DMH Newsletter is a vital news hub with crucial updates & narratives and trends

Spotlight Project: Perfect Swap

The leading DEX on Arbitrum by the innovation of ve(3,3)

PerfectSwap offers low fees, fast transactions, and an innovative incentive model ve(3,3). It builds on Solidly V2's liquidity framework, aiming to enhance efficiency and sustainability in DEXs.

🙍♂️ Followers: 5.4k

Impermanent Loss Defense: Overcoming LP Concerns

Concerns like impermanent loss deter liquidity provision. PerfectSwap challenges this by transforming their AMM into a JIT fee collector, ensuring fair profits for providers.

At PerfectSwap, they've integrated dynamic fee structures to protect pools from toxic flows during market volatility. Their solution: JIT fees that adjust based on market conditions to create a fairer environment for liquidity providers.

But how do they manage to do it?

They mitigate impermanent loss for LPs because they're able to compensate them more fairly as opposed to other ve3,3s with suboptimal fee mechanisms.

Not only are fees automatically adjusted but their measure to the degree at which they set the fees is a lot more accurate than any other ve3,3 with self-adjusting fees.

They take into consideration price, supply, and volume, and measure essentially what is volatility by combining these factors.

The liquidity they create can be a lot stickier than other DEXs.

Safeguarding LPs on PerfectSwap: A Deep Dive into LP Protection

PerfectSwap shields LPs from volatility and toxic flow with dynamic fee structures, direct LP incentives, and maximized rewards.

- Dynamic fees minimize risks during volatility and maintain engagement in calmer times.

- LPs receive specific tokens as rewards, ensuring fair shares of trading fees.

- LPs enjoy a majority of swap fees, $PRFCT emissions, and 100% of LP incentives on PerfectSwap

2/➯ Updates & Upgrades in DeFi

Blast BigBang Competition Complete:

Parcl Released Info about their token:

Introducing Across V3:

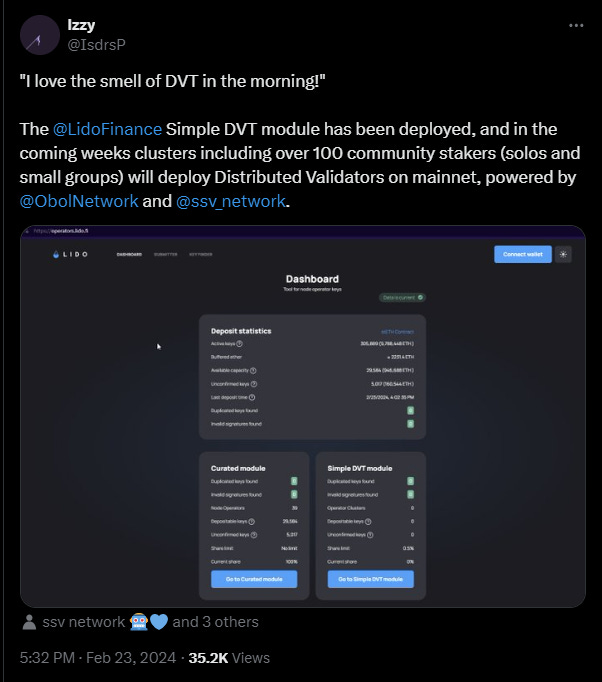

Lido's Simple DVT module has been deployed:

Uniswap proposal to reward UNI token holders who stake or delegate:

XAI staking v1 will be this week:

a16z invests $100M in Eigenlayer:

Fuel - The Rollup OS for Ethereum

3/➯ Alpha by Threadors & Good Reads

Research about ZkML - The Next Big Narrative in AI:

Gmx released a few more incremental changes: building the GMX Chain:

When to Sell Airdrops: 46% of Top Airdrops Hit All-Time High in 2 Weeks:

Castle Research about Hyperliquid: A Deep Dive into its Future and Its Fair Valuation:

When will new airdr0p tokens launch:

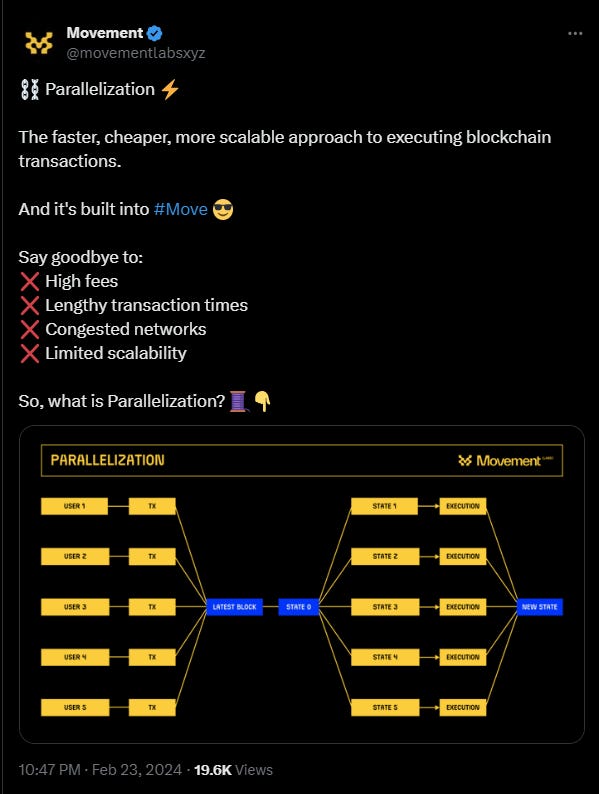

Report about Parallelization:

Make L2s Scale Again:

4/➯ VITAL NEWS📰₿

Avalanche back online after inscriptions mint triggers six-hour outage:

Lawyer Scott Johnsson said the U.S. SEC may follow BTC’s timeline and approve an ETH spot ETF, if not in May 2024, then by mid-2025:

Ronin was suspected of having its private keys leaked and more than 2,790 ETH was mixed into Tornado Cash:

Frax Finance is considering a Uniswap-like reward mechanism for token Stakers:

5/➯⛓️On-Chain Data:

There were $200M+ staked in the first three days in Zircuit:

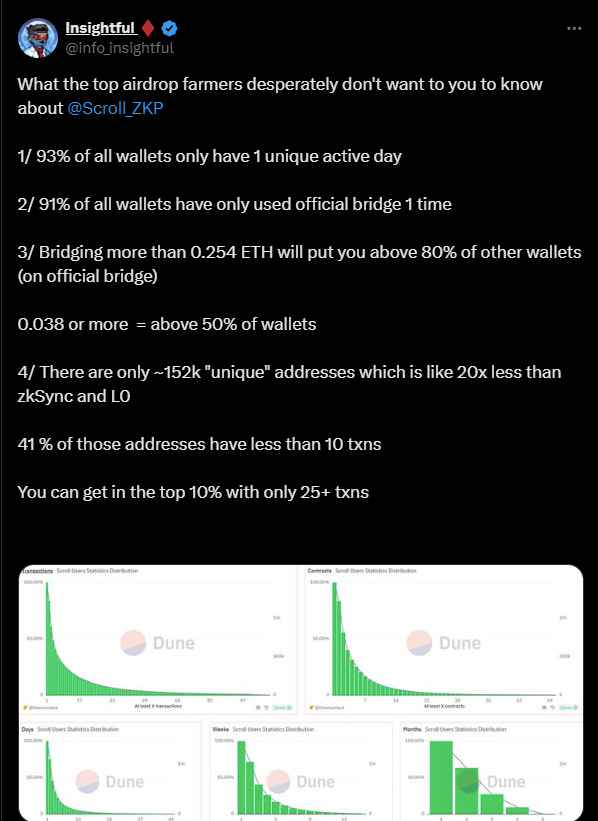

On-chain stats on Scroll:

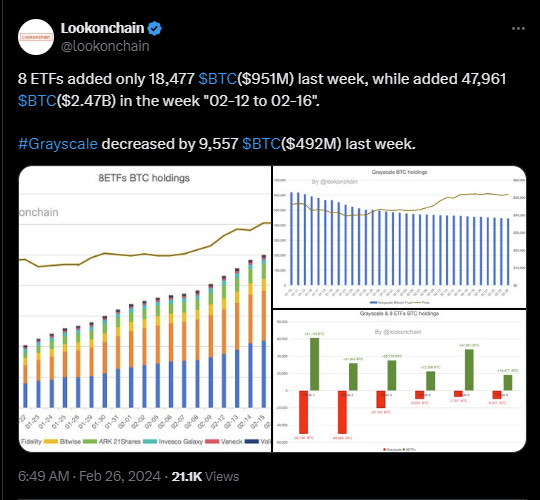

ETF Inflow analysis:

Over 11.000 BTCs were deposited in Merlin Chain:

6/➯ Macro Metrics 📈

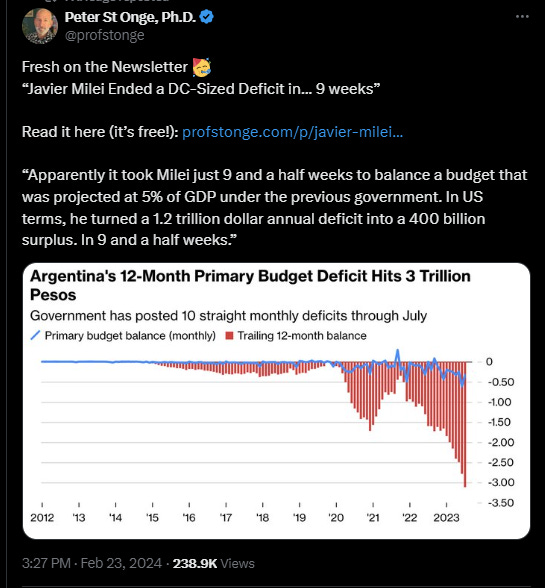

Argentina's 12-Month Primary Budget Deficit Hits 3 Trillion Pesos:

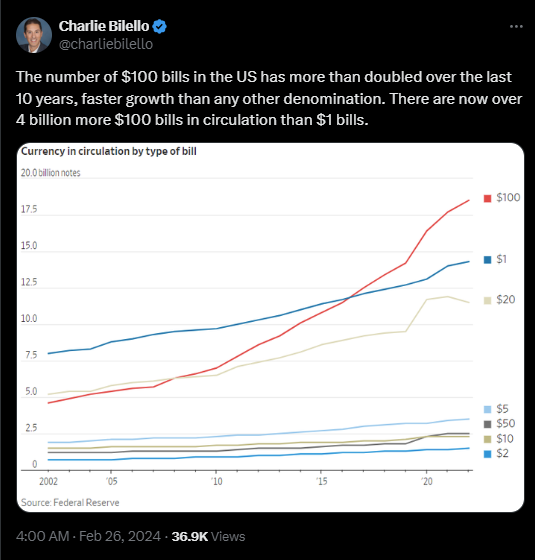

$100 bills in the US have more than doubled over the last 10 years:

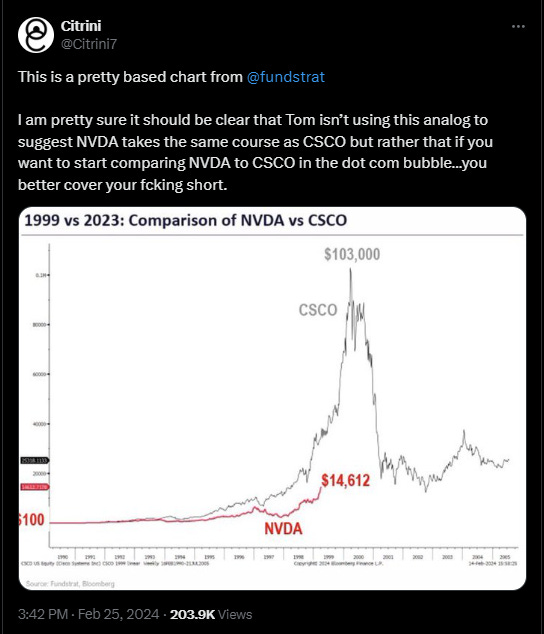

1999 vs 2023 - Comparison of NVDA vs CSCO:

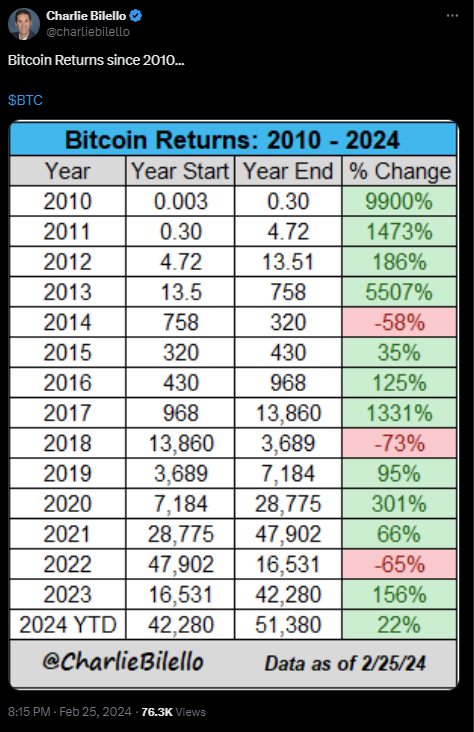

Bitcoin Returns since 2010:

7/➯ Exploits & Bugs

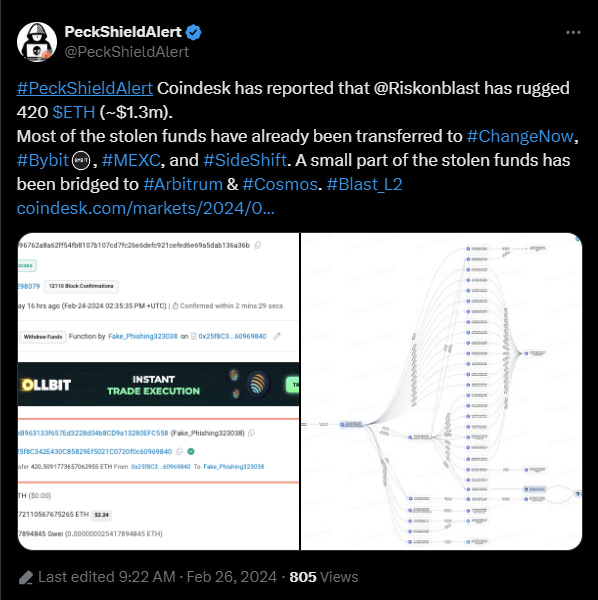

RiskOnBlast rugs for ~420 ETH:

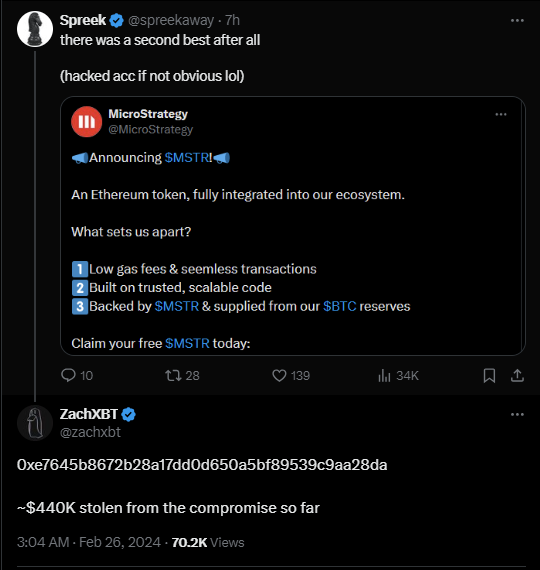

MicroStrategy's Twitter account was hacked and posted a phishing airdrop link:

That’s it for today, my friends!

Thank you all for staying with us. Your future self will undoubtedly be grateful for the knowledge and insights gained here.

For more crypto-related content, feel free to follow me on Twitter ➯ DeFi_Made_Here.

I'll continue sharing valuable information about the latest insights and my thoughts in this fast-paced field.

If you enjoyed this newsletter as much as we did creating it, don't hesitate to share this post with your fellow crypto enthusiasts! Together, let's expand our understanding of this ever-evolving industry.