DMH Newsletter is a vital news hub with crucial updates & narratives and trends

Spotlight Project: HMX

HMX offers up to 1000x leverage on Crypto, Forex, and Commodities. It accepts various crypto assets as collateral with cross-margin collateral support, enabling flexible position and risk management strategies.

Additionally, HMX provides low fees comparable to CEXs. What sets HMX apart are its additional features like subaccount support, instantaneous execution, one-click trading, on-chart trading, and more, which offer a user experience similar to CEXs while still retaining the benefits of decentralization.

Users also have the opportunity to become market makers for traders at HMX by depositing assets into the HLP vault. The liquidity in the HLP vault serves as the market-making liquidity for traders at HMX and the vault is unique because it is built on top of GMX's GM token.

This unique feature allows depositors to earn yields from both GMX and HMX fees, maximizing passive real yields for the same liquidity used in market-making for both platforms.

The collateral factor for the BTC and ETH has been increased to 0.90.

With this change, your $BTC and $ETH collateral will now give you more buying power, allowing you to open larger positions!

Current HMX fees still the lowest in the market (0.02% for BTC& ETH, 0.03% for other cryptos & commodities, 0.01% for FX)

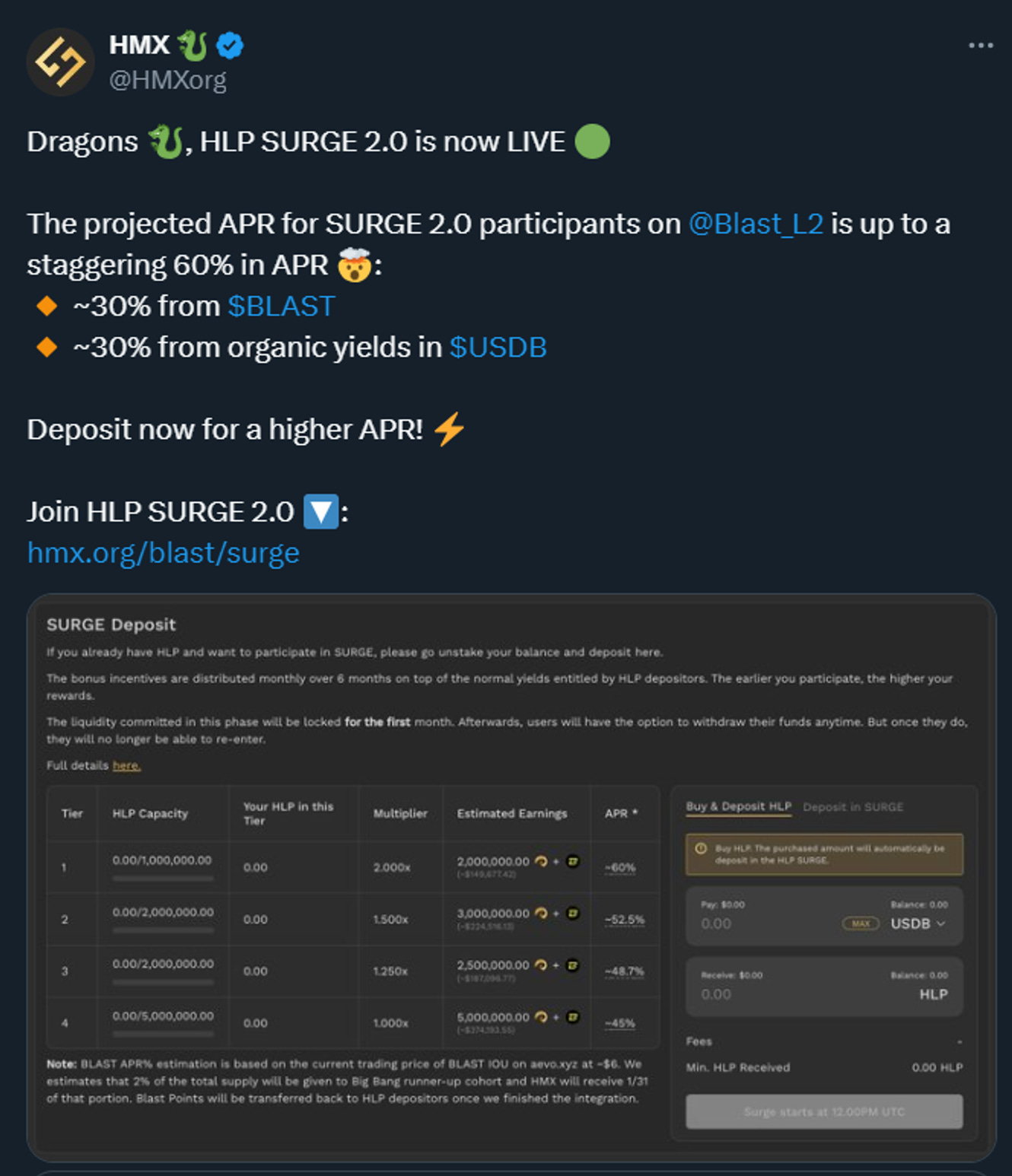

HMX inaugurates its expansion to Blast with the SURGE 2.0

After surpassing $14 billion in cumulative volumes on Arbitrum, HMX's perpetual DEX launched trading on Blast.

All of the $BLAST airdrop intended for developers on HMX will be distributed to traders and liquidity providers.

HMX’s second SURGE initiative to kickstart liquidity for HLP on Blast is currently active.

For more details, check out: the link

From March 7th to 11th, you can lock HLP for at least one month and earn Surge Points. The sooner the deposit, the greater the rewards.

Participants in SURGE 2.0 receive approximately 30% in native $USDB rewards and another 30% in $BLAST rewards.

Begin depositing on HMX to start earning over +60% APR: Deposit

2/➯ Updates & Upgrades in DeFi

FRAX chain is live:

The Saga Community Genesis Drop is here:

Astar's zkEVM Mainnet is Live:

Pirex ETH is going multichain:

Ether.fi pledges $600M in staked ETH to help secure Omni through Testnet and Mainnet:

Upcoming ArbOS 20 Atlas upgrade on Arbitrum:

Deposit wstETH in Radpie to unlock 17.28% APR:

3/➯ Alpha by Threadors & Good Reads

PERP DEX CASHFLOW ANALYSIS - FEBRUARY 2024:

Altlayer: Deep Dive

MEV and sandwich attacks on SOL:

weETH Risk Report:

Crypto Market Sets 4-Month Record Without ‘Fear’ Sentiment:

Blueprint of “DeFi Rollups” - Why This Will Disrupt DeFi Dapps:

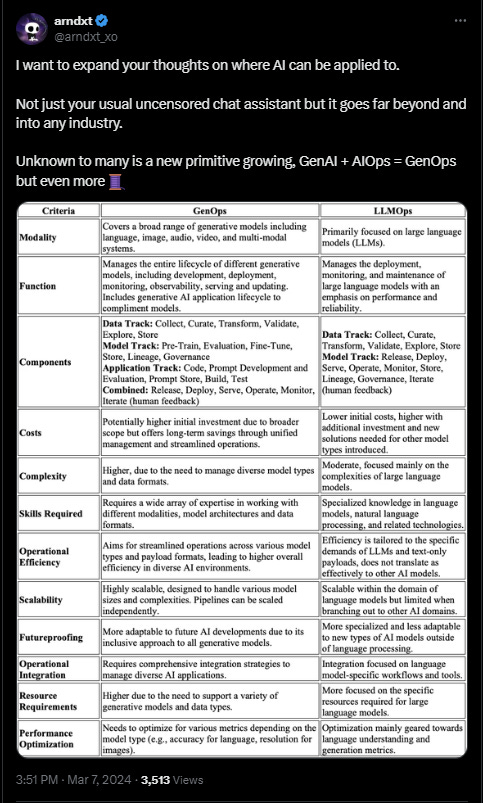

Where AI can be applied to:

4/➯ VITAL NEWS📰₿

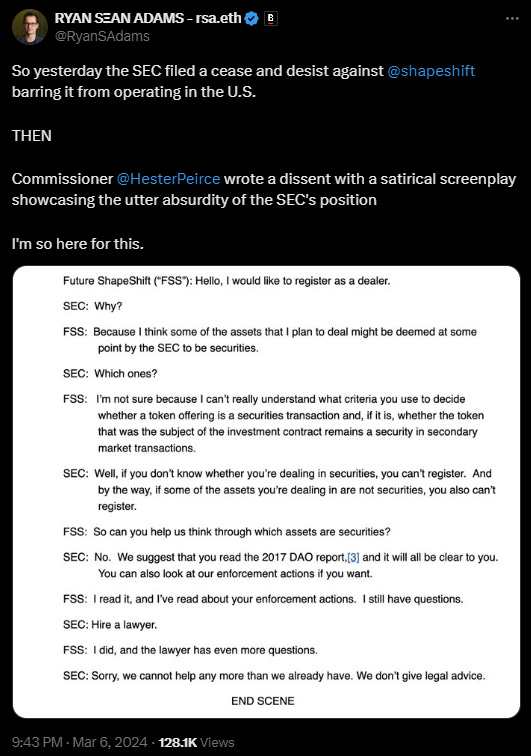

The SEC has filed a cease-and-desist action against Shapeshift barring it from operating in the US

Pantera Raising Funds to Buy Big Solana Holding From FTX Estate:

SEC delays decision on BlackRock's spot ETH ETF

Injective and DojoSwap released the CW20-Reflection standard which enables developers to deploy tokens with increased customizability such as a protocol fee-sharing parameter

Bitcoin ETF Giant Grayscale Introduces a Crypto Staking Fund

Arizona Senate considers adding spot Bitcoin ETFs to the state retirement portfolio

5/➯⛓️On-Chain Data:

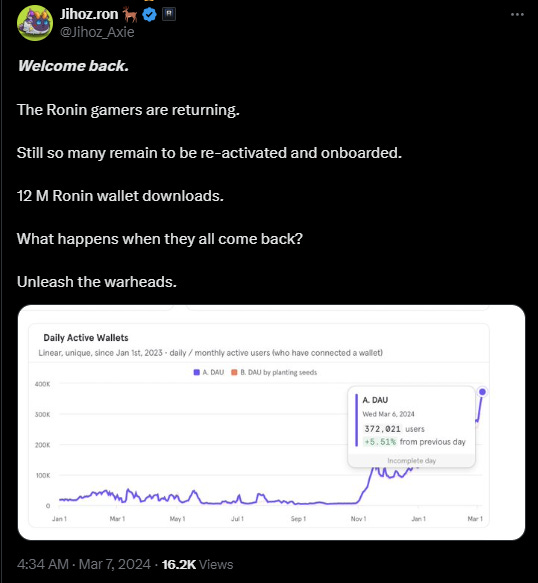

A new narrative of gaming blockchain:

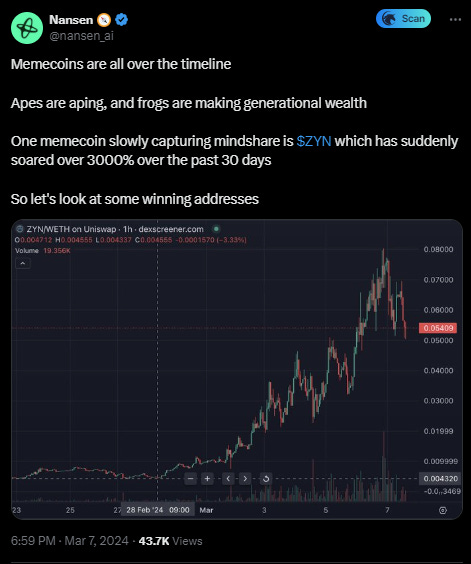

Investigation of the best Memecoins hunters:

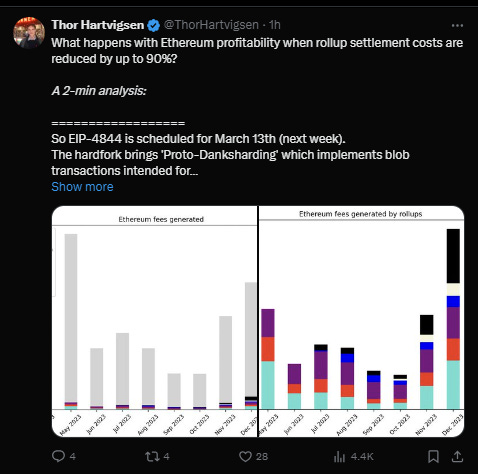

What happens with Ethereum profitability when rollup settlement costs are reduced by up to 90%?

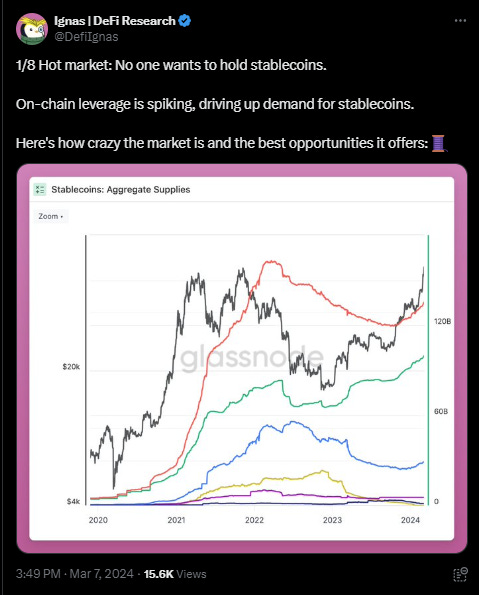

No one wants to hold stablecoins, what's happened with the market

6/➯ Macro Metrics 📈

The "Great Resignation" Becomes the "Great Stay"

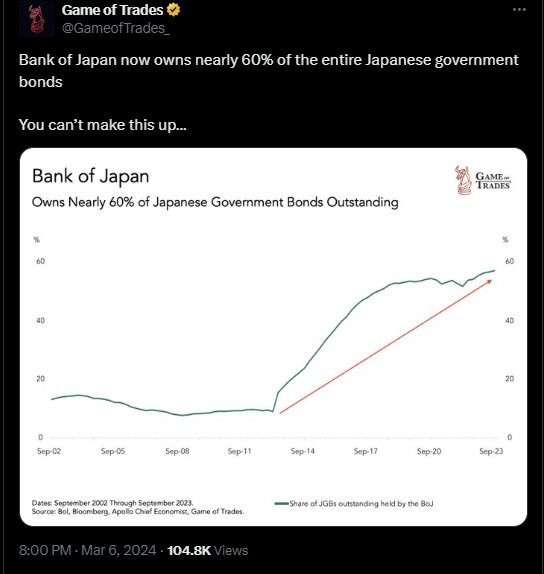

Bank of Japan Owns Nearly 60% of Japanese Government Bonds Outstanding

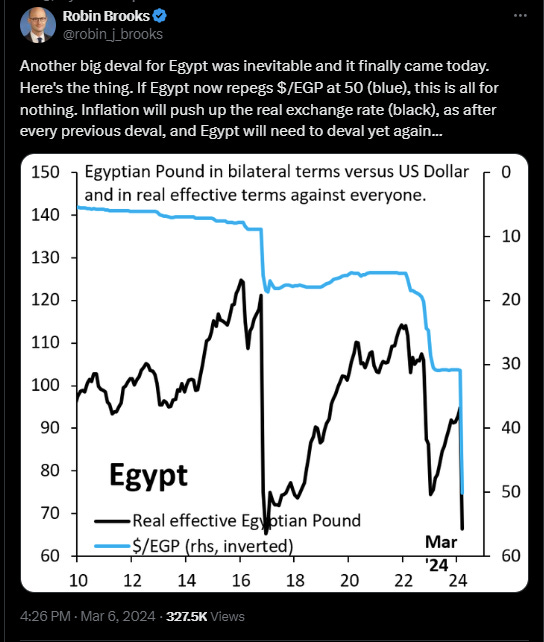

Egyptian Pound in bilateral terms versus the US Dollar and in real effective terms against everyone

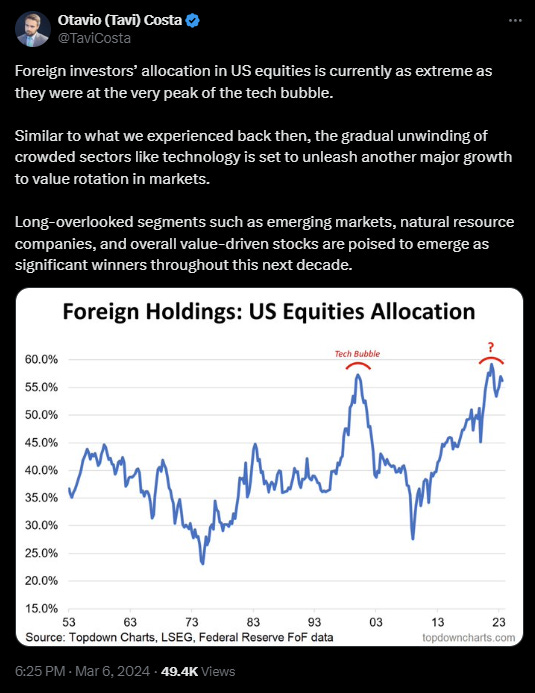

Foreign Holdings: US Equities Allocation

7/➯ Exploits & Bugs

Bitcoin Bridge OrdiZK Suffers Apparent $1.4M Rug Pull, Token Crashes to Zero

WOOFi offers bounty after $8.75 million exploit on Arbitrum

That’s it for today, my friends!

Thank you all for staying with us. Your future self will undoubtedly be grateful for the knowledge and insights gained here.

For more crypto-related content, feel free to follow me on Twitter ➯ DeFi_Made_Here.

I'll continue sharing valuable information about the latest insights and my thoughts in this fast-paced field.

If you enjoyed this newsletter as much as we did creating it, don't hesitate to share this post with your fellow crypto enthusiasts! Together, let's expand our understanding of this ever-evolving industry.