DMH Newsletter is a vital news hub with crucial updates & narratives and trends

Spotlight Project: Perfect Swap

The leading DEX on Arbitrum by the innovation of ve(3,3)

PerfectSwap offers low fees, fast transactions, and an innovative incentive model ve(3,3). It builds on Solidly V2's liquidity framework, aiming to enhance efficiency and sustainability in DEXs.

🙍♂️ Followers: 5.4k

Impermanent Loss Defense: Overcoming LP Concerns

Concerns like impermanent loss deter liquidity provision. PerfectSwap challenges this by transforming their AMM into a JIT fee collector, ensuring fair profits for providers.

At PerfectSwap, they've integrated dynamic fee structures to protect pools from toxic flows during market volatility. Their solution: JIT fees that adjust based on market conditions to create a fairer environment for liquidity providers.

But how do they manage to do it?

They mitigate impermanent loss for LPs because they're able to compensate them more fairly as opposed to other ve3,3s with suboptimal fee mechanisms.

Not only are fees automatically adjusted but their measure to the degree at which they set the fees is a lot more accurate than any other ve3,3 with self-adjusting fees.

They take into consideration price, supply, and volume, and measure essentially what is volatility by combining these factors.

The liquidity they create can be a lot stickier than other DEXs.

Last Update: Volatile Pools

Volatile pools comprise assets that exhibit no direct price correlation, such as Chainlink (LINK) and Ethereum (ETH).

In these pools, the price of one asset is not dependent on the price of another.

These pools are ideal for trading assets with independent price movements.

2/➯ Updates & Upgrades in DeFi

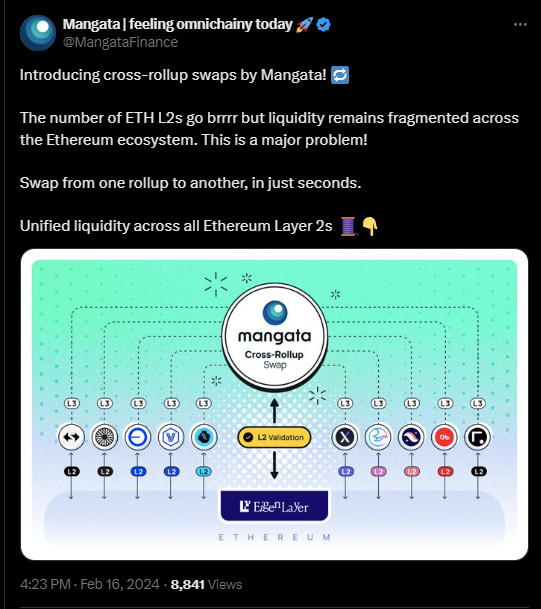

Сross-rollup swaps by Mangata:

Yuga Labs has acquired PROOF:

The CMP token IDO from Campie is coming at 4 Million FDV:

Filecoin integrates with Solana:

Uniswap v4's launch is tentatively set for Q3 2024:

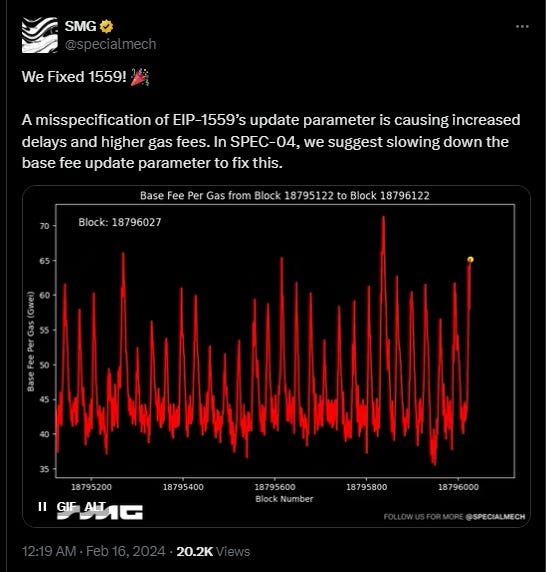

DYNAMIC TRANSACTION FEE MECHANISM DESIGN:

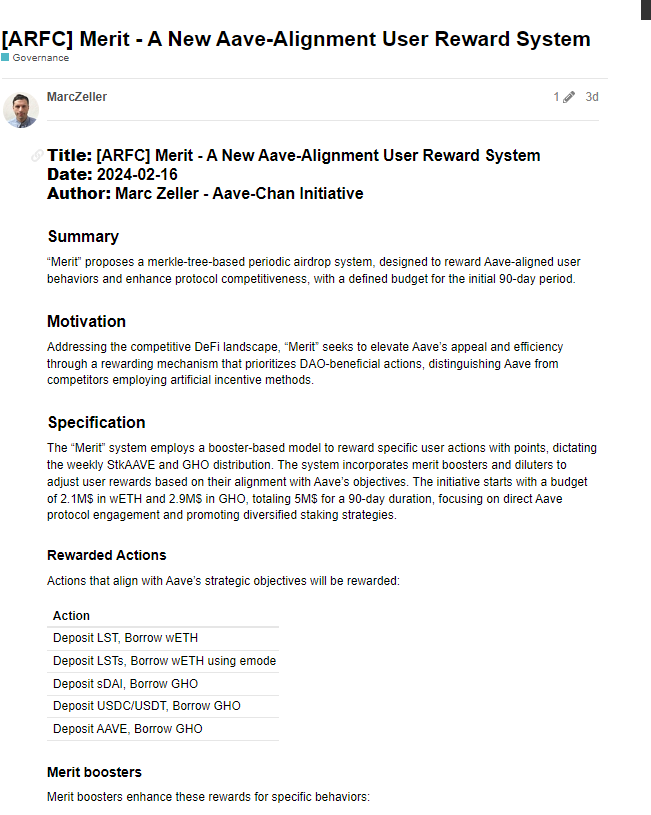

Merit - A New Aave-Alignment User Reward System:

ZKX Pro Trade is Now LIVE on Starknet Mainnet:

Take a look at the mdLP-dLP liquidity pool that has been deployed on Radpie:

3/➯ Alpha by Threadors & Good Reads

DeFi Degen's Playbook for Starknet:

If 100 People Use These Chains, How Many Remain After 1 Month:

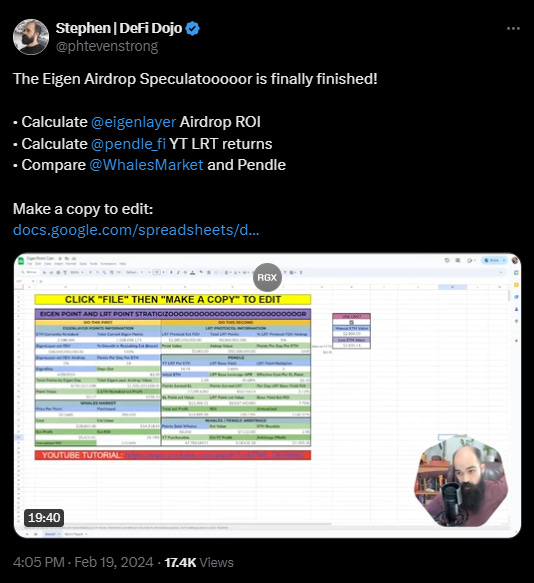

Eigen Airdrop Speculatooooor spreadsheets:

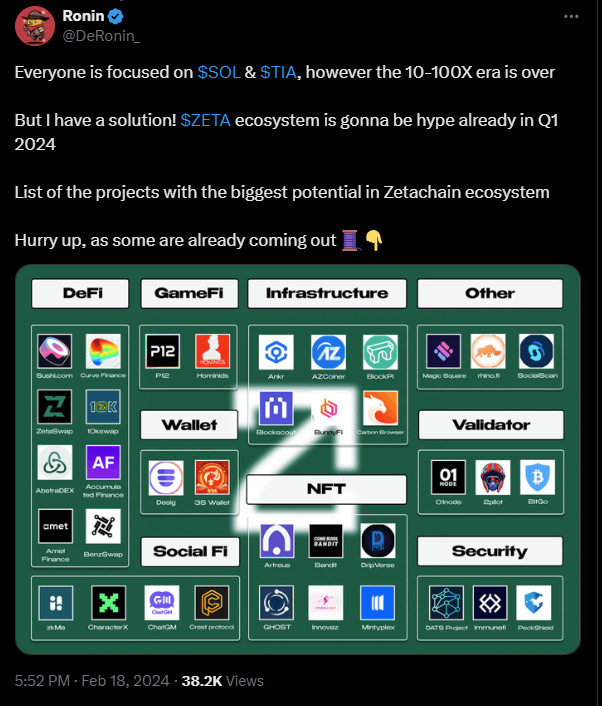

ZetaChain ecosystem:

Modular Expansion timeline for 2024:

4/➯ VITAL NEWS📰₿

North Korea’s Lazarus hackers embrace new mixer after Tornado Cash, Sinbad sanctions:

Japan has approved a proposal that would allow Japanese venture capital firms to invest in projects that only issue cryptocurrencies:

Bahamas Bank Deltec Accused of Giving Bankman-Fried ‘Secret’ Credit to Buy Tether:

Scroll lead says users are wasting their time with new airdrop scheme:

Crypto funds hit $2.5 billion weekly inflow record amid growing spot Bitcoin ETF interest:

5/➯⛓️On-Chain Data:

Many new crvUSD users in February:

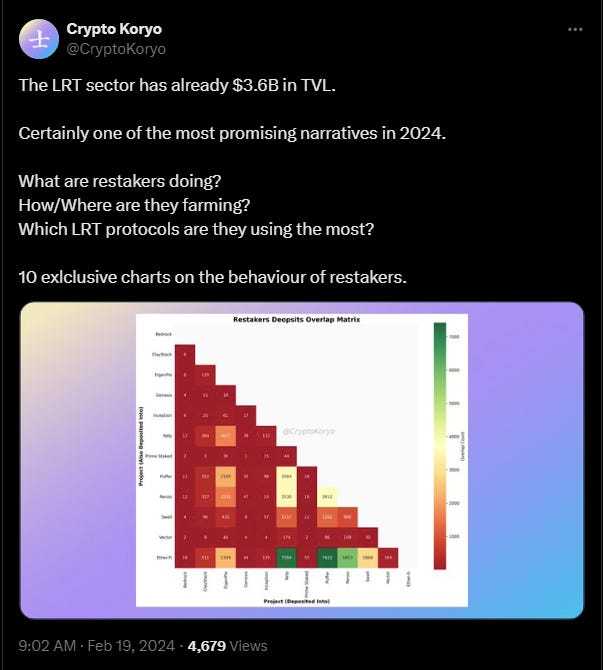

10 exclusive charts on the behavior of restakers:

4,276 Pudgy Penguin NFTs out of 8888 have been held for 365+ days:

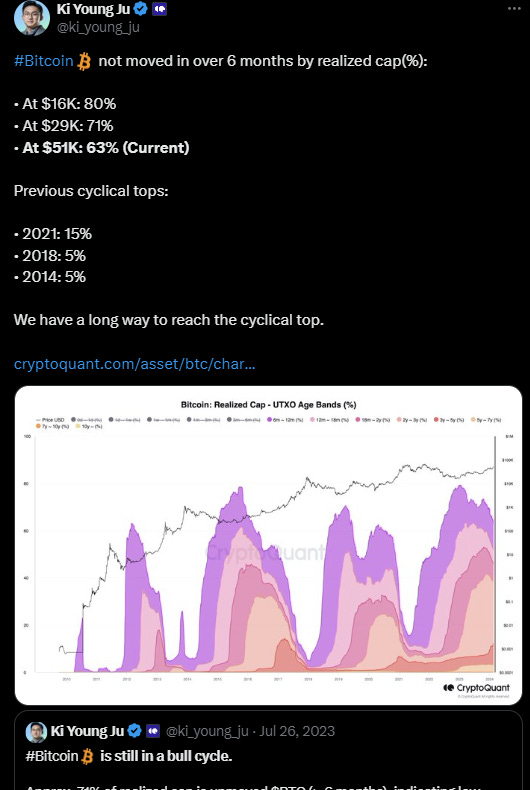

Bitcoin has not moved in over 6 months by realized cap:

6/➯ Macro Metrics 📈

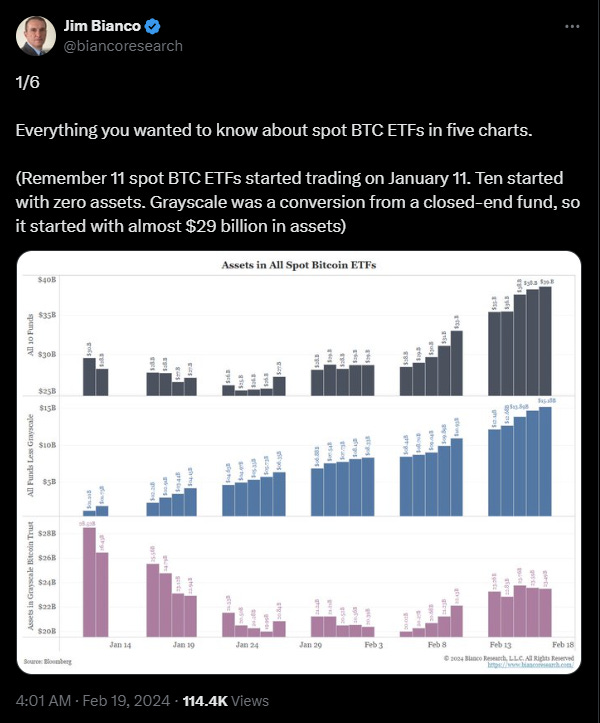

Everything you wanted to know about spot BTC ETFs in five charts:

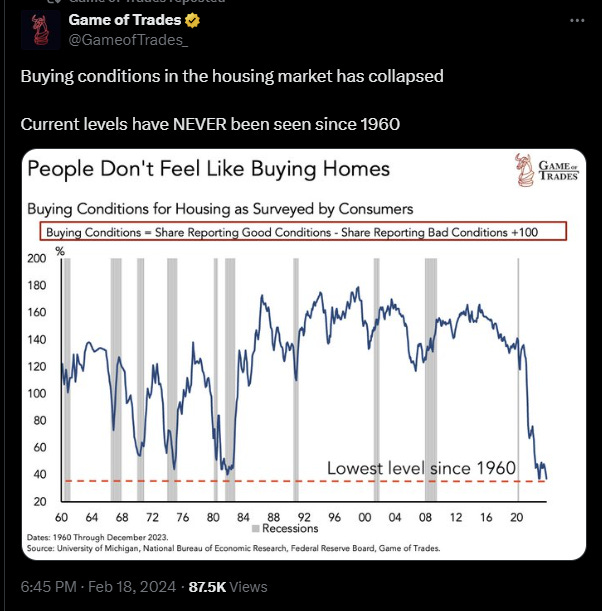

People Don't Feel Like Buying Homes:

Delinquency Rate of Multifamily Housing:

Chinese Stocks Set To Soar:

7/➯ Exploits & Bugs

FixedFloat was exploited for ~$26.1M:

That’s it for today, my friends!

Thank you all for staying with us. Your future self will undoubtedly be grateful for the knowledge and insights gained here.

For more crypto-related content, feel free to follow me on Twitter ➯ DeFi_Made_Here.

I'll continue sharing valuable information about the latest insights and my thoughts in this fast-paced field.

If you enjoyed this newsletter as much as we did creating it, don't hesitate to share this post with your fellow crypto enthusiasts! Together, let's expand our understanding of this ever-evolving industry.