you will find Alpha on:

Spotlight

Updates & Upgrades in DeFi

Alpha by Threadors & Good Reads

OnChain & Macro & News

Exploits & Bugs

Spotlight Project: Kyberswap

Multichain #DeFi exchange & aggregator on 13 chains⚡Swap at the best rates⚡LPs earn more | $KNC alpha: http://Discord.gg/kyberswap | TG: http://t.me/kybernetwork

🙍♂️ Followers: 295k

KyberSwap Description:

My friends from KyberSwap are one of the OGs in the space. They launched in 2017 and since then they have built the most integrated DEX aggregator with over 70 DEXes on 14 chains.

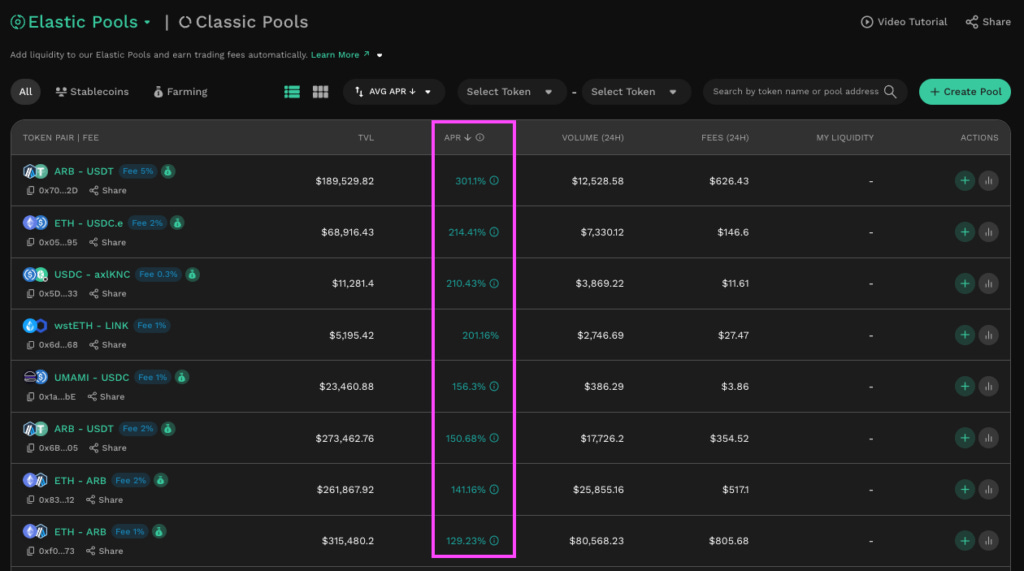

They have a unique concentrated liquidity design. Liquidity Providers do get not only high fees from the trading pools but also extra farming rewards on top of them.

Kyber also reworked Discovery Tool into KyberAI which brings a lot of insights about the market but is still in Beta. I will update you when it is available for everyone

KyberSwap September 2023 Product Updates:

Exciting updates and improvements in their platform!

New features and enhancements for a better trading experience on KyberSwap.

Check out their latest blog post for all the details.

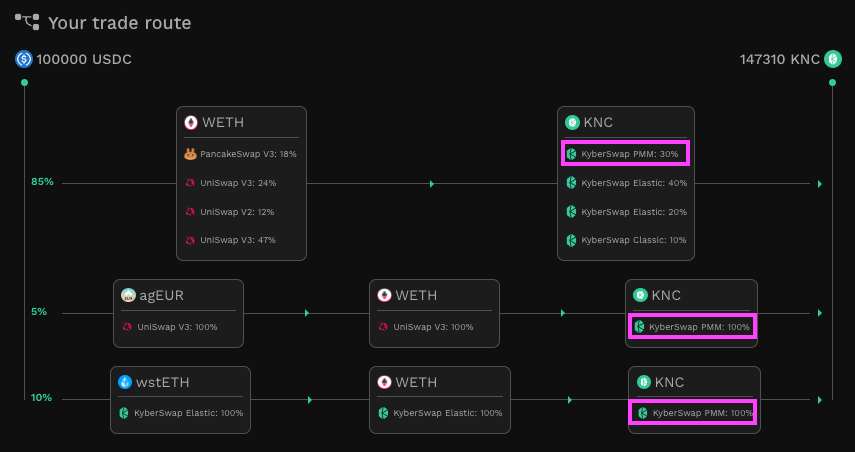

1/ Greater Market Depth With Professional Market Maker:

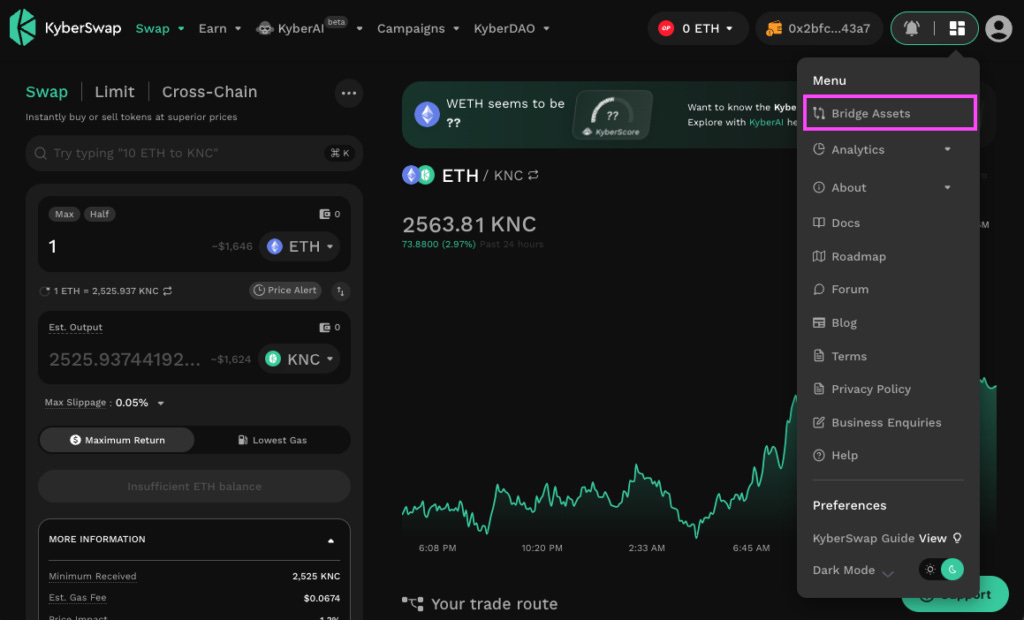

2/ Explore New Chains With Ease Via Native Bridges:

3/ More Accurate Elastic APRs For Less Active Pools:

2/➯ Updates & Upgrades in DeFi

Frax V3 Docs:

Protocol and staking pool changes that could improve decentralization and reduce consensus overhead:

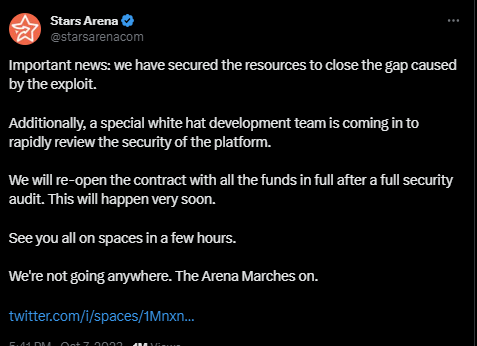

Starsarenacom PSA, secured funding to cover the exploit:

Uniswap releases docs on TWAMM hook:

Deribit to Offer Options on More Tokens, Expand in EU:

Deposit with a Valio manager in Valio:

Solana's new 1.16 update:

Temp check for CRVUSD onboarding on Aave v3 pool:

Weekly IPOR APRs Update:

3/➯ Alpha by Threadors & Good Reads

A vision of Ethereum Staking & Protocol Decentralization:

Сreated by @stacy_muur

Overview of On-Chain RWAs and the Forces Propelling Their Growth:

Helius: Solana’s v1.16 Update:

Constantly updated information on Arbitrum STIP proposals voting progress:

Сreated by @DeFi_Made_Here

Understanding FRAX v3: A Breakdown:

Сreated by @stacy_muur

Breathtaking Arbitrum Tier List:

Сreated by @TheDefiDog

Frax V3: the Final Stablecoin:

Сreated by

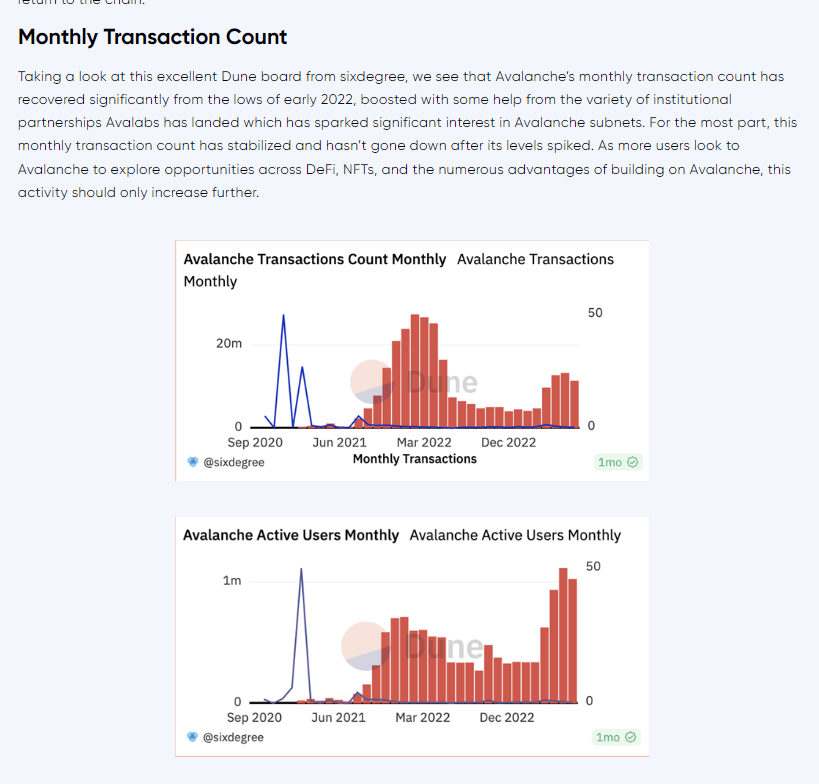

Avalanche Q3 Overview:

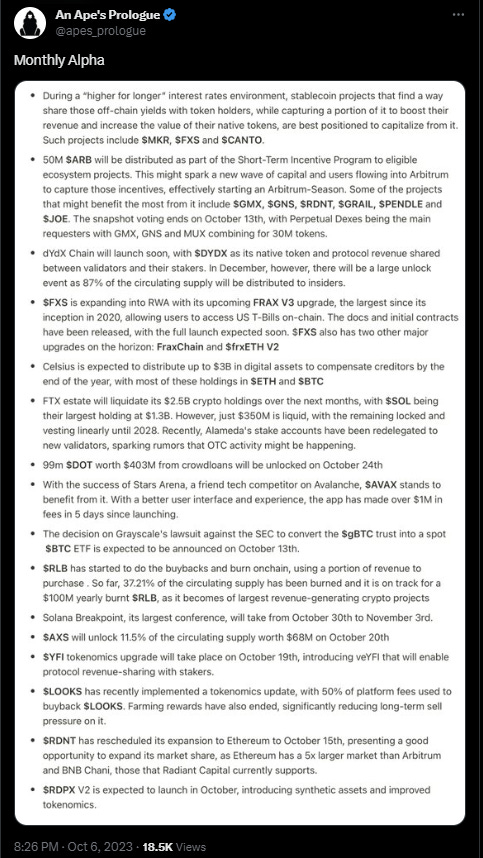

Monthly Alpha:

Сreated by @apes_prologue

Unleash a 55% delta-neutral strategy on $ETH with three game-changing protocols: Pendle_fi, Penpiexyz_io, and Stellaxyz:

Сreated by

Spotlight Project - Asymetrix

Asymetrix is the decentralized, non-custodial protocol for asymmetric yields distribution generated from staking. You can deposit stETH into a shared pool which accrues around 5% annually as a staking reward.

🙍♂️ Followers: 3,3k

Asymetrix Description

How it works:

1. Users deposit stETH tokens into Asymetrix protocol, receiving Pool Share Tokens (PST) in a 1:1 ratio.

2. ETH staking rewards accumulate at the Lido APR speed and update every 24 hours.

3. Yield is distributed through random draws, with winners selected using Chainlink VFR. Initial deposits remain for future draws.

4. Winners automatically receive rewards as PST, increasing their chances of winning in future draws.

5. Users can withdraw their initial deposit at any time, exchanging PST for stETH at a 1:1 ratio. Asymetrix is non-custodial.

4/➯ VITAL NEWS📰₿

On the day FTX declared bankruptcy, someone stole hundreds of millions from its coffers. A WIRED investigation reveals the company's efforts to stop them:

FTX used random numbers to generate the size of its insurance fund:

Upbit, South Korea's largest exchange, said it suffered 159,061 attempted network attacks in the first half of this year, 2.17 times more than last year:

Ledger cuts 12% of staff due to 'macroeconomic headwinds':

Israeli crypto and web3 communities launch "Crypto Aid Israel" to raise funds for war victims:

7 projects have already reached enough quorum in the Arbitrum grants voting:

Huobi, KuCoin, over 140 crypto exchanges ‘non-authorized’ — UK regulator:

Worldcoin's Sam Altman tells Joe Rogan that US government is waging war on crypto:

CFTC staff may take action against Ehrlich for violating U.S. derivatives rules before Voyager's bankruptcy in July 2022.

Ehrlich feels the allegations are unfair, like changing the rules after the game is over:

In the past month, ETH supply increased by 30k ETH ($47.9 million) due to reduced Ethereum network transactions, including NFT trades and DeFi activity:

5/➯⛓️On-Chain Data:

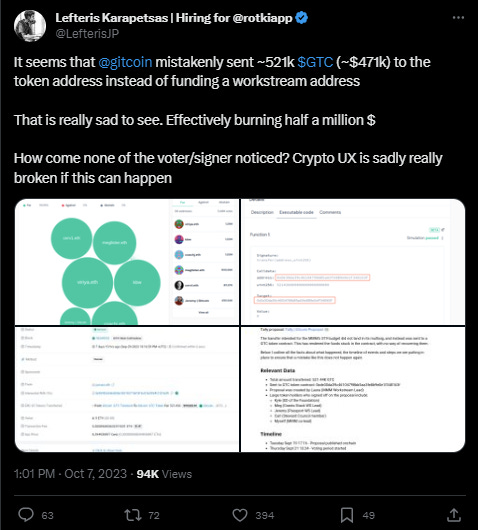

Gitcoin mistakenly sent ~521k GTC (~$471k) to the token address instead of funding a workstream address:

Friend Tech Trend Tracker (10.9):

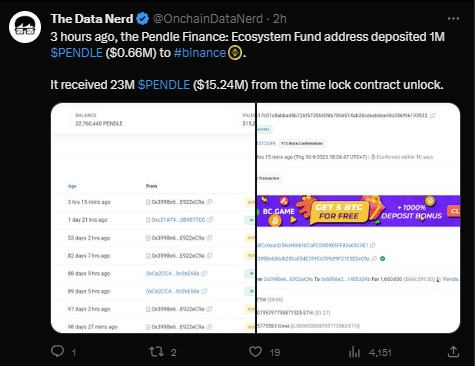

3 hours ago, the Pendle Finance: Ecosystem Fund address deposited 1M PENDLE ($0.66M) to Binance:

L2 transactions accounted for 61% of all Ethereum transactions in Q3:

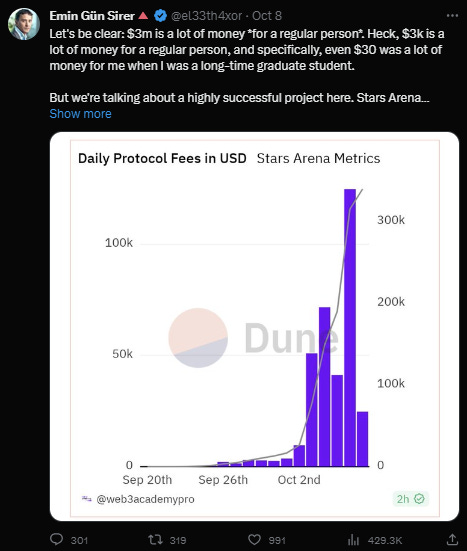

Stars Arena earned more than $120k in a day:

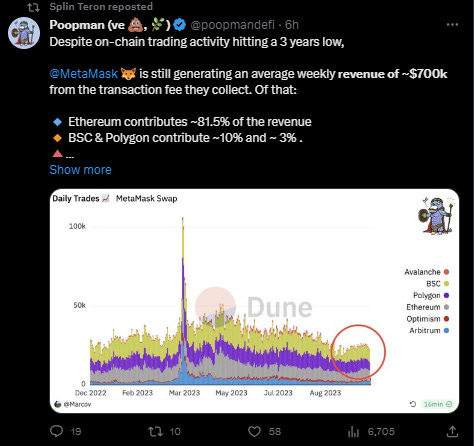

MetaMask is still generating an average weekly revenue of ~$700k from the transaction fee they collect:

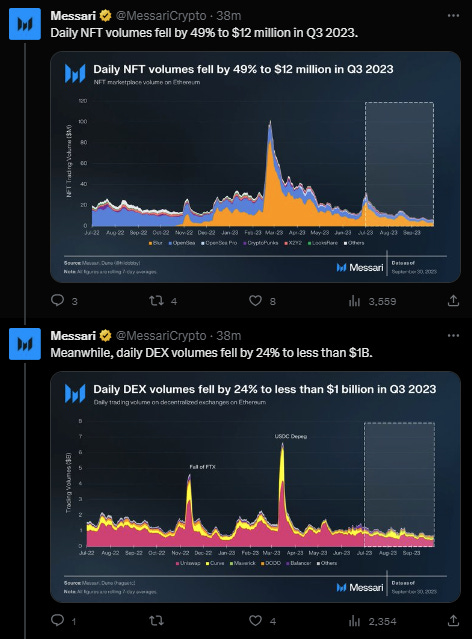

Daily NFT volumes fell by 49% to $12 million in Q3 2023:

6/➯ Macro Metrics 📈

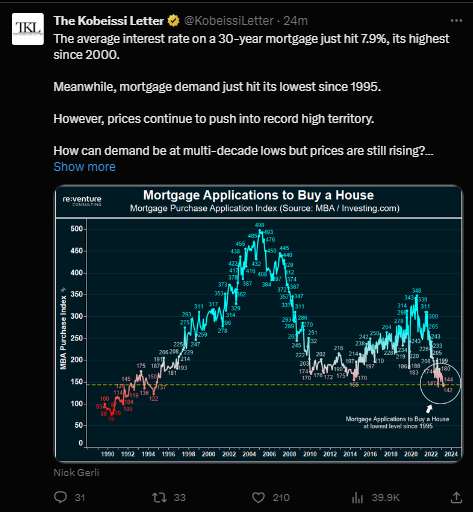

The average interest rate on a 30-year mortgage just hit 7.9%, its highest since 2000:

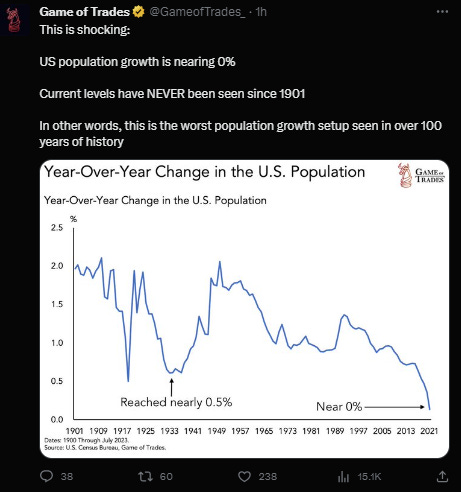

US population growth is nearing 0%:

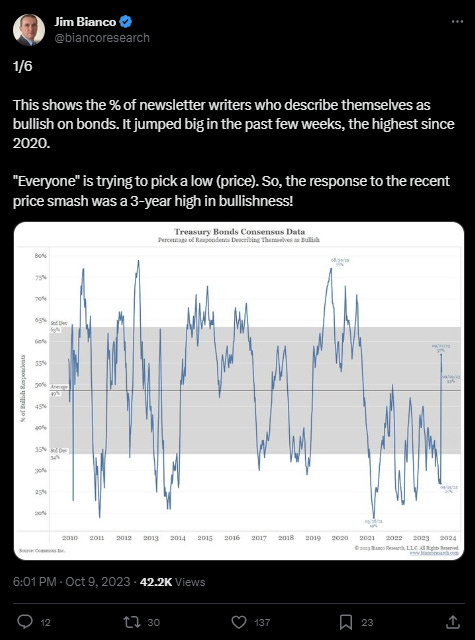

Percent of newsletter writers who describe themselves as bullish on bonds:

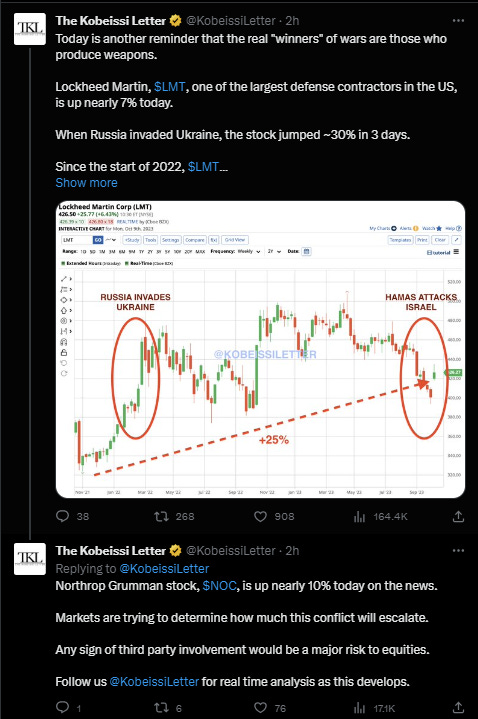

How wars affect the macro:

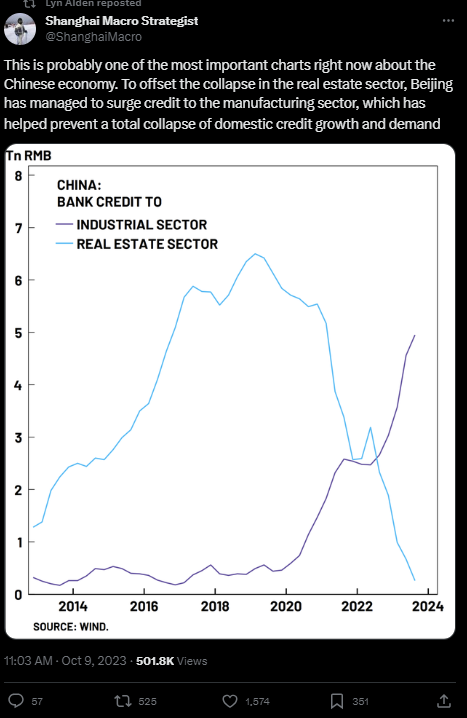

One of the most important charts right now about the Chinese economy:

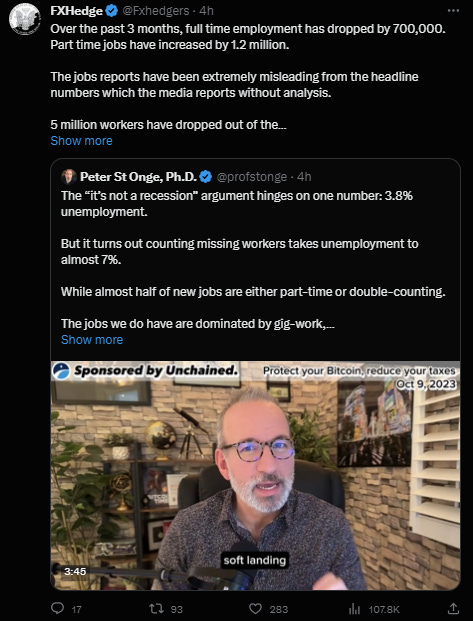

Over the past 3 months, full-time employment has dropped by 700,000. Part-time jobs have increased by 1.2 million:

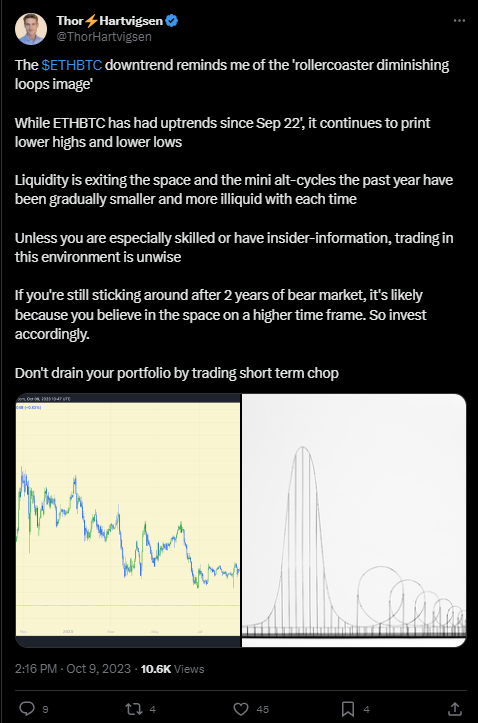

While ETH/BTC has had uptrends since Sep 22', it continues to print lower highs and lower lows:

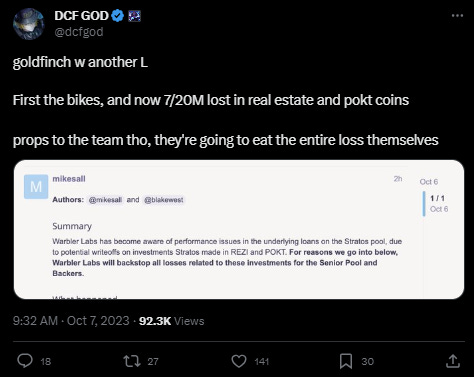

Goldfinch_fi loses $7m due to default but covers it on its own:

7/➯ Exploits & Bugs

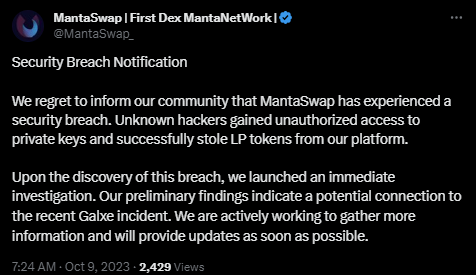

MantaSwap_exploited for $100k:

Update from Stars Arena about the exploit:

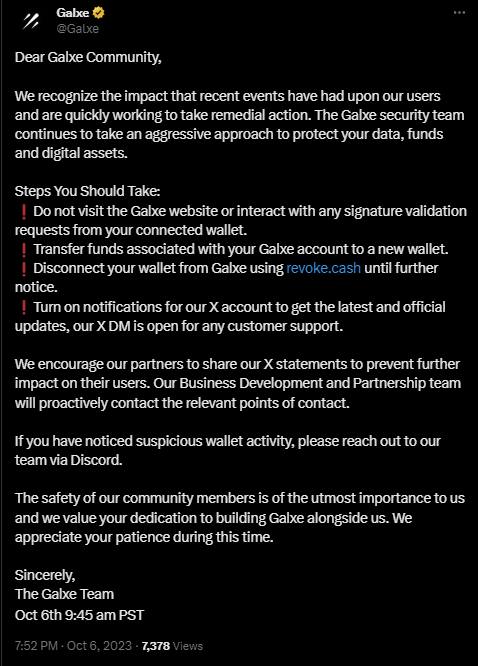

Galxe hit by DNS attack:

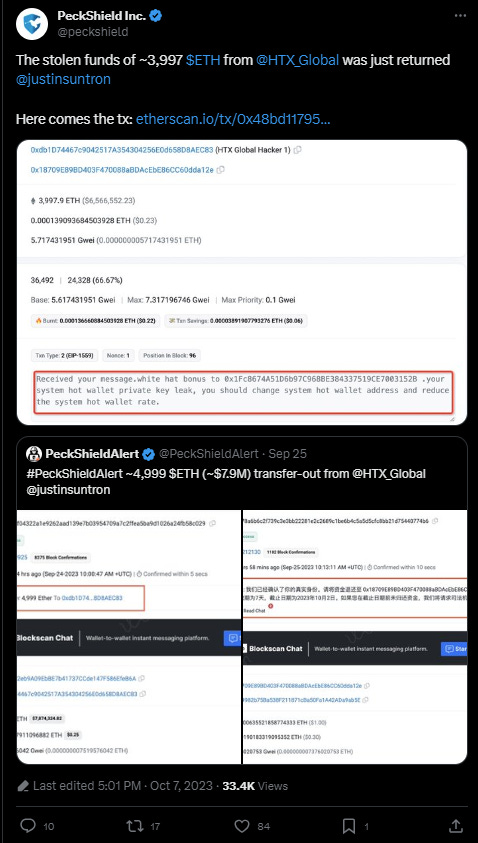

HTX_Global exploiter returned funds:

That’s it for today frens!

Thank you for staying with us. Your future self will be grateful.

You can follow me on Twitter ➯ DeFi_Made_Here

If you liked this newsletter and love to learn and share knowledge about crypto, you can share this post with your crypto frens!